Dillard's 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

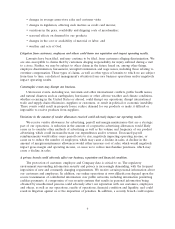

ITEM 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our ‘‘Management’s

Discussion and Analysis of Financial Condition and Results of Operations’’, our consolidated audited

financial statements and notes thereto and the other information contained elsewhere in this report.

(Dollars in thousands of dollars,

except per share data) 2009 2008 2007 2006* 2005

Net sales ................. $ 6,094,948 $ 6,830,543 $ 7,207,417 $ 7,636,056 $ 7,551,697

Percent change ........... (11)% (5)% (6)% 1% 0%

Cost of sales .............. 4,102,892 4,827,769 4,786,655 5,032,351 5,014,021

Percent of sales ........... 67.3% 70.7% 66.4% 65.9% 66.4%

Interest and debt expense, net . . 74,003 88,821 91,556 87,642 105,570

Income (loss) before income

taxes and equity in (losses)

earnings of joint ventures .... 84,525 (380,005) 60,518 253,842 125,791

Income taxes (benefit) ....... 12,690 (140,520) 13,010 20,580 14,300

Equity in (losses) earnings of

joint ventures ............ (3,304) (1,580) 6,253 12,384 9,994

Net income (loss) ........... 68,531 (241,065) 53,761 245,646 121,485

Net income (loss) per diluted

common share ........... 0.93 (3.25) 0.68 3.05 1.49

Dividends per common share . . . 0.16 0.16 0.16 0.16 0.16

Book value per common share . . 31.21 30.65 33.45 32.19 29.43

Average number of diluted

shares outstanding ......... 73,783,960 74,278,461 79,103,423 80,475,210 81,660,619

Accounts receivable, net(1) .... 63,222 87,998 10,880 10,508 12,523

Merchandise inventories ...... 1,300,680 1,374,394 1,779,279 1,772,150 1,802,695

Property and equipment, net . . . 2,780,837 2,973,151 3,190,444 3,146,626 3,147,623

Total assets ............... 4,606,327 4,745,844 5,338,129 5,396,735 5,505,639

Long-term debt ............ 747,587 757,689 760,165 956,611 1,058,946

Capital lease obligations ...... 22,422 24,116 25,739 28,328 31,806

Other liabilities ............ 213,471 220,911 217,403 206,122 259,111

Deferred income taxes ....... 349,722 378,348 436,541 448,770 475,007

Subordinated debentures ...... 200,000 200,000 200,000 200,000 200,000

Total stockholders’ equity ..... 2,304,103 2,251,115 2,514,111 2,579,789 2,333,377

Number of stores

Opened ................ 0 10 9 8 9

Closed(2) ............... 6 21 11 10 8

Total—end of year ......... 309 315 326 328 330

* 53 weeks

(1) As discussed in Note 2 of the Notes to Consolidated Financial Statements, the Company purchased the

remaining interest in CDI, a former 50% equity method joint venture investment of the Company, on

August 29, 2008.

(2) One store in Biloxi, Mississippi, not in operation during fiscal 2007 and fiscal 2006 due to the hurricanes

of 2005 and included in the 2006 closed store totals, was re-opened in early fiscal 2008.

13