DELPHI 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 DELPHI annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

Delphi Automotive PLC (DLPH) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/17/2012 Filed Period 12/31/2011 -

Page 2

...(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission file number: 001-35346 DELPHI AUTOMOTIVE PLC (Exact name of registrant as... -

Page 3

...Comments Properties Legal Proceedings Mine Safety Disclosure Part II Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operation Quantitative... -

Page 4

... factors are discussed under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Company's filings with the Securities and Exchange Commission. New risks and uncertainties arise from time to time, and it is impossible for us... -

Page 5

... product solutions for our customers. In line with the growth in emerging markets, we have been increasing our focus on these markets, particularly China, where we have a major manufacturing base and strong customer relationships. Website Access to Company's Reports Delphi's internet website address... -

Page 6

... management systems including fuel handling, fuel injection, combustion, electronic controls, test and validation capabilities, diesel and automotive aftermarket, and original equipment services. We design solutions to optimize powertrain power and performance while helping our customers meet new... -

Page 7

... automotive OEMs in the world, and, in 2011, 23% of our net sales came from emerging markets (Asia Pacific and South America). Our six largest platforms in 2011 were with six different OEMs. In addition, in 2011 our products were found in 17 of the 20 top-selling vehicle models in the United States... -

Page 8

...and performance from gasoline and diesel internal combustion engines. At the same time, suppliers are also developing and marketing new and alternative technologies that support hybrid vehicles, electric vehicles and fuel cell products to improve fuel economy and emissions. Connected. The third mega... -

Page 9

... Our organizational structure and management reporting support the management of these core product lines: Electrical/Electronic Architecture. This segment offers complete electrical and electronic architectures for our customer-specific needs that help reduce production cost, weight and mass, and... -

Page 10

... sensing. Electric and hybrid electric vehicle power electronics comprises power modules, inverters and converters and battery packs. Thermal Systems. This segment offers energy efficient thermal system and component solutions for the automotive market and continues to develop applications for the... -

Page 11

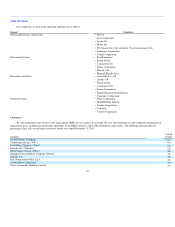

... parts, including the aftermarket operations of our OEM customers and to other distributors and retailers. The following table provides the percentage of net sales to our largest customers for the year ended December 31, 2011: % of our revenue Customer General Motors Company Volkswagen Group ("VW... -

Page 12

... available raw materials, sub-components and work-inprocess inventory for OEM orders and from current on-hand finished goods inventory for aftermarket orders. The dollar amount of such purchase order releases on hand and not processed at any point in time is not believed to be significant based upon... -

Page 13

... Intellectual Property We maintain technical engineering centers in major regions of the world to develop and provide advanced products, processes and manufacturing support for all of our manufacturing sites, and to provide our customers with local engineering capabilities and design development on... -

Page 14

... other material-related cost pressures using a combination of strategies, including working with our suppliers to mitigate costs, seeking alternative product designs and material specifications, combining our purchase requirements with our customers and/or suppliers, changing suppliers, hedging of... -

Page 15

... of Delphi Electrical/Electronic Architecture (E/EA) effective February 2012. He also continues to serve as president of Delphi Asia-Pacific. Mr. Abulaban was most recently president of the Connection Systems product business unit for Delphi E/EA. Mr. Abulaban was appointed managing director... -

Page 16

... business line executive in Delphi's Powertrain division in Luxembourg and in the Asia Pacific and North America regions. Ms. Lùcia V. Moretti, 47, is senior vice president of Delphi and president of Delphi Product and Service Solutions (DPSS). She was named to her current position in August 2011... -

Page 17

... of Delphi Electronics and Safety (E&S). He was named to his current position in February 2012 and was most recently vice president of the Infotainment & Driver Interface product business unit (PBU) for Delphi E&S since August 2009. He was previously general director of the Controls & Security PBU... -

Page 18

... in automotive sales and production by our customers could have a material adverse effect on our business, results of operations and financial condition. A drop in the market share and changes in product mix offered by our customers can impact our revenues. We are dependent on the continued growth... -

Page 19

..., GM, PSA and VW accounted for approximately 47% of our total net sales in the year ended December 31, 2011. Accordingly, our revenues may be disproportionately affected by decreases in any of their businesses or market share. Because our customers typically have no obligation to purchase a specific... -

Page 20

... at the right time to support product development and manufacturing capacity in areas where we can support our customer base. We have identified the Asia Pacific and South American regions, and China, Brazil and India, in particular, as key markets likely to experience substantial growth, and... -

Page 21

... purchase orders from our customers, these purchase orders generally provide for the supply of a customer's requirements for a particular vehicle model and assembly plant, rather than for the purchase of a specific quantity of products. The loss of business with respect to, or the lack of commercial... -

Page 22

... impact on our business, results of operations or financial condition. Continuing volatility may have adverse effects on our business, results of operations or financial condition. We will continue efforts to pass some supply and material cost increases onto our customers, although competitive and... -

Page 23

... defined benefit pension plans, which generally provide benefits based on negotiated amounts for each year of service. Our primary non-U.S. plans are located in Mexico and the United Kingdom and were underfunded by $319 million as of December 31, 2011. The funding requirements of these benefit plans... -

Page 24

... will be completed as planned or achieve the desired results. Additionally, from time to time in the past, we have recorded asset impairment losses relating to specific plants and operations. Generally, we record asset impairment losses when we determine that our estimates of the future undiscounted... -

Page 25

... in Asia Pacific, Eastern and Western Europe, South America and Northern Africa. We also purchase raw materials and other supplies from many different countries around the world. For the year ended December 31, 2011, approximately 69% of our net revenue came from sales outside the United States... -

Page 26

... to manage and keep our operations running efficiently and effectively. An incident that results in a wider or sustained disruption to our business could have a material adverse effect on our business, financial condition and results of operations. Risks Related to Our Ordinary Shares The price... -

Page 27

... a material adverse effect on our business. OEMs also require their suppliers to guarantee or warrant their products and bear the costs of repair and replacement of such products under new vehicle warranties. Depending on the terms under which we supply products to a vehicle manufacturer, a vehicle... -

Page 28

... assure that our costs of complying with current and future environmental and health and safety laws, and our liabilities arising from past or future releases of, or exposure to, hazardous substances will not adversely affect our business, results of operations or financial condition. For example... -

Page 29

... the supply of wire harnesses to vehicle manufacturers, for which no accruals have been recorded as of December 31, 2011. While we believe our reserves are adequate, the final amounts required to resolve these matters could differ materially from our recorded estimates and our results of operations... -

Page 30

... of operations and financial condition. Taxing authorities could challenge our historical and future tax positions. The amount of tax we pay is subject to our interpretation of applicable tax laws in the jurisdictions in which we file. We have taken and will continue to take tax positions based on... -

