Dillard's 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Earnings (Loss) per Share (Continued)

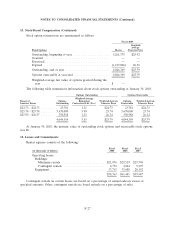

Earnings (loss) per common share has been computed as follows:

Fiscal 2009 Fiscal 2008 Fiscal 2007

(in thousands, except per share data) Basic Diluted Basic Diluted Basic Diluted

Net earnings (loss) available for

per-share calculation ............ $68,531 $68,531 $(241,065) $(241,065) $53,761 $53,761

Average shares of common stock

outstanding .................. 73,784 73,784 74,278 74,278 78,406 78,406

Dilutive effect of stock-based

compensation ................. — — — — — 697

Total average equivalent shares ...... 73,784 73,784 74,278 74,278 78,406 79,103

Per share of common stock:

Net income (loss) ............... $ 0.93 $ 0.93 $ (3.25) $ (3.25) $ 0.69 $ 0.68

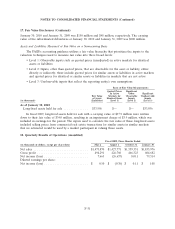

Total stock options outstanding were 4,044,369, 5,261,375 and 5,376,375 at January 30, 2010,

January 31, 2009 and February 2, 2008, respectively. Of these, options to purchase 4,044,369, 5,261,375

and 5,376,375 shares of Class A Common Stock at prices ranging from $24.73 to $26.57, $24.01 to

$30.47 and $24.01 to $30.47 were outstanding at January 30, 2010, January 31, 2009 and February 2,

2008, respectively, but were not included in the computations of diluted earnings (loss) per share

because the effect of their inclusion would have been antidilutive.

13. Stock-Based Compensation

The Company has various stock option plans that provide for the granting of options to purchase

shares of Class A Common Stock to certain key employees of the Company. Exercise and vesting terms

for options granted under the plans are determined at each grant date. All options were granted at not

less than fair market value at dates of grant. As of January 30, 2010, 7,527,451 shares were available for

grant under the plans and 11,571,820 shares of Class A Common Stock were reserved for issuance

under the stock option plans.

There were no stock options granted during fiscal 2009, 2008 and 2007. The fair values generated

by the Black-Scholes model may not be indicative of the future benefit, if any, that may be received by

the option holder.

F-26