Dillard's 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

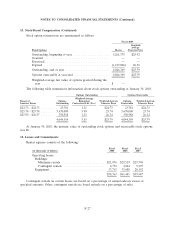

18. Quarterly Results of Operations (unaudited) (Continued)

• a $7.2 million pretax gain ($4.6 million after tax or $0.06 per share) related to the sale of a store

in San Antonio, Texas.

Fourth Quarter

2009

• a $3.1 million pretax charge ($2.0 million after tax or $0.03 per share) for asset impairment and

store closing charges related to certain stores.

• a $5.7 million pretax gain ($3.6 million after tax or $0.05 per share) related to proceeds received

from settlement of the Visa Check/Mastermoney Antitrust litigation.

• a $2.3 million pretax gain ($1.5 million after tax or $0.02 per share) related to the sale of a

vacant store location in Kansas City, Missouri.

2008

• a $177.9 million pretax charge ($123.9 million after tax or $1.69 per share) for asset impairment

and store closing charges related to (1) a write-off of goodwill on seven stores totaling

$31.9 million, (2) a write-down of investment in two mall joint ventures of $58.8 million and a

write-down of property and equipment in 18 operating stores totaling $54.2 million and 12

closed or closing stores totaling $33.0 million.

• a $2.9 million pretax charge ($1.8 million after tax or $0.03 per share) related to hurricane losses

and remediation expenses incurred as a result of Hurricane Ike which occurred in September of

2008.

F-33