Dick's Sporting Goods 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

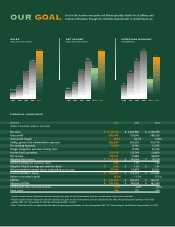

NET INCOME1

(DOLLARS IN MILLIONS)

2002 2003 2004 2005 2005P 2006

$112.6

$81.1

$94.5

$74.5

$50.3

$39.6

OPERATING MARGINS1

(PERCENTAGE)

2002 2003 2004 2005 2005P 2006

6.3

5.6

6.5

6.2

5.8

5.4

SALES

(DOLLARS IN MILLIONS)

2002 2003 2004 2005 2006

$3,114

$2,625

$2,109

$1,471

$1,273

is to be the number one sports and fitness specialty retailer for all athletes and

outdoor enthusiasts, through the relentless improvement of everything we do.

OUR GOAL

FINANCIAL HIGHLIGHTS

Fiscal Year 2006 2005 2004

(Dollars in thousands, except per share data)

Net sales $ 3,114,162 $2,624,987 $2,109,399

Gross profit 896,699 737,640 586,526

Gross profit margin 28.8%28.1% 27.8%

Selling, general and administrative expenses 682,625 556,320 443,776

Pre-opening expenses 16,36410,781 11,545

Merger integration and store closing costs –37,790 20,336

Income from operations 197,710 132,749110,869

Net Income112,611 72,980 68,905

Adjusted Net Income2$ $112,611 $81,064$74,518

Diluted earnings per common share 2.03 1.35 1.30

Adjusted Diluted earnings per common share 2$ 2.03 $1.50 $1.41

Diluted weighted average shares outstanding (in thousands) 55,395 53,97952,921

Total stockholders’ equity$ 620,550 $414,793$313,667

Return on invested capital 10.5% 11.3% 12.1%

EBITDA $ 252,639 $184,454 $160,471

Adjusted EBITDA 2$ 252,639 $197,058 $165,799

Comparable store net sales increase 6.0% 2.6%2.6%

Store count 294255 234

1Results exclude merger integration and store closing costs, gain on sale of investment, and loss on write-down of non-cash investment.

2Results exclude merger integration and store closing costs, gain on sale of investment, and are adjusted for the effect of expensing stock options as if we had

applied SFAS 123, “Accounting for Stock-Based Compensation”, in 2005.

2005 P: Proforma results are adjusted for the effect of expensing stock options as if we had applied SFAS 123,

“

Accounting for Stock-Based Compensation”, in 2005.