Page 31

... North America Asia Pacific South America Total Electrical/Electronic Architecture Powertrain Systems Electronics and Safety Thermal Systems Total 26 4 3 5 38 17 10 10 4 41 13 5 3 4 25 6 2 1 1 10 62 21 17 14 114 In addition to these manufacturing sites, we had 15 major technical centers... -

Page 32

... recorded as of December 31, 2011. Unsecured Creditors Litigation In December 2011, a complaint was filed in the Bankruptcy Court alleging that the redemption by Delphi Automotive LLP of the membership interests of GM and the PBGC, our initial public offering and a distribution by Delphi Automotive... -

Page 33

... matters. While we believe our accruals are adequate, the final amounts required to resolve these matters could differ materially from our recorded estimates and our results of operations could be materially affected. Romania Value Added Tax ("VAT") Assessment During the first quarter of 2010, as... -

Page 34

... AND ISSUER PURCHASES OF EQUITY SECURITIES Our ordinary shares have only been publicly traded since November 17, 2011 when our ordinary shares were listed and began trading on the New York Stock Exchange (NYSE) under the symbol "DLPH". The following table sets forth the high and low sales price per... -

Page 35

... units and the estimated VCP award shares have no exercise price. Remaining shares available under the Long Term Incentive Plan. Repurchase of Equity Securities None of our issued ordinary shares have been reacquired by the Company since their initial issuance on November 17, 2011. In January 2012... -

Page 36

... 328,244,510 ordinary shares in exchange for all outstanding membership interests of Delphi Automotive LLP pursuant to Section 4(2) under the Securities Act of 1933. Initial Public Offering Proceeds We completed our initial public offering on November 22, 2011 pursuant to a registration statement... -

Page 37

... Annual Report. The financial information presented may not be indicative of our future performance. Successor Period Year ended December 31, from August 19 to December 31, 2011 2010 2009 (dollars and shares in millions, except per share data) Statements of operations data: Net sales Depreciation... -

Page 38

...to 1) the implementation of information technology systems to support finance, manufacturing and product development initiatives, 2) certain plant consolidations and closures costs and 3) consolidation of many staff administrative functions into a global business service group. The reconciliation of... -

Page 39

...and electronic, powertrain, safety and thermal technology solutions to the global automotive and commercial vehicle markets. We are one of the largest vehicle component manufacturers and our customers include 24 of the 25 largest automotive OEMs in the world. Business Strategy We believe the Company... -

Page 40

... 72% of our 2011 net sales, including electrical/ electronic distribution systems, automotive connection systems, diesel engine management systems, and infotainment & driver interface; Providing products in 2011 that were found in 17 of the 20 top-selling vehicle models in the United States, in all... -

Page 41

...years. All of our business segments have operations and sales in China. As a result, we have well-established relationships with all of the major OEMs in China. We generated approximately $2 billion in revenue from China in 2011. With only 21 of our 33 offered products currently locally manufactured... -

Page 42

... on developing leading product solutions for our key markets, located at 15 major technical centers in Brazil, China, France, Germany, India, Luxembourg, Mexico, Poland, South Korea, the United Kingdom and the United States. We invest approximately $1 billion annually in research and development... -

Page 43

... global vehicle components industry is generally capital intensive and a portion of a supplier's capital equipment is frequently utilized for specific customer programs. Lead times for procurement of capital equipment are long and typically exceed start of production by one to two years. Substantial... -

Page 44

...and this business constituted the entirety of the operations of the Successor. Accordingly, as required under the applicable accounting guidance, the financial information set forth herein reflects the consolidated results of operations of the Successor for the years ended December 31, 2011 and 2010... -

Page 45

... Results of Operations Our improved total net sales during the year ended December 31, 2011 as compared to 2010 reflect the impacts of increased OEM production volumes as well as the level of our content per unit, and, to a lesser extent, the impacts of foreign currency exchange rate fluctuations... -

Page 46

... using a number of approaches, including combining purchase requirements with customers and/or other suppliers, using alternate suppliers or product designs, negotiating cost reductions and/or commodity cost contract escalation clauses into our vehicle manufacturer supply contracts, and hedging... -

Page 47

...compared to year ended December 31, 2010. The increase in total net sales resulted primarily from increased volume as a result of improved OEM production schedules in 2011 as well as the level of our content per unit, and to a lesser extent, the impacts of foreign currency exchange rate fluctuations... -

Page 48

... rate of net sales. Increases in SG&A were largely attributable to foreign exchange effects and increased accruals for incentive compensation of $29 million including the accelerated vesting of Board of Directors shares upon our initial public offering. Amortization Year ended December 31, 2011... -

Page 49

... of net sales $ 31 0.2% $ 224 1.6% $ 193 The decrease in restructuring expense is due to a decline in workforce reductions and programs related to the rationalization of manufacturing and engineering processes, including plant closures, in the year ended December 31, 2011 as compared... -

Page 50

... legal entity restructuring and changes in valuation allowances on deferred tax assets. Our effective tax rate can potentially have wide variances from quarter to quarter, resulting from interim reporting requirements and the recognition of discrete events. Equity Income Year ended December 31, 2011... -

Page 51

...and improving the functionality of information technology systems to support finance, manufacturing and product development initiatives, 2) certain plant consolidations and closures costs, 3) continued consolidation of many staff administrative activities, and 4) employee benefit plan settlements in... -

Page 52

...by segment for the years ended December 31, 2011 and 2010 are as follows: Net Sales by Segment Years ended December 31, Volume, net of contractual price reductions $ 632 749 260 86 (6) 1,721 $ Variance due to: 2011 Electrical/Electronic Architecture Powertrain Systems Electronics and Safety Thermal... -

Page 53

... for incentive compensation in 2011 related to our executive Long-Term Incentive Plan, as well as vesting of Board of Directors shares including accelerated vesting upon our initial public offering; and $23 million related to divestitures that occurred during the year ended December 31, 2010. 52 -

Page 54

...: Successor Year ended December 31, 2010 Period from August 19 to December 31, 2009 Predecessor Period from January 1 to October 6, 2009 (dollars in millions) (dollars in millions) Net sales Cost of sales Gross margin Selling, general and administrative Amortization Restructuring Operating income... -

Page 55

... of Sales Cost of sales is primarily comprised of material, labor, manufacturing overhead, freight, fluctuations in foreign currency exchange rates, product engineering, design and development expenses, depreciation and amortization, warranty costs and other operating expenses. Successor Year ended... -

Page 56

... to October 6, 2009 (dollars in millions) (dollars in millions) Selling, general and administrative expense Percentage of net sales Successor $ 815 5.9% $ 242 7.1% $ 734 8.8% SG&A continued to decline as a percent of sales in the year ended December 31, 2010 and the Successor Period of 2009... -

Page 57

... Contents Successor During the year ended December 31, 2010, we continued our restructuring actions to align our manufacturing operations with current OEM production levels as well as continuing to relocate our manufacturing and engineering processes to lower cost locations. As such, we recognized... -

