Dell 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

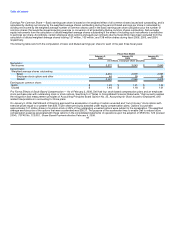

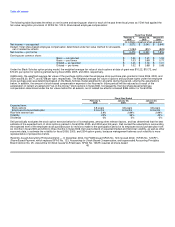

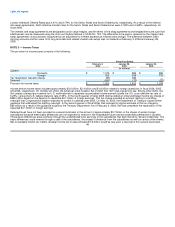

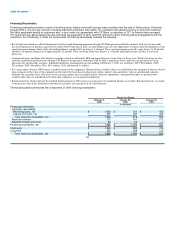

The following table illustrates the effect on net income and earnings per share for each of the past three fiscal years as if Dell had applied the

fair value recognition provisions of SFAS No. 123 to share-based employee compensation:

Fiscal Year Ended

February 3, January 28, January 30,

2006 2005 2004

(in millions, except per share amounts)

Net income — as reported $ 3,572 $ 3,043 $ 2,645

Deduct: Total share-based employee compensation determined under fair value method for all awards,

net of related tax effects (1,094) (812) (829)

Net income — pro forma $ 2,478 $ 2,231 $ 1,816

Earnings per common share:

Basic — as reported $ 1.49 $ 1.21 $ 1.03

Basic — pro forma $ 1.03 $ 0.89 $ 0.71

Diluted — as reported $ 1.46 $ 1.18 $ 1.01

Diluted — pro forma $ 1.02 $ 0.88 $ 0.68

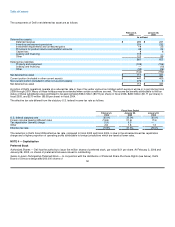

Under the Black-Scholes option pricing model, the weighted average fair value of stock options at date of grant was $10.22, $10.72, and

$10.25, per option for options granted during fiscal 2006, 2005, and 2004, respectively.

Additionally, the weighted average fair value of the purchase rights under the employee stock purchase plan granted in fiscal 2006, 2005, and

2004 was $6.30, $9.77, and $7.88 per right, respectively. The weighted average fair value of options and purchase rights under the employee

stock purchase plan was determined based on the Black-Scholes model weighted for all grants during the period, utilizing the assumptions

below. In addition, the amount of stock-based compensation expense to be incurred in future periods will be reduced as a result of the

acceleration of certain unvested and "out-of-the-money" stock options in fiscal 2006. Consequently, the total share-based employee

compensation determined under the fair value method for all awards, net of related tax effects increased $384 million for fiscal 2006.

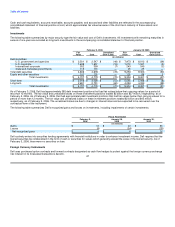

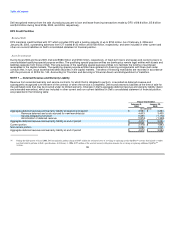

Fiscal Year Ended

February 3, January 28, January 30,

2006 2005 2004

Expected term:

Stock options 3.8 years 3.8 years 3.8 years

Employee stock purchase plan 3 months 6 months 6 months

Risk-free interest rate 3.9% 2.89% 2.99%

Volatility 25% 36% 43%

Dividends 0% 0% 0%

Dell periodically evaluates the stock option exercise behavior of its employees, among other relevant factors, and has determined that the best

estimate of the expected term of stock options granted in fiscal 2006, 2005, and 2004 was 3.8 years. Dell revised the assumptions surrounding

the expected term of the employee stock purchase plan for revisions made to the participation period of its employee stock purchase plan from

six months in fiscal 2005 and 2004 to three months in fiscal 2006. Dell used a blend of expected implied and historical volatility, as well as other

economic data, to estimate the volatility for fiscal 2006, 2005, and 2004 option grants, because management believes such volatility is more

representative of prospective trends.

Recently Issued Accounting Pronouncements — In December 2004, the FASB issued SFAS No. 123 (revised 2004) ("SFAS No. 123(R)"),

Share-Based Payment, which replaced SFAS No. 123, Accounting for Stock-Based Compensation, and superseded Accounting Principles

Board Opinion No. 25, Accounting for Stock Issued to Employees. SFAS No. 123(R) requires all share-based

45