Dillard's 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dillard’s Corporate Offi ce

Little Rock, AR 72201

Copies of fi nancial documents and other Company information such as

Dillard’s, Inc. reports on Form 10-K and 10-Q and other reports fi led with

the Securities and Exchange Commission are available by contacting:

Dillard’s, Inc.

Investor Relations

Little Rock, Arkansas 72201

E-mail: investor[email protected]

Financial reports, press releases and other Company information are

available on the Dillard’s, Inc. website: www.dillards.com.

Individuals or securities analysts with questions regarding Dillard’s, Inc.

may contact:

Julie Johnson Bull

Director of Investor Relations

Little Rock, Arkansas 72201

Telephone: 501.376.5965

Fax: 501.376.5917

E-mail: [email protected]

Registered shareholders should direct communications regarding address changes, lost

certifi cates, and other administrative matters to the Company’s Transfer Agent and Regis-

Registrar and Transfer Company

10 Commerce Drive

Cranford, New Jersey 07016-3572

Telephone: 800.368.5948

E-mail: [email protected]

Web site: www.rtco.com

Please refer to Dillard’s, Inc. on all correspondence and have available your

name as printed on your stock certifi cate, your Social Security number, your

address and phone number.

Little Rock, Arkansas 72201

Post Offi ce Box 486

Little Rock, Arkansas 72203

Telephone: 501.376.5200

Fax: 501.376.5917

New York Stock Exchange,

Ticker Symbol “DDS”

Table of contents

-

Page 1

-

Page 2

..., moderate department store peers in terms of merchandise mix, presentation and customer service. We are continually working to provide an unmatched shopping experience at Dillard's by emphasizing and supporting highly revered national and exclusive brands, seeking exciting new brands and products... -

Page 3

... in its charter) DELAWARE State or other jurisdiction of incorporation or organization 1600 CANTRELL ROAD, LITTLE ROCK, ARKANSAS (Address of principal executive offices) 71-0388071 (IRS Employer Identification No.) 72201 (Zip Code) Registrant's telephone number, including area code (501) 376-5200... -

Page 4

...State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of August 3, 2013: $3,261,211,987. Indicate the number of shares...the Proxy Statement for the Annual Meeting of Stockholders to be held May 17, 2014 (the "Proxy Statement") are ... -

Page 5

... Disclosures about Market Risk...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive... -

Page 6

(This page has been left blank intentionally.) -

Page 7

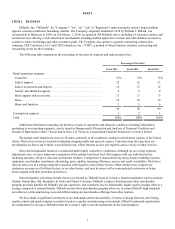

... of net sales by segment and major product line: Percentage of Net Sales Fiscal 2013 Fiscal 2012 Fiscal 2011 Retail operations segment: Cosmetics ...Ladies' apparel ...Ladies' accessories and lingerie...Juniors' and children's apparel...Men's apparel and accessories ...Shoes ...Home and furniture... -

Page 8

... and management of the credit card business. We seek to expand the number and use of the proprietary cards by, among other things, providing incentives to sales associates to open new credit accounts, which generally can be opened while a customer is visiting one of our stores. Customers who open... -

Page 9

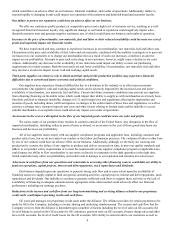

..., of this Annual Report on Form 10-K for the year ended February 1, 2014, could materially and adversely affect our business, financial condition and results of operations. The Company cautions that forward-looking statements, as such term is defined in the Private Securities Litigation Reform... -

Page 10

...-term marketing and servicing alliance related to our proprietary credit cards could impact operating results and cash flows. GE owns and manages our proprietary credit cards under the Alliance. The Alliance provides for certain payments to be made by GE to the Company, including a revenue sharing... -

Page 11

...of credit or increase the cost of credit to our cardholders or negatively impact provisions which affect our revenue streams associated with our proprietary credit card, our results of operations could be adversely affected. In addition, changes in credit card use, payment patterns, or default rates... -

Page 12

... in the United States, we may be required to suspend operations in some or all of our stores, which could have a material adverse impact on our business, financial condition, and results of operations. Increases in the cost of employee benefits could impact the Company's financial results and... -

Page 13

... affect our business, reputation and financial condition. We receive certain personal information about our employees and our customers, including information permitting cashless payments, both in our stores and through our online operations at www.dillards.com. In addition, our online operations... -

Page 14

additional resources related to our information security systems and could result in a disruption of our operations, particularly our online sales operations. The percentage-of-completion method of accounting that we use to recognize contract revenues for our construction segment may result in ... -