Page 58

...(in millions) Sale / disposition of the Predecessor Extinguishment of liabilities subject to compromise PBGC termination of U.S. pension plans Salaried OPEB settlement Professional fees directly related to reorganization Other Total reorganization items Income Taxes Successor Year ended December 31... -

Page 59

... of 2009 includes the losses related to the operations and assets held for sale of the halfshaft and steering system products (the "Steering Business") and the Automotive Holdings Group ("AHG"), which included various non-core product lines and plant sites that did not fit our or the Predecessor... -

Page 60

...to 1) the implementation of information technology systems to support finance, manufacturing and product development initiatives, 2) certain plant consolidations and closures costs and 3) consolidation of many staff administrative functions into a global business service group. The reconciliation of... -

Page 61

... Predecessor Electrical/ Electronic Architecture Electronics Powertrain Systems Thermal and Safety Systems (in millions) Eliminations and Other Total January 1 - October 6, 2009: Adjusted EBITDA Transformation and rationalization charges: Employee termination benefits and other exit costs Other... -

Page 62

...and $55 million in the Electronics and Safety, Powertrain Systems and Electrical/Electronic Architecture, respectively, offset by increased costs of $36 million and $10 million in the Thermal Systems and Eliminations and Other segments, respectively. Favorable foreign currency exchange impact of $29... -

Page 63

...company, and had nominal assets, no liabilities and had conducted no operations prior to the completion of its initial public offering on November 22, 2011. Delphi Automotive PLC completed the initial public offering of 24,078,827 ordinary shares by the selling shareholders for an aggregate purchase... -

Page 64

..., additional share repurchases, and/or general corporate purposes. Pursuant to the registration rights agreement for the Senior Notes, during the first half of 2012, the Company expects to file a Form S-4 Registration Statement to register the debt securities. Credit Agreement In March 2011, in... -

Page 65

...and November 15 of each year. Delphi paid $30 million of interest in November 2011. We paid approximately $23 million of debt issuance costs in connection with the Senior Notes. The net proceeds of approximately $1.0 billion as well as cash on hand were used to pay down amounts outstanding under the... -

Page 66

...received $55 million from these Federal agencies in 2011 for work performed. These programs supplement our internal research and development funds and directly support our product focus of Safe, Green and Connected. The largest current program by cost was awarded as part of the American Recovery and... -

Page 67

...information on our recurring purchases of materials for use in our manufacturing operations. These amounts are generally consistent from year to year, closely reflect our levels of production, and are not long-term in nature. The amounts below exclude as of December 31, 2011, the gross liability for... -

Page 68

...) Electrical/Electronic Architecture Powertrain Systems Electronics and Safety Thermal Systems Eliminations and Other Continuing operations capital expenditures Discontinued operations Total capital expenditures North America Europe, Middle East & Africa Asia Pacific South America Continuing... -

Page 69

... of our non-U.S. subsidiaries sponsor defined benefit pension plans, which generally provide benefits based on negotiated amounts for each year of service. Our primary non-U.S. plans are located in France, Germany, Luxembourg, Mexico, Portugal and the United Kingdom ("U.K."). The U.K. and certain... -

Page 70

Table of Contents plans are funded. In addition, we have defined benefit plans in South Korea, Turkey and Italy for which amounts are payable to employees immediately upon separation. The obligations for these plans are recorded based on the vested obligation. We anticipate making required pension ... -

Page 71

... environmental requirements will not change or become more stringent over time or that our eventual environmental remediation costs and liabilities will not be material. Certain environmental laws assess liability on current or previous owners or operators of real property for the cost of removal... -

Page 72

... future claims on products sold. We base our estimate on historical trends of units sold and payment amounts, combined with our current understanding of the status of existing claims and discussions with our customers. The key factors which impact our estimates are (1) the stated or implied warranty... -

Page 73

... details. The key factors which impact our estimates are (1) discount rates; (2) asset return assumptions; and (3) actuarial assumptions such as retirement age and mortality which are determined as of the current year measurement date. We review our actuarial assumptions on an annual basis and make... -

Page 74

...sales data, independent automotive production volume estimates and customer commitments and review of appraisals. The key factors which impact our estimates are (1) future production estimates; (2) customer preferences and decisions; (3) product pricing; (4) manufacturing and material cost estimates... -

Page 75

... a material impact on our financial condition and results of operations. We calculate our current and deferred tax provision based on estimates and assumptions that could differ from the actual results reflected in income tax returns filed in subsequent years. Adjustments based on filed returns are... -

Page 76

... herein), a long-term incentive plan for key employees. Estimating the fair value for share-based payments requires us to make assumptions regarding the nature of the payout of the award as well as changes in our stock price during the post-initial public offering period. Any differences in actual... -

Page 77

Table of Contents Refer to Note 21. Share-Based Compensation to the audited consolidated financial statements included... required to implement which may be applicable to our operations. Additionally the significant accounting standards that have been adopted during the year ended December 31, 2011 ... -

Page 78

... herein. We maintain risk management control systems to monitor exchange and commodity risks and related hedge positions. Positions are monitored using a variety of analytical techniques including market value and sensitivity analysis. The following analyses are based on sensitivity tests, which... -

Page 79

...Credit Agreement. The applicable interest rates listed above for the Revolving Credit Facility and the Tranche A Term Loan may increase or decrease from time to time by 0.25% based on changes to our corporate credit ratings. Accordingly, the interest rate will fluctuate during the term of the Credit... -

Page 80

... (United States), Delphi Automotive PLC's internal control over financial reporting as of December 31, 2011, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 17, 2012... -

Page 81

... opinion, Delphi Automotive PLC maintained, in all material respects, effective internal control over financial reporting as of December 31, 2011, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the... -

Page 82

... Year ended December 31, 2011 Year ended December 31, 2010 Period from August 19 to December 31, 2009 Predecessor Period from January 1 to October 6, 2009 (in millions, except per share amounts) (in millions, except per share amounts) Net sales: Operating expenses: Cost of sales Selling, general... -

Page 83

...DELPHI AUTOMOTIVE PLC CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Successor Year ended December 31, 2011 Year ended...effect, a $7 million tax effect, a $10 million tax effect and a $371 million tax effect related to employee benefit plans liability adjustments for the years ended December 31, 2011... -

Page 84

...DELPHI AUTOMOTIVE PLC CONSOLIDATED BALANCE SHEETS December 31, 2011 (in millions) 2010 ASSETS Current assets: Cash and cash equivalents (Note 2) Restricted cash Time deposits (Note 2) Accounts receivable, net (Note 2) Inventories (Note 4) Other current assets (Note 5) Total current assets Long-term... -

Page 85

... affiliates to minority shareholders Distributions to Delphi equity holders Redemption of membership interests Discontinued operations Net cash (used in) provided by financing activities Effect of exchange rate fluctuations on cash and cash equivalents Year ended December 31, 2010 (in millions... -

