Discover 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Discover annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

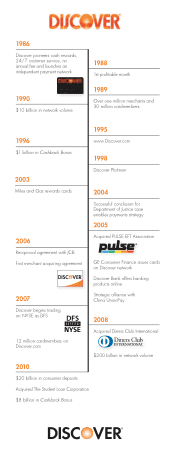

Total Network Volume

[Billions]

Direct Banking Loans*

[Billions]

2006 2007 2008 2009 2010

$45.8 $48.2 $51.1 $50.9

*2006–2009 as adjusted

Consumer Deposits

[Billions]

2006 2007 2008 2009 2010

$28.4

$32.0

$34.3

$24.6

$13.2

Diners Club International

$48.8

Brokered

Direct-to-ConsumerPULSE

Discover Network

2006

$163

93

70

2007

$186

99

86

2010

$248

103

118

27

2009

$232

97

109

26

2008

$221

102

106

13

In addition, Discover ended the year with a strong liquidity and capital position.

Progress on Performance Priorities

We achieved success in 2010 because Discover employees were very focused on our performance priorities, and they

collaborated on multiple cross-functional initiatives. For example, I believe the increase in Discover card sales volume

reflects not only the early stages of economic recovery, but also the payback from our investments to expand merchant

acceptance, enhance our industry-leading rewards programs and further strengthen the Discover brand.

and we activated more international outlets as well, making it possible to use the Discover card at more places

around the world.

Cashback Bonus during the holidays for online shoppers,

new redemption options and bonus offers from merchant partners.

up our advertising, which highlights our leadership in customer service and rewards.

Another very high priority for us was expansion of other parts of our Direct Banking business.

Last year was also a year of important progress with our global network initiatives.

to transaction volume on our networks.

Discover Network in 2010.

acquirer agreements.

2.6 3.4 6.1

12.6

20.6

10.6

21.2

22.3

19.4

13.7