Page 15

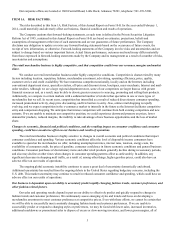

... for rental payments based on a percentage of net sales with a guaranteed minimum annual rent. In general, the Company pays the cost of insurance, maintenance and real estate taxes related to the leases. The following table summarizes by state of operation the number of retail stores we operate... -

Page 16

...the following additional facilities: Owned / Leased Facility Location Square Feet Distribution Centers: ...Mabelvale, AR Gilbert, AZ Valdosta, GA Olathe, KS Salisbury, NC Ft. Worth, TX Internet Fulfillment Center ...Maumelle, AR Dillard's Executive Offices ...Little Rock, AR CDI Contractors, LLC... -

Page 17

... President Director; Senior Vice President; Chief Financial Officer Vice President Vice President Vice President Vice President Vice President Vice President Vice President Vice President 1998 1998 1984 1998 1988 2001 1993 1995 2014 1998 1984 1998 2011 Not applicable Brother of William Dillard, II... -

Page 18

... AND ISSUER PURCHASES OF EQUITY SECURITIES. Market and Dividend Information for Common Stock The Company's Class A Common Stock trades on the New York Stock Exchange under the Ticker Symbol "DDS". No public market currently exists for the Company's Class B Common Stock. The high and low sales prices... -

Page 19

... Stock, the Standard & Poor's 500 Index and the Standard & Poor's 500 Department Stores Index as of the last day of each of the Company's last five fiscal years. 2009 2010 2011 2012 2013 Dillard's, Inc...$ S&P 500 ...S&P 500 Department Stores ... 386.62 133.14 167.17 $ 944.55 161.44 191.73... -

Page 20

... our "Management's Discussion and Analysis of Financial Condition and Results of Operations", our consolidated audited financial statements and notes thereto and the other information contained elsewhere in this report. (Dollars in thousands, except per share data) 2013 2012* 2011 2010 2009... -

Page 21

...to Consolidated Financial Statements). an $18.1 million income tax benefit ($0.37 per share) due to a one-time deduction related to dividends paid to the Dillard's, Inc. Investment and Employee Stock Ownership Plan (see Note 6 of Notes to Consolidated Financial Statements). • • 2011 The items... -

Page 22

...$0.05 per share) related to the sale of five retail store locations. a $9.7 million income tax benefit ($0.14 per share) primarily related to net decreases in unrecognized tax benefits, interest and penalties due to resolutions of federal and state examinations; decreases in state net operating loss... -

Page 23

... OF OPERATIONS. Dillard's, Inc. operates 296 retail department stores spanning 29 states and an Internet store. The Company also operates a general contractor, CDI, a portion of whose business includes constructing and remodeling stores for the Company, which is a reportable segment separate from... -

Page 24

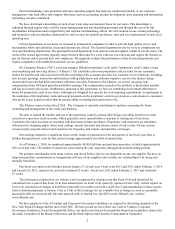

... use a number of key indicators of financial condition and operating performance to evaluate the performance of our business, including the following: Fiscal 2013 Fiscal 2012 Fiscal 2011 Net sales (in millions) ...Gross profit (in millions) ...Gross profit as a percentage of net sales ...Retail... -

Page 25

... stores; sales from new stores opened during the current fiscal year; sales in the previous fiscal year for stores closed during the current or previous fiscal year that are no longer considered comparable stores; sales in clearance centers; and changes in the allowance for sales returns. Service... -

Page 26

...marketing commitment, the Company participates in the marketing of the proprietary credit cards and accepts payments on the proprietary credit cards in its stores as a convenience to customers who prefer to pay in person rather than by paying online or mailing their payments to GE. Revenues from CDI... -

Page 27

...additional facts become known or as circumstances change. Changes in the Company's assumptions and judgments can materially affect amounts recognized in the consolidated balance sheets and statements of income. The total amount of unrecognized tax benefits as of February 1, 2014 and February 2, 2013... -

Page 28

... of limitation. The Company does not expect a material change in unrecognized tax benefits in the next twelve months. Pension obligations. The discount rate that the Company utilizes for determining future pension obligations is based on the Citigroup Above Median Pension Index Curve on its annual... -

Page 29

...by segment and product category in the Company's sales for the past two years is as follows: Percent Change Fiscal 2013 - 2012 (1) Fiscal 2012 - 2011 (2) Retail operations segment Cosmetics...Ladies' apparel ...Ladies' accessories and lingerie ...Juniors' and children's apparel ...Men's apparel and... -