Page 86

(Decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $ (1,856) 3,219 1,363 $ 112 3,107 3,219 $ 3,107 - 3,107 $ (959) 959 - See notes to consolidated financial statements. 84 -

Page 87

Table of Contents DELPHI AUTOMOTIVE PLC CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (DEFICIT)-PREDECESSOR Common Stock Accumulated Paid-in Capital ...Deficit) (14,266) 9,347 4,946 (7) (20) - - Shares Balance at January 1, 2009 Net income Other comprehensive income Deconsolidation of ... -

Page 88

...DELPHI AUTOMOTIVE PLC CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY-SUCCESSOR Ordinary Shares Number Additional of Paid in Retained Shares...tax effect); and • Income from employee benefit plans liability adjustments of $59 million (net of a $17 million tax effect) • As of December 2011, ... -

Page 89

... largest vehicle component manufacturers, and its customers include 24 of the 25 largest automotive original equipment manufacturers ("OEMs") in the world. Delphi operates 114 major manufacturing facilities and 15 major technical centers utilizing a regional service model that enables the Company to... -

Page 90

...had conducted no operations prior to its initial public offering. On November 22, 2011, in conjunction with the completion of its initial public offering by the selling shareholders, all of the outstanding equity of Delphi Automotive LLP was exchanged for ordinary shares of Delphi Automotive PLC. As... -

Page 91

...25 (10,210) Disposition of the Predecessor-The Predecessor sold the automotive supply business (other than the global steering business and the UAW manufacturing facilities in the U.S. which were acquired by GM) to Delphi. Certain assets and liabilities were retained by DPHH and various liabilities... -

Page 92

... in Kokomo, Indiana; Rochester, New York; Lockport, New York; and Grand Rapids, Michigan, for no cash consideration paid to Delphi. Under the MDA, in exchange for the sale of these businesses, GM waived certain claims, paid a portion of the DIP loans, agreed to pay certain administrative claims and... -

Page 93

... applying the DCF method: • • Delphi provided its independent valuation specialist with projected net sales, expenses and cash flows, for the years ending December 31, 2010, 2011 and 2012 representing the Company's best estimates at the time the analysis was prepared. Discount rates to determine... -

Page 94

... units on a controlling basis in consideration of the difficult conditions within the automotive supplier industry. • Cost Approach: The cost approach considers reproduction or replacement cost as an indicator of value. The cost approach is based on the assumption that a prudent investor would pay... -

Page 95

... of the Company's property, plant and equipment were based on a combination of the cost or market approach, depending on whether market data was available. Identifiable intangible assets are recorded at fair value and include customer relationships, trade names, patents and in-process research and... -

Page 96

... and balances between consolidated Delphi businesses have been eliminated. Use of estimates-Preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP") requires the use of estimates and assumptions that... -

Page 97

... public offering on November 22, 2011 of 24,078,827 ordinary shares by the selling shareholders for an aggregate purchase price of approximately $530 million, all of the outstanding equity of Delphi Automotive LLP was exchanged for 328,244,510 ordinary shares, par value $0.01 in Delphi Automotive... -

Page 98

...-Property, plant and equipment, including internally-developed internal use software and special tools, were adjusted to fair value as of October 6, 2009, which represents a new cost basis, and were adjusted for depreciation in subsequent periods. Major improvements that materially extend the useful... -

Page 99

... is estimated by engineering, financial, and legal specialists based on current law and considers the estimated cost of investigation and remediation required and the likelihood that, where applicable, other responsible parties will be able to fulfill their commitments. The process of estimating 97 -

Page 100

... of the hedging program approval process, Delphi identifies the specific financial risk which the derivative transaction will minimize, the appropriate hedging instrument to be used to reduce the risk and the correlation between the financial risk and the hedging instrument. Purchase orders, sales... -

Page 101

... Plan for more information. Discontinued operations-In accordance with FASB ASC 360-10, Property, Plant, and Equipment, the general accounting principles applicable to the impairment or disposal of long-lived assets, a business component that is disposed of or classified as held for sale is reported... -

Page 102

... is effective for public companies for interim and annual reporting periods ending on or after December 15, 2010 and for nonpublic companies, for annual reporting periods ending on or after December 15, 2011. In January 2011, the FASB issued ASU 2011-01 Receivables- Deferral of the Effective Date of... -

Page 103

... real estate, it would continue to recognize the asset and related debt until the real estate is legally transferred to satisfy the debt. The guidance is effective for fiscal years beginning after June 15, 2012, and early adoption is permitted. Delphi is evaluating the effects of this guidance but... -

Page 104

... other things, govern certain aspects of the commercial relationship between the Predecessor and Old GM following the effectiveness of the Amended MRA and continuing after the Predecessor's emergence from chapter 11. The Amended MRA addressed the scope of Old GM's existing and future business awards... -

Page 105

...had agreed to continue manufacturing at certain non-core sites to meet Old GM's production requirements and Old GM had agreed to provide the Predecessor with operating cash flow breakeven support, or production cash burn breakeven ("PCBB"), from January 1, 2008 through site-specified time periods to... -

Page 106

... initiatives continued to be required. The Predecessor implemented a number of cash conservation measures, including a short-term salaried layoff plan, the suspension of 2009 pay increases and annual incentive payments for eligible employees, the cessation of health care and life insurance benefits... -

Page 107

... method of accounting. These affiliates are not publicly traded companies and are located primarily in South Korea, China and Mexico. Delphi's ownership percentages vary generally from approximately 20% to 50%, with the most significant investments in Korea Delphi Automotive Systems Corporation... -

Page 108

...under the equity method as of December 31, 2011 and 2010 and for the years ended December 31, 2011 and 2010, ...Sales to affiliates Purchases from affiliates 7. PROPERTY, NET Property, net consisted of: $ $ 66 304 $ $ 62 315 $ $ 7 51 $ $ 8 90 Estimated Useful Lives (Years) December 31, 2011... -

Page 109

...2010 Accumulated Amortization (in millions) Net Carrying Amount Amortized intangible assets: Patents and developed technology Customer relationships Trade names Total Unamortized intangible assets: In-process research & development Goodwill Total $ 487 140 96 723 27 8 758 $ 94 57 11 162 - - 162... -

Page 110

... for the years ended December 31, 2011 and 2010 is presented below: 2011 (in millions...2011 (in millions) 2010 Payroll-related obligations Employee benefits, including current pension obligations Income and other taxes payable Warranty obligations (Note 10) Restructuring (Note 11) Customer... -

Page 111

... its operating segments as of December 31, 2011. The estimated reasonably possible amounts to ultimately resolve all matters are not materially different from the recorded reserves as of December 31, 2011. The table below summarizes the activity in the product warranty liability for the years ended... -

Page 112

... as it relates to executing the Company's strategy in the normal course of business and transforming the salaried workforce to reduce general and administrative expenses. The following table summarizes the restructuring charges recorded for the years ended December 31, 2011 and 2010, and the periods... -

