Delta Airlines 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

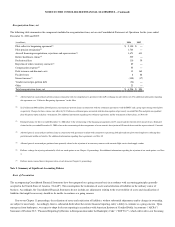

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

..

Note 1. Chapter 11 Proceedings

General Information

Delta Air Lines, Inc., a Delaware corporation, is a major air carrier that provides air transportation for passengers and cargo throughout the U.S. and

around the world. Our Consolidated Financial Statements include the accounts of Delta Air Lines, Inc. and our wholly owned subsidiaries, including Comair,

Inc. (“Comair”), which are collectively referred to as Delta.

On September 14, 2005 (the “Petition Date”), we and substantially all of our subsidiaries (collectively, the “Debtors”) filed voluntary petitions for

reorganization under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”), in the United States Bankruptcy Court for the Southern

District of New York (the “Bankruptcy Court”). The reorganization cases are being jointly administered under the caption “In re Delta Air Lines, Inc., et al.,

Case No. 05-17923-ASH.”

The Debtors are operating as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of

the Bankruptcy Code. In general, as debtors-in-possession, the Debtors are authorized under Chapter 11 to continue to operate as an ongoing business, but

may not engage in transactions outside the ordinary course of business without the prior approval of the Bankruptcy Court.

Our reorganization in Chapter 11 has involved a fundamental transformation of our business. Shortly after the Petition Date, we outlined a business plan

intended to make Delta a simpler, more efficient and more customer focused airline with an improved financial condition. Under this plan, we were seeking

$3.0 billion in annual financial improvements by the end of 2007 through revenue increases and cost reductions. As of December 31, 2006, we reached that

goal and these improvements are reflected in our Consolidated Financial Statements for 2006. We expect we will achieve additional financial improvements

in 2007.

As a result of our reorganization, we expect to emerge from bankruptcy as a competitive, standalone airline with a global network. Our business strategy

touches all facets of our operations - the destinations we will serve, the way we will serve our customers, and the fleet we will operate - in order to earn

customer preference and continue to improve revenue performance. At the same time, we intend to remain focused on maintaining the competitive cost

structure we have obtained from our reorganization to improve our financial position and pursue long-term stability as a standalone carrier.

Important aspects of our emergence business strategy include the following:

•Leveraging Network Strength to Provide Expanded International Service. We will continue to focus on international growth. With our

geographically-balanced hubs, we believe we are well-positioned for international growth from the U.S. to Europe and Latin America. In addition,

we expect our hubs will help us increase service to Africa and Asia.

•Maintaining Focus on Improving the Customer Experience. Our focus on safety will remain our top priority. We are also committed to continuous

improvement throughout our operations to earn our customers’ preference. We have renewed our focus on improving our product and customer

service through aircraft cabin and airport improvements.

•Maximizing a Streamlined and Upgraded Fleet. We are supporting the ongoing changes to our network by bolstering our internationally-capable

mainline fleet. We plan to pursue additional strategic improvements to our fleet by adding high-performance aircraft that will enable us to serve

new destinations with appropriate capacity. We have announced plans to add 28 internationally capable aircraft scheduled for delivery in 2007

through 2009.

•Capturing the Benefit of Competitive Cost Structure. Through initiatives undertaken during the Chapter 11 proceedings and previous productivity

initiatives, we currently have one of the lowest mainline unit cost structures of any full service carrier. These efforts have resulted in reduced costs

throughout our organization, including reductions in employment costs, retiree pension and healthcare costs and aircraft fleet costs. We recognize

that, to succeed, we must maintain the competitive unit cost structure that we developed through our restructuring efforts.

F-9