Page 30

... of dollars) Fiscal 2013 Fiscal 2012 Fiscal 2011 2013 - 2012 2012 - 2011 Percent Change 2013 - 2012 2012 - 2011 Service charges and other income: Retail operations segment Income from GE marketing and servicing alliance ...$ 113.1 Leased department income...9.2 Shipping and handling income ...20... -

Page 31

... stores decreased 1% as of February 2, 2013 compared to January 28, 2012. During fiscal 2012, gross margin improved moderately in the home and furniture category and improved slightly in ladies' accessories and lingerie. Gross margin in all other product categories was essentially flat. Gross profit... -

Page 32

...resulting from the 53rd week of fiscal 2012. Total weighted average debt outstanding during fiscal 2013 decreased approximately $23.0 million compared to fiscal 2012, which included an increase in weighted average short-term debt under the credit facility. 2012 Compared to 2011 Net interest and debt... -

Page 33

...in Acumen Brands ("Acumen"), an eCommerce company based in Fayetteville, Arkansas. The sale resulted in a gain of $11.7 million that was recorded in gain on disposal of assets. During fiscal 2013, the Company also received proceeds of $1.7 million from the sale of two former retail stores located in... -

Page 34

... 30.2% in fiscal 2012, and (15.6)% in fiscal 2011. The Company expects the fiscal 2014 federal and state effective income tax rate to approximate 35%. Fiscal 2013 During fiscal 2013, income taxes included the recognition of tax benefits of approximately $5.5 million related to decreases in valuation... -

Page 35

... the Alliance with GE, which owns and manages the Company's private label credit card business under the Alliance, and cash distributions from joint ventures. Operating cash outflows include payments to vendors for inventory, services and supplies, payments to employees and payments of interest and... -

Page 36

... Mall ...Twin Peaks Mall...Total closed square footage ... Logan, Utah Asheboro, North Carolina Euclid, Ohio Plano, Texas Chapel Hill, North Carolina Longmont, Colorado 94,000 60,000 100,000 195,000 64,000 90,000 603,000 During fiscal 2013, 2012 and 2011, we received proceeds from the sale... -

Page 37

... in fiscal 2012 was primarily due to the payment of regularly scheduled maturities of the unsecured notes, term note and mortgage principal. In addition to paying the regularly scheduled maturities of the unsecured notes, term note and mortgage principal during fiscal 2011, the Company repurchased... -

Page 38

... of raising capital, incurring debt or operating the Company's business. The Company does not have any off-balance-sheet arrangements or relationships that are reasonably likely to materially affect the Company's financial condition, changes in financial condition, revenues or expenses, results... -

Page 39

... limited to 90% of the inventory of certain Company subsidiaries (approximately $909 million at February 1, 2014). At February 1, 2014, letters of credit totaling $35.7 million were issued under the credit facility. NEW ACCOUNTING PRONOUNCEMENTS Presentation of Comprehensive Income In February 2013... -

Page 40

... or credit card income; adequate and stable availability of materials, production facilities and labor from which the Company sources its merchandise at acceptable pricing; changes in operating expenses, including employee wages, commission structures and related benefits; system failures or data... -

Page 41

... as of the end of the fiscal year covered by this annual report, and based on that evaluation, the Company's CEO and CFO have concluded that these disclosure controls and procedures were effective. Management's Report on Internal Control over Financial Reporting Our management is responsible for... -

Page 42

... charge on the Company's website, www.dillards.com, and is available in print to any shareholder who requests copies by contacting Julie J. Bull, Director of Investor Relations, at the Company's principal executive offices set forth above. ITEM 11. EXECUTIVE COMPENSATION. The information called for... -

Page 43

... the headings "Security Ownership of Certain Beneficial Holders" and "Security Ownership of Management" in the Proxy Statement. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. The information called for by this item is incorporated herein by reference from the... -

Page 44

PART IV ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES. (a)(1) and (2) Financial Statements An "Index of Financial Statements" has been filed as a part of this Report beginning on page F-1 hereof. (a)(3) Exhibits and Management Compensatory Plans An "Exhibit Index" has been filed as a part of ... -

Page 45

...Mike Dillard Executive Vice President and Director /s/ H. LEE HASTINGS H. Lee Hastings Director /s/ REYNIE RUTLEDGE Reynie Rutledge Director /s/ J. C. WATTS, JR. J. C. Watts, Jr. Director Date: March 27, 2014 /s/ JAMES I. FREEMAN James I. Freeman Senior Vice President and Chief Financial Officer and... -