Page 113

... 2011. • Realignment of existing manufacturing capacity and closure of facilities. As part of Delphi's ongoing efforts to lower costs and operate efficiently, the Company recorded $10 million of restructuring costs in North America and South America, primarily related to the Electrical/Electronic... -

Page 114

... related to the rationalization of manufacturing and engineering processes. Additionally, the Electronics and Safety segment incurred $5 million and $7 million of costs related to upcoming sales and wind-down of its occupant protection systems business in North America and Europe during periods from... -

Page 115

... changes in the Company's corporate credit ratings. Upon completion of our initial public offering, the applicable interest rates for the Tranche A Term Loan and Revolving Credit Facility were reduced by 25 basis points. The Credit Agreement also requires that the Issuer pay certain commitment fees... -

Page 116

... type. The Company was in compliance with the Credit Agreement covenants as of December 31, 2011. The Tranche A Term Loan and the Tranche B Term Loan were each issued under the Credit Agreement at a 0.5% discount and Delphi paid approximately $86 million of debt issuance costs in connection with the... -

Page 117

... benefits based on negotiated amounts for each year of service. Delphi's primary non-U.S. plans are located in France, Germany, Luxembourg, Mexico, Portugal and the United Kingdom ("U.K."). The U.K. and certain Mexican plans are funded. In addition, Delphi has defined benefit plans in South Korea... -

Page 118

...Plan to the GM Hourly-Rate Employees Pension Plan, representing 30% and 10% of the projected benefit obligation and plan assets, respectively, as of September 29, 2008. The 414(l) Net Liability Transfer was sufficient to avoid an accumulated funding deficiency for the Hourly Plan for plan year ended... -

Page 119

... as a curtailment and a settlement under the guidance related to employer's accounting for postretirement benefits other than pensions. During the Predecessor period from January 1 to October 6, 2009, Old GM and GM funded an additional $41 million of OPEB payments made to the hourly workforce. 117 -

Page 120

.... Year ended Year ended December 31, December 31, 2011 2010 (in millions) Benefit obligation at beginning of period Interest cost Actuarial loss Benefits paid Benefit obligation at end of period Change in plan assets: Fair value of plan assets at beginning of period Delphi contributions Benefits... -

Page 121

... 2011 and 2010. Year ended Year ended December 31, December 31, 2011 2010 (in millions) Benefit obligation at beginning of period Service cost Interest cost Plan participants' contributions Actuarial loss Benefits paid Impact of curtailments Plan amendments and other Exchange rate movements Benefit... -

Page 122

...116 74 103 1,518 1,320 910 Plans with Plan Assets in Excess of ABO $ $ $ $ Total $ $ $ $ Benefit costs presented below were determined based on actuarial methods and included the following: U.S. Pension Plans Successor Year ended December 31, 2011 Year ended December 31, 2010 (in millions... -

Page 123

...4.10% N/A 2011 5.24% 3.66% Non-U.S. Plans 2010 5.69% 3.88% Assumptions used to determine net expense for years ended December 31: Pension Benefits U.S. Plans 2011 Weighted-average discount rate Weighted-average rate of increase in compensation levels Expected long-term rate of return on plan assets... -

Page 124

... of recent fund performance and historical returns, in developing the long-term rate of return assumptions. The assumptions for the United Kingdom and Mexico are primarily conservative long-term, prospective rates. Delphi's pension expense for 2012 is determined at the 2011 measurement date. For... -

Page 125

... quoted market prices on regulated financial exchanges of the underlying investments included in the fund. Real Estate-The fair value of real estate properties is estimated using an annual appraisal provided by the administrator of the property investment. Management believes this is an appropriate... -

Page 126

... Company's operating results and cash flows. However, at this time, Delphi is unable to estimate any reasonably possible range of loss that may ultimately result from this investigation. No accrual for this matter has been recorded as of December 31, 2011. Class Action Antitrust Litigation A number... -

Page 127

... recorded, Delphi's results of operations could be materially affected. At December 31, 2011, the difference between the recorded liabilities and the reasonably possible range of loss was not significant. Ordinary Business Litigation Delphi is from time to time subject to various legal actions... -

Page 128

... reserve is adequate, the final amounts required to resolve this initial assessment could differ materially from our recorded estimate. Operating leases Rental expense totaled $95 million, $98 million, $34 million and $76 million for the years ended December 31, 2011 and 2010, and the periods from... -

Page 129

... to the U.K., as is the case for U.S. based companies. A reconciliation of the provision (benefit) for income taxes compared with the amounts at the notional U.S. federal statutory rate was: Successor Year ended December 31, 2011 Year ended December 31, 2010 (in millions) Period from August... -

Page 130

... financial reporting purposes and the bases of such assets and liabilities as measured by tax laws. Significant components of the deferred tax assets and liabilities are as follows: December 31 2011 (in millions) 2010 Deferred tax assets: Pension Employee Benefits Net operating loss carryforwards... -

Page 131

... recorded valuation allowances of $3 million and $19 million at December 31, 2011 and 2010, respectively. These tax credit carryforwards expire in 2012 through 2029. Cumulative undistributed foreign earnings Withholding taxes of $39 million on undistributed earnings are related to China, South Korea... -

Page 132

... reduction in unrecognized tax benefits over the next twelve months of approximately $22 million due to expected resolution with tax authorities. Tax return filing determinations and elections Delphi Automotive LLP, which acquired the automotive supply and other businesses of the Predecessor on... -

Page 133

..., the Acquisition Date, which liability could have a material adverse impact on our results of operations and financial condition. 16. SHAREHOLDERS' EQUITY AND NET INCOME (LOSS) PER SHARE Overview On May 19, 2011, Delphi Automotive PLC was formed as a Jersey public limited company, and had nominal... -

Page 134

... using the treasury stock method by dividing net income (loss) attributable to Delphi by the diluted weighted average number of ordinary shares outstanding. In the second quarter of 2010, Delphi's Board of Managers approved and authorized the Value Creation Plan (the "VCP"). Refer to Note 21. Share... -

Page 135

... per share attributable to Delphi and the weighted average shares outstanding used in calculating basic and diluted income (loss) per share: Successor Period from Year ended Year ended August 19 to December 31, December 31, December 31, 2011 2010 2009 (in millions, except per share data) Predecessor... -

Page 136

... derived from negotiations between GM and the PBGC with respect to the Predecessor's terminated U.S. pension plans. In June 2010, 24,000 Class E-1 membership interests were issued to Delphi Automotive LLP's Board of Managers, under the Class E-1 Interest Incentive Plan in order to attract and reward... -

Page 137

...Delphi Automotive LLP's Board of Managers approved a repurchase program of Class B membership interests. During the year ended December 31, 2011, 10,005 Class B membership interests were repurchased for a cumulative cost of approximately $180 million at an average price per membership interests unit... -

