Dell 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

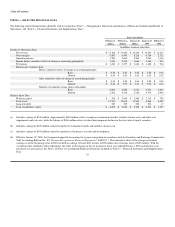

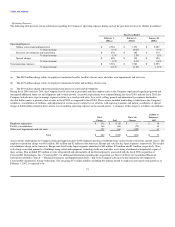

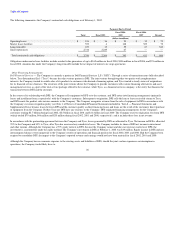

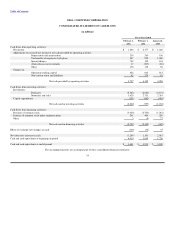

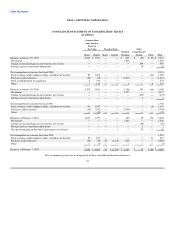

The following summarizes the Company's contractual cash obligations as of February 1, 2002.

Payments Due by Period

Fiscal 2004- Fiscal 2006-

Total Fiscal 2003 2005 2007 Beyond

(dollars in millions)

Operating leases $ 196 $ 36 $ 53 $ 35 $ 72

Master leases facilities 553 4 168 309 72

Long-term debt 679 15 55 67 542

Share repurchases 2,316 2,249 67 — —

Total contractual cash obligations $ 3,744 $ 2,304 $ 343 $ 411 $ 686

Obligations under master lease facilities include residual value guarantees of up to $162 million in fiscal 2004, $306 million in fiscal 2006, and $71 million in

fiscal 2008. Amounts due under the Company's long-term debt include the net impact of interest rate swap agreements.

Other Financing Arrangements

Dell Financial Services — The Company is currently a partner in Dell Financial Services L.P. ("DFS"). Through a series of transactions more fully described

below, Tyco International Ltd. ("Tyco") became the other venture partner in DFS. The joint venture brought together two parties with complementary

interests: the Company wanted to enable sales of its products to customers who desired a financing option, and Tyco wanted a steady source of originations

for its financial services business. The existence of the joint venture allows the Company to provide customers with various financing alternatives and asset

management services as a part of the total service package offered to the customer, while Tyco, as a financial services company, is the entity that finances the

transaction between DFS and the customer.

In the course of its relationship with DFS, the Company sells equipment to DFS or to the customer, and DFS enters into financing arrangements (primarily

leases and installment loans, respectively) with the Company's customers. Subsequent to origination, DFS sells the loan or lease receivable stream to Tyco,

and DFS remits the product sales invoice amounts to the Company. The Company recognizes revenue from the sale of equipment to DFS in accordance with

the Company's revenue recognition policy (see Note 1 of Notes to Consolidated Financial Statements included in "Item 8 — Financial Statements and

Supplementary Data) because leases between DFS and the customer qualify as direct financing leases and loans are the result of the customers' direct purchase

of equipment from the Company. Neither Tyco nor DFS have any recourse to the Company. DFS originated financing arrangements for the Company's

customers totaling $2.7 billion during fiscal 2002, $2.5 billion in fiscal 2001 and $1.8 billion in fiscal 2000. The Company receives origination fees from DFS

(which totaled $70 million, $66 million and $20 million during fiscal 2002, 2001 and 2000, respectively), and it includes those fees in net revenue.

In accordance with the partnership agreement between the Company and Tyco, losses generated by DFS are allocated to Tyco. Net income in DFS is allocated

70% to the Company and 30% to Tyco, after Tyco has recovered any cumulative losses. The Company includes its share of DFS net income in investment

and other income. Although the Company has a 70% equity interest in DFS, because the Company cannot and does not exercise control over DFS, the

investment is accounted for under the equity method. The Company's investment in DFS at February 1, 2002 was $19 million. Equity income in DFS and any

intercompany balances were immaterial to the Company's results of operations and financial position for fiscal 2002, 2001 and 2000. Had the Company been

required to consolidate DFS, the impact to the Company's reported revenue and earnings would not have been material for fiscal 2002, 2001 and 2000.

Although the Company has no economic exposure to the existing assets and liabilities of DFS, should the joint venture experience an interruption in

operations, the Company would likely have to

26