Dish Network 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

The issuance costs related to the series D preferred stock will be recorded as a reduction of the carrying

value of the series D preferred stock and corresponding contingent value rights and will be immediately charged to

retained earnings upon issuance of the series D preferred stock, which will have a negative impact on our net income

(loss) available to common shareholders.

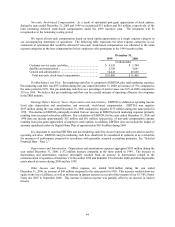

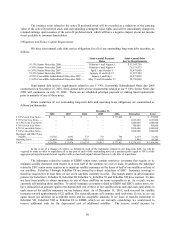

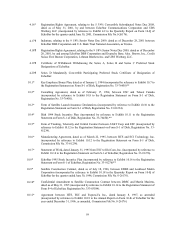

Obligations and Future Capital Requirements

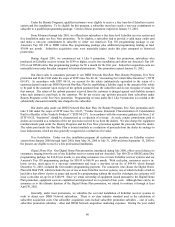

We have semi-annual cash debt service obligations for all of our outstanding long-term debt securities, as

follows:

Semi-Annual Payment

Dates

Semi-Annual Debt

Service Requirements

9 1/4% Senior Notes due 2006 .................................. February 1 and August 1 $ 17,343,750

9 3/8% Senior Notes due 2009 .................................. February 1 and August 1 76,171,875

10 3/8% Senior Notes due 2007 .................................. April 1 and October 1 51,875,000

9 1/8% Senior Notes due 2009 .................................. January 15 and July 15 31,937,500

4 7/8% Convertible Subordinated Notes due 2007...... January 1 and July 1 24,375,000

5 3/4% Convertible Subordinated Notes due 2008...... May 15 and November 15 28,750,000

Semi-annual debt service requirements related to our 5 3/4% Convertible Subordinated Notes due 2008

commenced on November 15, 2001. Semi-annual debt service requirements related to our 9 1/8% Senior Notes due

2009 will commence on July 15, 2002. There are no scheduled principal payment or sinking fund requirements

prior to maturity of any of these notes.

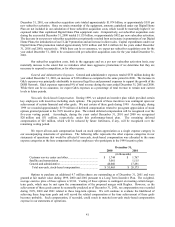

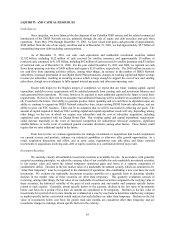

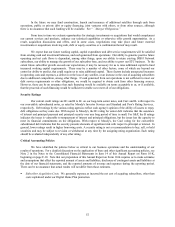

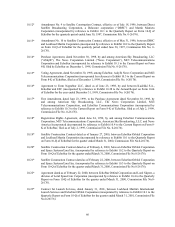

Future maturities of our outstanding long-term debt and operating lease obligations are summarized as

follows (in thousands):

December 31,

2002 2003 2004 2005 2006 Thereafter Total

9 1/4% Seven Year Notes .... $ – $ – $ – $ – $ 375,000 $ – $ 375,000

9 3/8% Ten Year Notes........ – – – – – 1,625,000 1,625,000

10 3/8% Seven Year Notes .. – – – – – 1,000,000 1,000,000

9 1/8% Seven Year Notes .... – – – – – 700,000 700,000

4 7/8% Convertible Notes .... – – – – – 1,000,000 1,000,000

5 3/4% Convertible Notes .... – – – – – 1,000,000 1,000,000

Mortgages and Other Notes

Payable ............................ 14,782 1,992 723 753 798 2,214 21,262

Operating leases................... 11,918 11,486 9,551 5,262 1,623 3,444 43,284

Total.................................... $ 26,700 $ 13,478 $ 10,274 $ 6,015 $ 377,421 $ 5,330,658 $ 5,764,546

In the event of a change of control, as defined in each of the indentures related to our long-term debt, we will be

required to make an offer to repurchase all or any part of each of the outstanding notes at a purchase price equal to 101% of the

aggregate principal amount thereof, together with accrued and unpaid interest thereon, to the date of repurchase.

The indentures related to certain of EDBS’ senior notes contain restrictive covenants that require us to

maintain satellite insurance with respect to at least half of the satellites we own or lease. In addition, the indenture

related to EBC senior notes requires us to maintain satellite insurance on the lesser of half of our satellites or three of

our satellites. EchoStar I through EchoStar IX are owned by a direct subsidiary of EBC. Insurance coverage is

therefore required for at least three of our seven satellites currently in orbit. The launch and/or in-orbit insurance

policies for EchoStar I, EchoStar II, EchoStar III, EchoStar V, EchoStar VI and EchoStar VII have expired. To date

we have been unable to obtain insurance on any of these satellites on terms acceptable to us. As a result, we are

currently self-insuring these satellites. To satisfy insurance covenants related to EDBS’ and EBC’s senior notes, we

have reclassified an amount equal to the depreciated cost of three of our satellites from cash and cash equivalents to

cash reserved for satellite insurance on our balance sheet. As of December 31, 2001, cash reserved for satellite

insurance totaled approximately $122 million. The reclassifications will continue until such time, if ever, as we can

again insure our satellites on acceptable terms and for acceptable amounts. If we lease or transfer ownership of

EchoStar VII, EchoStar VIII or EchoStar IX to EDBS, which we are currently considering, we would need to

reserve additional cash for the depreciated cost of additional satellites. The reserve would increase by