Page 46

(This page has been left blank intentionally.) -

Page 47

... FINANCIAL STATEMENTS DILLARD'S, INC. AND SUBSIDIARIES Year Ended February 1, 2014 Page Report of Independent Registered Public Accounting Firm ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets-February 1, 2014 and February 2, 2013 ...Consolidated Statements... -

Page 48

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Dillard's, Inc. and subsidiaries as of February 1, 2014 and February 2, 2013, and the related consolidated statements of income, comprehensive income, stockholders... -

Page 49

... of the years in the period ended February 1, 2014, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of... -

Page 50

Consolidated Balance Sheets Dollars in Thousands February 1, 2014 February 2, 2013 Assets Current assets: Cash and cash equivalents ...$ Accounts receivable ...Merchandise inventories ...Other current assets ...Total current assets ...Property and equipment: Land and land improvements ...Buildings ... -

Page 51

Consolidated Statements of Income Dollars in Thousands, Except Per Share Data Years Ended February 1, 2014 February 2, 2013 January 28, 2012 Net sales ...$ Service charges and other income...Cost of sales ...Selling, general and administrative expenses ...Depreciation and amortization ...Rentals...... -

Page 52

Consolidated Statements of Comprehensive Income Dollars in Thousands Years Ended February 1, 2014 February 2, 2013 January 28, 2012 Net income ...$ Other comprehensive income (loss): Amortization of retirement plan and other retiree benefit adjustments (net of tax of $4,452, $2,640 and $11,903) ...... -

Page 53

Consolidated Statements of Stockholders' Equity Dollars in Thousands, Except Per Share Data Additional Paid-in Capital Accumulated Other Comprehensive Loss Common Stock Class A Class B Retained Earnings Treasury Stock Total Balance, January 29, 2011 . $ 1,177 Net income ...- Other comprehensive... -

Page 54

... payments on long-term debt and capital lease obligations Cash dividends paid ...Purchase of treasury stock ...Proceeds from issuance of common stock ...Excess tax benefits from share-based compensation ...Issuance cost of line of credit ...Purchase and retirement of common stock...Net cash used... -

Page 55

... of Business-Dillard's, Inc. ("Dillard's" or the "Company") operates retail department stores, located primarily in the Southeastern, Southwestern and Midwestern areas of the United States, and a general contracting construction company based in Little Rock, Arkansas. The Company's fiscal year ends... -

Page 56

... two shopping malls located in Denver, Colorado and Bonita Springs, Florida; one property located in Toledo, Ohio; and an investment in Acumen Brands ("Acumen"), an eCommerce company based in Fayetteville, Arkansas. During fiscal 2013, the Company received proceeds of $15.7 million from the sale of... -

Page 57

... cards in its stores as a convenience to customers who prefer to pay in person rather than by mailing their payments to GE. Amounts received for providing these services are included in the amounts disclosed above. Revenue from CDI construction contracts is generally recognized by applying... -

Page 58

... Handling-The Company records shipping and handling reimbursements in service charges and other income. The Company records shipping and handling costs in cost of sales. Defined Benefit Retirement Plans-The Company's defined benefit retirement plan costs are accounted for using actuarial valuations... -

Page 59

... of net sales by segment and major product line: Percentage of Net Sales Fiscal 2013 Fiscal 2012 Fiscal 2011 Retail operations segment: Cosmetics ...Ladies' apparel ...Ladies' accessories and lingerie ...Juniors' and children's apparel ...Men's apparel and accessories ...Shoes...Home and furniture... -

Page 60

.... The Company pays an annual commitment fee to the banks of 0.25% of the committed amount less outstanding borrowings and letters of credit. The Company had weighted-average borrowings of $45.5 million and $17.0 million during fiscal 2013 and 2012, respectively. 4. Long-Term Debt Long-term debt of... -

Page 61

... of dollars) February 1, 2014 February 2, 2013 Trade accounts payable...$ Accrued expenses: Taxes, other than income ...Salaries, wages and employee benefits ...Liability to customers...Interest ...Rent ...Other...$ 6. Income Taxes The provision for federal and state income taxes is summarized as... -

Page 62

... capital loss carryforward available in the amended return year, and $1.0 million related to decreases in valuation allowances related to state net operating loss carryforwards. In January 2011, the Company formed a wholly-owned subsidiary intended to operate as a real estate investment trust... -

