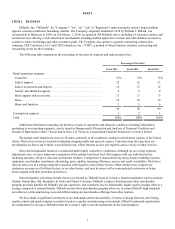

Dillard's 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3

Our corporate offices are located at 1600 Cantrell Road, Little Rock, Arkansas 72201, telephone: 501-376-5200.

ITEM 1A. RISK FACTORS.

The risks described in this Item 1A, Risk Factors, of this Annual Report on Form 10-K for the year ended February 1,

2014, could materially and adversely affect our business, financial condition and results of operations.

The Company cautions that forward-looking statements, as such term is defined in the Private Securities Litigation

Reform Act of 1995, contained in this Annual Report on Form 10-K are based on estimates, projections, beliefs and

assumptions of management at the time of such statements and are not guarantees of future performance. The Company

disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the

receipt of new information, or otherwise. Forward-looking statements of the Company involve risks and uncertainties and are

subject to change based on various important factors. Actual future performance, outcomes and results may differ materially

from those expressed in forward-looking statements made by the Company and its management as a result of a number of risks,

uncertainties and assumptions.

The retail merchandise business is highly competitive, and that competition could lower our revenues, margins and market

share.

We conduct our retail merchandise business under highly competitive conditions. Competition is characterized by many

factors including location, reputation, fashion, merchandise assortment, advertising, operating efficiency, price, quality,

customer service and credit availability. We have numerous competitors nationally, locally and on the Internet, including

conventional department stores, specialty retailers, off-price and discount stores, boutiques, mass merchants, Internet and mail-

order retailers. Although we are a large regional department store, some of our competitors are larger than us with greater

financial resources and, as a result, may be able to devote greater resources to sourcing, promoting and selling their products.

Additionally, we compete in certain markets with a substantial number of retailers that specialize in one or more types of

merchandise that we sell. In recent years, competition has intensified as a result of reduced discretionary consumer spending,

increased promotional activity, deep price discounting, and few barriers to entry. Also, online retail shopping is rapidly

evolving, and we expect competition in the e-commerce market to intensify in the future as the Internet facilitates competitive

entry and comparison shopping. We anticipate that intense competition will continue from both existing competitors and new

entrants. If we are unable to maintain our competitive position, we could experience downward pressure on prices, lower

demand for products, reduced margins, the inability to take advantage of new business opportunities and the loss of market

share.

Changes in economic, financial and political conditions, and the resulting impact on consumer confidence and consumer

spending, could have an adverse effect on our business and results of operations.

The retail merchandise business is highly sensitive to changes in overall economic and political conditions that impact

consumer confidence and spending. Various economic conditions affect the level of disposable income consumers have

available to spend on the merchandise we offer, including unemployment rates, interest rates, taxation, energy costs, the

availability of consumer credit, the price of gasoline, consumer confidence in future economic conditions and general business

conditions. Consumer purchases of discretionary items and other retail products generally decline during recessionary periods,

and also may decline at other times when changes in consumer spending patterns affect us unfavorably. In addition, any

significant decreases in shopping mall traffic, as a result of, among other things, higher gasoline prices, could also have an

adverse effect on our results of operations.

The ongoing global economic instability continues to cause a great deal of uncertainty domestically and abroad.

Additional uncertainty has resulted from the ongoing debate in the United States regarding budgetary concerns, including the

U.S. debt. This market uncertainty may continue to result in reduced consumer confidence and spending, which could have an

adverse effect on our results of operations.

Our business is dependent upon our ability to accurately predict rapidly changing fashion trends, customer preferences, and

other fashion-related factors.

Our sales and operating results depend in part on our ability to effectively predict and quickly respond to changes in

fashion trends and customer preferences. We continuously assess emerging styles and trends and focus on developing a

merchandise assortment to meet customer preferences at competitive prices. Even with these efforts, we cannot be certain that

we will be able to successfully meet constantly changing fashion trends and customer preferences. If we are unable to

successfully predict or respond to changing styles or preferences, we may be faced with lower sales, increased inventories,

additional markdowns or promotional sales to dispose of excess or slow-moving inventory, and lower gross margins, all of