Page 138

... operations, Delphi enters into various derivative transactions pursuant to its risk management policies, which prohibit holding or issuing derivative financial instruments for trading purposes, and designation of derivative instruments is performed on a transaction basis to support hedge accounting... -

Page 139

... GBP SGD The fair value of derivative financial instruments recorded in the consolidated balance sheets as of December 31, 2011 and 2010 are as follows: Asset Derivatives Balance Sheet Location Designated derivatives instruments: Commodity derivatives Foreign currency derivatives Foreign currency... -

Page 140

...gain or loss recognized in income for the ineffective portion of designated derivative instruments excluded from effectiveness testing were recorded to cost of sales in the consolidated statements of operations for the years ended December 31, 2011 and 2010. The gain or loss recognized in income for... -

Page 141

... is in a net derivative liability position, estimates of peer companies' CDS rates are applied to the net derivative liability position. In certain instances where market data is not available, Delphi uses management judgment to develop assumptions that are used to determine fair value. This could... -

Page 142

... Year ended December 31, 2011 Year ended December 31, 2010 (in millions) Period from August 19 to December 31, 2009 Predecessor Period from January 1 to October 6, 2009 (in millions) Interest income Costs associated with initial public offering Impairment-investment in available-for-sale security... -

Page 143

...May 2011, Delphi's Powertrain segment completed the acquisition of a manufacturer of specialized diesel testing equipment for a purchase price of $19 million. The acquisition was not material to the Company's consolidated financial statements. In connection with the acquisition, the Company recorded... -

Page 144

...2008 annual revenues for the global suspension and brakes business were $670 million. The closing of the sale occurred in October 2009 and Delphi received net proceeds of $82 million, which, under the terms of the Acquisition were transferred, net of Delphi's costs in connection with the sale, to GM... -

Page 145

...service through applicable vesting dates as follows 20% on November 1, 2010 40% on November 1, 2011 40% on November 1, 2012 However, in conjunction with the completion of the initial public offering in November 2011, these interests were exchanged for 1,938,249 ordinary shares of Delphi Automotive... -

Page 146

... 31, 2012. The estimated fair value of the awards granted as of December 31, 2011 was $186 million. Because of Delphi's completed initial public offering, the estimated enterprise value will be based on the average daily closing market price of the Company between November 17, 2011 and the end of... -

Page 147

... the Class E-1 awards and for the years ended December 31, 2010, 2011, 2012 and 2013 for the VCP awards. These financial projections represent management's best estimate at the time of the contemporaneous valuations. Discount rates used to determine the present value of future cash flows were based... -

Page 148

...534 725 (27) 18 716 (156) 560 17 - 577 72 505 $ Parent Companies Net sales Operating expenses: Cost of sales Selling, general and administrative Amortization Restructuring Total operating expenses Operating (loss) income Interest expense Other income (expense), net (Loss) income before income taxes... -

Page 149

...Companies Net sales Operating expenses: Cost of sales Selling, general and administrative Amortization Restructuring Total operating expenses Operating... (3) 15 $ (18) Statement of Comprehensive Income Year Ended December 31, 2011 NonGuarantor Guarantor Subsidiaries Subsidiaries (in millions) $ 121 $... -

Page 150

...19 13 $ 6 Balance Sheet as of December 31, 2011 NonParent Companies ASSETS Current assets: Cash and cash equivalents Restricted cash Accounts receivable Inventories Other current assets Total current assets Long-term assets: Property, net Intangible assets, net Investments in affiliates Investments... -

Page 151

...Contents Balance Sheet as of December 31, 2010 NonParent Companies ASSETS Current assets: Cash and cash equivalents Restricted cash Time Deposits Accounts receivable Inventories Other current assets Total current assets Long-term assets: Property, net Intangible assets, net Investments in affiliates... -

Page 152

... Statement of Cash Flows for the year ended December 31, 2011 NonParent Companies Net cash provided by (used in) operating activities Cash flows from investing activities: Capital expenditures Maturity of time deposits Proceeds from sale of property/investments Cost of acquisitions, net of cash sold... -

Page 153

... of Cash Flows for the year ended December 31, 2010 NonParent Companies Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Purchase of time deposits Maturity of time deposits Proceeds from sale of property/investments Decrease in restricted cash... -

Page 154

...controls and security systems, displays, mechatronics, passive and active safety electronics and electric and hybrid electric vehicle power electronics, as well as advanced development of software. Thermal Systems, which includes heating, ventilating and air conditioning ("HVAC") systems, components... -

Page 155

... EBITDA and Adjusted EBITDA, as determined and measured by Delphi, should also not be compared to similarly titled measures reported by other companies. Included below are sales and operating data for Delphi's segments for the years ended December 31, 2011 and 2010, and periods from August 19 to... -

Page 156

...-segment transactions. Includes charges recorded in 2011 related to costs associated with employee termination benefits and other exit costs of $5 million for Electronics and Safety, $12 million for Powertrain Systems, $12 million for Electrical/Electronic Architecture and $2 million for Thermal... -

Page 157

... of information technology systems to support finance, manufacturing and product development initiatives, 2) certain plant consolidations and closures costs, 3) consolidation of many staff administrative functions into a global business service group, and 4) employee benefit plan settlements in... -

Page 158

... Successor Electrical/ Electronic Architecture August 19-December 31, 2009: Electronics Powertrain Systems Thermal and Safety Systems (in millions) Eliminations and Other Total Adjusted EBITDA Transformation and rationalization charges: Employee termination benefits and other exit costs Other... -

Page 159

... Sales Property(1) Net Sales Net Property(1) Net Sales Year ended December 31, 2011 Net Net Sales Property(1) Year ended December 31, 2010 (in millions) Period from August 19 to December 31, 2009 United States Other North America Europe, Middle East & Africa(2) Asia Pacific South America Total... -

Page 160

...summary of the Company's unaudited quarterly results of continuing operations for fiscal 2011 and 2010. Three months ended March 31, 2011 Net sales Cost of sales (1) Gross profit Operating income Net income Net income attributable to Delphi Basic and diluted net income per share (2) Weighted average... -

Page 161

..., use or disposition of the Company's assets that could have a material effect on the financial statements. Management performed its assessment of internal controls over financial reporting as of December 31, 2011, the end of our fiscal year, based on the criteria set forth in the Internal Control... -

Page 162

...Incentive Plan for the fiscal year ended December 31, 2011 (the "2011 Annual Incentive Plan"). Other compensation for fiscal year 2011 was previously reported by the Company in the Summary Compensation Table beginning on page 134 of the Registration Statement on Form S-1, filed February 1, 2012 (the... -

Page 163

... performance for 2012, 2013 and 2014. Cumulative Net Income is based upon the total net income for the three-year period of 2012, 2013 and 2014. Relative Total Shareholder Return is a comparison of the average closing price per share of the Company's ordinary shares for all available trading days in... -

Page 164

... in 2012, Mr. O'Neal's annual incentive target was reduced by 18%, to $1,800,000. His long-term incentive award target was increased by 9%, to $6,000,000. After completion of one year of service following the grant date, Mr. O'Neal will not forfeit any unvested performance-based or time-based RSUs... -

