Dell 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

instruments represents a natural hedge as their gains and losses offset the changes in the underlying fair value of the monetary assets and liabilities due to

movements in currency exchange rates. These contracts generally expire in three months or less.

If the derivative is designated as a cash flow hedge, the effective portion of the change in the fair value of the derivative is initially deferred in other

comprehensive income. These amounts are subsequently recognized in income as a component of net revenue or cost of revenue in the same period the

hedged transaction affects earnings. The ineffective portion of the change in the fair value of cash flow hedge is recognized currently in earnings and is

reported as a component of investment and other income (loss), net. Hedge effectiveness is measured by comparing the hedging instrument's cumulative

change in fair value from inception to maturity to the forecasted transaction's terminal value.

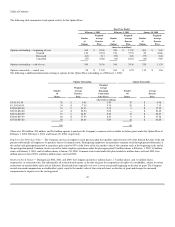

SFAS 133 requires that the Company recognize all derivatives as either assets or liabilities in the Consolidated Statement of Financial Position and measure

those instruments at fair value. At February 1, 2002, the Company held purchased option contracts with a notional amount of $2 billion, a net asset value of

$83 million and a net unrealized deferred gain of $11 million, net of taxes. At February 1, 2002, the Company held forward contracts with a notional amount

of $2 billion, a net asset value of $95 million and a net unrealized gain of $28 million, net of taxes. During the year ended February 1, 2002, the Company did

not discontinue any cash flow hedges for which it was probable that a forecasted transaction would not occur. Hedge ineffectiveness was not material.

At February 2, 2001, the Company held purchased option contracts with a notional amount of $2 billion, a net asset value of $67 million and a net unrealized

deferred loss of $4 million. At February 2, 2001, the Company held forward contracts with a notional amount of $713 million, a net liability value of

$49 million and a net unrealized deferred loss of $1 million.

Long-term Debt and Interest Rate Risk Management

In April 1998, the Company issued $200 million 6.55% fixed rate senior notes due April 15, 2008 (the "Senior Notes") and $300 million 7.10% fixed rate

senior debentures due April 15, 2028 (the "Senior Debentures"). Interest on the Senior Notes and Senior Debentures is paid semi-annually, on April 15 and

October 15. The Senior Notes and Senior Debentures rank pari passu and are redeemable, in whole or in part, at the election of the Company for principal, any

accrued interest and a redemption premium based on the present value of interest to be paid over the term of the debt agreements. The Senior Notes and

Senior Debentures generally contain no restrictive covenants, other than a limitation on liens on the Company's assets and a limitation on sale-leaseback

transactions.

Concurrent with the issuance of the Senior Notes and Senior Debentures, the Company entered into interest rate swap agreements converting the Company's

interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate characteristics to its cash and investments portfolio.

The interest rate swap agreements have an aggregate notional amount of $200 million maturing April 15, 2008 and $300 million maturing April 15, 2028. The

floating rates are based on three-month London interbank offered rates ("LIBOR") plus 0.41% and 0.79% for the Senior Notes and Senior Debentures,

respectively. As a result of the interest rate swap agreements, the Company's effective interest rates for the Senior Notes and Senior Debentures were 4.54%

and 4.87%, respectively, for fiscal 2002.

The interest rate swap agreements are designated as fair value hedges, and the terms of the swap agreements and hedged items are such that effectiveness can

be measured using the short-cut method defined in SFAS 133. The differential to be paid or received on the interest rate swap agreements is accrued and

recognized as an adjustment to interest expense as interest rates change.

42