Page 63

... the effective tax rate. The Company classifies accrued interest expense and penalties relating to income tax in the consolidated financial statements as income tax expense. The total interest and penalties recognized in the consolidated statements of income during fiscal 2013, 2012 and 2011 was... -

Page 64

... 2013, 2012 and 2011, respectively. The Company has an unfunded, nonqualified defined benefit plan ("Pension Plan") for its officers. The Pension Plan is noncontributory and provides benefits based on years of service and compensation during employment. Pension expense is determined using various... -

Page 65

...end of each fiscal year and is matched to the future expected cash flows of the benefit plans by annual periods. The discount rate had increased to 4.4% as of February 1, 2014 from 4.0% as of February 2, 2013. Weighted average assumptions are as follows: Fiscal 2013 Fiscal 2012 Fiscal 2011 Discount... -

Page 66

... for next ten fiscal years ...$ _____ 2,678 * 7,161 7,683 9,435 9,891 63,053 99,901 * The estimated benefit payment for fiscal 2014 also represents the amount the Company expects to contribute to the Pension Plan for fiscal 2014. 9. Stockholders' Equity Capital stock is comprised of the following... -

Page 67

...an average price of $79.14 per share, which completed the authorization under the 2012 Stock Plan. May 2011 Stock Plan In May 2011, the Company's Board of Directors authorized the Company to repurchase up to $250 million of the Company's Class A Common Stock under an open-ended plan ("May 2011 Stock... -

Page 68

... periodic pension cost. See Note 8, Benefit Plans, for additional information. Changes in AOCL Changes in AOCL by component (net of tax) are summarized as follows (in thousands): Defined Benefit Pension Plan Items Fiscal 2013 Beginning balance...$ Other comprehensive income before reclassifications... -

Page 69

... 2013 (in thousands, except per share data) Basic Diluted Basic Fiscal 2012 Diluted Basic Fiscal 2011 Diluted Net earnings available for pershare calculation ...$ Average shares of common stock outstanding ...Dilutive effect of stock-based compensation ...Total average equivalent shares Per share... -

Page 70

... reserve established for store closing charges: Balance, Beginning of Year (in thousands of dollars) Adjustments and Charges* Cash Payments Balance, End of Year Fiscal 2013 Rent, property taxes and utilities...$ Fiscal 2012 Rent, property taxes and utilities...Fiscal 2011 Rent, property taxes... -

Page 71

...assets held for use was based upon a contract the Company had entered to sell the assets. During fiscal 2013, the sale was not consummated, and the store remained in operation. Long-lived assets held for sale During fiscal 2013, the Company sold two former retail store locations with carrying values... -

Page 72

...information for fiscal 2013 and fiscal 2012 includes the following items: First Quarter 2013 Third Quarter 2012 • • a $1.1 million pretax gain ($0.7 million after tax or $0.01 per share) related to the sale of two former retail store locations. a $1.7 million income tax benefit ($0.04 per share... -

Page 73

... impairment and store closing charges related to the write-down of a property held for sale and of an operating property. an $18.1 million income tax benefit ($0.38 per share) due to a one-time deduction related to dividends paid to the Dillard's Inc. Investment and Employee Stock Ownership Plan... -

Page 74

(This page has been left blank intentionally.) -

Page 75

...). Purchase, Sale and Servicing Transfer Agreement among GE Capital Consumer Card Co., General Electric Capital Corporation, Dillard's, Inc. and Dillard National Bank (Exhibit 2.1 to Form 8-K dated as of August 12, 2004 in File No. 1-6140). Private Label Credit Card Program Agreement between Dillard... -

Page 76

...101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document _____ * ** Incorporated by reference as indicated. A management contract or compensatory plan or arrangement required to be filed as an exhibit to this report pursuant to Item 15... -

Page 77

(This page has been left blank intentionally.) -

Page 78

(This page has been left blank intentionally.) -

Page 79

...SF Holding Corp. - Little Rock, Arkansas J.C. Watts, Jr. - Former Member of Congress, Chairman of J.C. Watts Companies, Washington, D.C. Nick White - President & Chief Executive Ofï¬cer, White & Associates - Rogers, Arkansas CORPORATE ORGANIZATION William Dillard, II - Chief Executive Ofï¬cer Alex... -

Page 80

...compelling apparel and home selections complemented by exceptional customer care. Dillard's stores offer a broad selection of merchandise and feature products from both national and exclusive brand sources. The Company operates 278 Dillard's locations and 18 clearance centers spanning 29 states plus...