Page 165

...the headings "Security Ownership of Certain Beneficial Owners" and "Security Ownership of Management." Information as of December 31, 2011 about the Company's ordinary shares that may be issued under all of its equity compensation plans is set forth in Part II Item 5 of this Annual Report on Form 10... -

Page 166

...information called for by Item 13, as to related person transactions, is incorporated by reference to the Company's definitive Proxy Statement to be filed with the SEC pursuant to Regulation 14A in connection with the Company's 2012 Annual Meeting of Shareholders under the heading "Relationships and... -

Page 167

... SCHEDULES (a) The following documents are filed as part of this Form 10-K. (1) Financial Statements: Page No. 79 81 82 83 84 85 87 - Reports of Independent Registered Public Accounting Firm - Consolidated Statements of Operations for the Years Ended December 31, 2011 and 2010, the periods from... -

Page 168

... Plan(3)+ Form of Confidentiality and Noninterference Agreement pursuant to the Delphi Automotive LLP 2010 Management Value Creation Plan(3)+ Form of Delphi Automotive LLP Letter re: Special Bonus for Initial Public Offering or Sale of the Company(3)+ Delphi LLC Annual Incentive Plan(1)+ Delphi... -

Page 169

... Offer letter for Kevin P. Clark, dated June 10, 2010(1)+ Executive Release of Claims, Separation, Non-Solicitation and Non-Compete Agreement between Delphi Corporation and John D. Sheehan, dated February 22, 2010(1)+ Form of Officer RSU Award Agreement pursuant to Delphi Automotive PLC Long Term... -

Page 170

.... DELPHI AUTOMOTIVE PLC /s/ Kevin P. Clark By: Kevin P. Clark Senior Vice President and Chief Financial Officer Dated: February 17, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below as of February 17, 2012, by the following persons on... -

Page 171

Table of Contents /s/ Sean O. Mahoney Sean O. Mahoney /s/ Michael McNamara Michael McNamara /s/ Thomas W. Sidlik Thomas W. Sidlik /s/ Bernd Wiedemann Bernd Wiedemann /s/ Lawrence A. Zimmerman Lawrence A. Zimmerman 169 Director Director Director Director Director -

Page 172

... Number of Shares Underlying Award [Full name] [-] Shares (the "Target RSU Shares"), which are comprised of: (i) [-] Target RSU Shares that vest based on time (the "TimeBased RSU Shares") (ii) [-] Target RSU Shares that vest based on performance (the "Performance-Based RSU Shares") Grant Date... -

Page 173

.... Such pro rata portion shall equal (A) the number of unvested Time-Based RSU Shares as of such termination, multiplied by (B) a fraction, the numerator of which shall be the number of full months between the Time-Based Vesting Date that immediately precedes such termination and the termination... -

Page 174

... the requirements of Section 4(b) (a "Replacement Award") is provided to the Participant to replace this Award (the "Replaced Award"): (i) Any unvested Time-Based RSU Shares shall vest in full and be delivered to the Participant on the effective date of such Change in Control; and (ii) A number of... -

Page 175

...Control), in connection with or during a period of 2 years after the Change in Control, any Replacement Award that replaces this Award, to the extent not vested as of such Termination of Service, shall vest in full and all previously undelivered Time-Based RSU Shares and Performance-Based RSU Shares... -

Page 176

... the effective date of such Change in Control. Section 5. Delivery of Shares. Subject to Section 4: (a) Time-Based RSU Shares. As soon as practicable and within 30 days following each Time-Based Vesting Date, the Company shall deliver to the Participant the portion of the Time-Based RSU Shares that... -

Page 177

... Company, to: Delphi Automotive PLC c/o Delphi Automotive Systems, LLC 5725 Delphi Drive Troy, MI 48098 Attention: David M. Sherbin Facsimile: (248) 813-2491 if to the Participant, to the address that the Participant most recently provided to the Company, or to such other address or facsimile number... -

Page 178

.... (j) Governing Law. The Agreement shall be governed by the laws of the State of New York, without application of the conflicts of law principles thereof. (k) No Right to Continued Service. The granting of the Award evidenced hereby and this Agreement shall impose no obligation on the Company A-6 -

Page 179

... to continue the service of the Participant and shall not lessen or affect the right that the Company or any Affiliate may have to terminate the service of such Participant. (l) WAIVER OF JURY TRIAL. EACH OF THE PARTIES HERETO IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL... -

Page 180

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first written above. DELPHI AUTOMOTIVE PLC By: Name: Title: PARTICIPANT Name: A-8 -

Page 181

... and Formula Used to Determine the Number of Earned Performance-Based RSU Shares Metric 1: Return on Net Assets ("RONA") • Definition: Tax-affected operating income, divided by average net working capital plus average net property, plant and equipment expense, measured each calendar year. Final... -

Page 182

... of 2014 compared to average closing price per share of all available trading days in the 4th quarter of 2011, measured against the market capitalization-weighted Russell 3000 Auto Parts Index; all measures include dividends • Weight: 20% of Performance-Based RSU Shares granted • Number of... -

Page 183

... to the public or to the Company's competitors. (b) You further acknowledge and agree that: (i) the business in which the Company is engaged is intensely competitive and that your position and employment by Delphi has required, and will continue to require, that you have access to, and knowledge of... -

Page 184

... Information of the Company or its customers or suppliers, without limitation as to when or how you may have acquired such information, other than in the proper performance of your duties to Delphi, unless and until such Confidential Information is or shall become general public knowledge through no... -

Page 185

...become the registered or beneficial owner of up to five percent (5%) of any class of share of any entity in Competition with Delphi that is publicly traded on a recognized domestic or foreign securities exchange, provided that you do not otherwise participate in the business of such corporation. C-3 -

Page 186

... For purposes of this Agreement, "Business" means the creation, development, manufacture, sale, promotion and distribution of vehicle electronics, transportation components, integrated systems and modules, electronic technology and other products and services which Delphi engages in, or is preparing... -

Page 187

... President and General Counsel and the Vice President of Human Resources of Delphi if, at any time during your employment or within twenty-four (24) months following the termination of your employment with Delphi, you accept a position to be employed by, associated with or represent any person, firm... -

Page 188

located within the state of Michigan in any matter arising out of or in connection with, this Agreement. I, Date: (Signature) (Type/Print Name) C-6 , have executed this Confidentiality and Noninterference Agreement on the respective date set forth below: -

Page 189

...Based RSU Shares One-third of the Time-Based RSU Shares will first vest on each of the first three The "Performance Period" will be from January 1, 2012 to December 31, 2014. anniversaries of the Grant Date (each, a "Time-Based Vesting Date"), as follows: Friday, Feb. 15, 2013 23,697 On the last day... -

Page 190

... $6,000,000, subject to any increases which may be approved. The terms of such award are set forth in this Agreement. III. Annual Incentive and Continuity Incentive Award Your target annual incentive under the Delphi LLC Annual Incentive Plan (the "AIP") will be $1,800,000, or approximately 148% of... -

Page 191

... of age 55 with at least ten years of service with the Company or its predecessors, all of the unvested Time-Based RSU Shares shall vest on the Time-Based Vesting Date or Dates following such termination as if the Participant's employment continued through such dates. (ii) Any Other Termination of... -

Page 192

... 55 with at least ten years of service with the Company or its predecessors, the number of Earned Performance-Based RSU Shares shall be determined in accordance with Section 2(b) above as if the Participant's employment continued through the Performance-Based Vesting Date. (ii) Any Other Termination... -

Page 193

... 30 days following such termination. The total number of Performance-Based RSU Shares delivered to the Participant pursuant to this Section 4(c) shall equal (i) the greater of (A) the number of Earned Performance-Based RSU Shares that would vest if the effective date of the Change in Control were... -

Page 194

... and within 30 days following each Time-Based Vesting Date, the Company shall deliver to the Participant the portion of the Time-Based RSU Shares that vests on such Time-Based Vesting Date. (b) Performance-Based RSU Shares. The Company shall deliver any Earned Performance-Based RSU Shares to the... -

Page 195

... Company, to: Delphi Automotive PLC c/o Delphi Automotive Systems, LLC 5725 Delphi Drive Troy, MI 48098 Attention: David M. Sherbin Facsimile: (248) 813-2491 if to the Participant, to the address that the Participant most recently provided to the Company, or to such other address or facsimile number... -

Page 196

...be governed by the laws of the State of New York, without application of the conflicts of law principles thereof. (k) No Right to Continued Service. The granting of the Award evidenced hereby and this Agreement shall impose no obligation on the Company or any Affiliate to continue the service of the... -

Page 197

(l) WAIVER OF JURY TRIAL. EACH OF THE PARTIES HERETO IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. A-7 -

Page 198

... Metrics and Formula Used to Determine the Number of Earned Performance-Based RSU Shares Metric 1: Return on Net Assets ("RONA Definition: Tax-affected operating income, divided by average net working capital plus average net property, plant and equipment expense, measured each calendar year. Final... -

Page 199

...2014 compared to average closing price per share of all available trading days in the 4th quarter of 2011, measured against the market capitalization-weighted Russell 3000 Auto Parts Index; all measures include dividends Weight: 20% of Performance-Based RSU Shares granted Number of Performance-Based... -

Page 200

... to the public or to the Company's competitors. (b) You further acknowledge and agree that: (i) the business in which the Company is engaged is intensely competitive and that your position and employment by Delphi has required, and will continue to require, that you have access to, and knowledge of... -

Page 201

... Information of the Company or its customers or suppliers, without limitation as to when or how you may have acquired such information, other than in the proper performance of your duties to Delphi, unless and until such Confidential Information is or shall become general public knowledge through no... -

Page 202

...become the registered or beneficial owner of up to five percent (5%) of any class of share of any entity in Competition with Delphi that is publicly traded on a recognized domestic or foreign securities exchange, provided that you do not otherwise participate in the business of such corporation. C-3 -

Page 203

... For purposes of this Agreement, "Business" means the creation, development, manufacture, sale, promotion and distribution of vehicle electronics, transportation components, integrated systems and modules, electronic technology and other products and services which Delphi engages in, or is preparing... -

Page 204

... President and General Counsel and the Vice President of Human Resources of Delphi if, at any time during your employment or within twenty-four (24) months following the termination of your employment with Delphi, you accept a position to be employed by, associated with or represent any person, firm... -

Page 205

jurisdiction of the federal and state courts located within the state of Michigan in any matter arising out of or in connection with, this Agreement. I, Date: (Signature) (Type/Print Name) C-6 , have executed this Confidentiality and Noninterference Agreement on the respective date set forth below: -

Page 206

Attachment D Annual Incentive Plan Award And Continuity Incentive Award Terms and Conditions 1. Annual Incentive Plan Award. Each year you will participate in the Delphi LLC Annual Incentive Plan ("AIP") and receive a target award of $1,800,000 (or approximately 148% of your base salary), or such ... -

Page 207

...Based RSU Shares Performance-Based RSU Shares One-third of the Time-Based RSU Shares will first vest on each of the first three The "Performance Period" will be from January 1, 2012 to December 31, 2014. anniversaries of the Grant Date (each, a "Time-Based Vesting Date"), as follows: On the last day... -

Page 208

Based RSU Shares") based on the performance of certain metrics during the Performance Period in accordance with the formula set forth on Attachment B. Continuity Incentive RSU Shares The Continuity Incentive RSU Shares will vest in full on [-], 2015, the final TimeBased Vesting Date. 2 -

Page 209

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first written above. DELPHI AUTOMOTIVE PLC By: Name: Title: PARTICIPANT Name: 3 -

Page 210

.... Such pro rata portion shall equal (A) the number of unvested Time-Based RSU Shares as of such termination, multiplied by (B) a fraction, the numerator of which shall be the number of full months between the Time-Based Vesting Date that immediately precedes such termination and the termination... -

Page 211

...with at least ten years of service with the Company or its predecessors, the number of Earned Performance-Based RSU Shares shall equal (A) the number of Earned Performance-Based RSU Shares determined in accordance with Section 2(b) above, multiplied by (B) a fraction, the numerator of which shall be... -

Page 212

...(the "Replaced Award"): (i) Any unvested Time-Based RSU Shares and unvested Continuity Incentive RSU Shares shall vest in full and be delivered to the Participant on the effective date of such Change in Control; and (ii) A number of Earned Performance-Based RSU Shares equal to the greater of (A) the... -

Page 213

... the effective date of such Change in Control. Section 5. Delivery of Shares. Subject to Section 4: (a) Time-Based RSU Shares. As soon as practicable and within 30 days following each Time-Based Vesting Date, the Company shall deliver to the Participant the portion of the Time-Based RSU Shares that... -

Page 214

...and within 30 days following the final Time-Based Vesting Date, the Company shall deliver to the Participant the vested Continuity Incentive RSU Shares. Section 6. Dividend Equivalents. If a dividend is paid on Shares during the period commencing on the Grant Date and ending on the date on which the... -

Page 215

... Company, to: Delphi Automotive PLC c/o Delphi Automotive Systems, LLC 5725 Delphi Drive Troy, MI 48098 Attention: David M. Sherbin Facsimile: (248) 813-2491 if to the Participant, to the address that the Participant most recently provided to the Company, or to such other address or facsimile number... -

Page 216

...be governed by the laws of the State of New York, without application of the conflicts of law principles thereof. (k) No Right to Continued Service. The granting of the Award evidenced hereby and this Agreement shall impose no obligation on the Company or any Affiliate to continue the service of the... -

Page 217

... Metrics and Formula Used to Determine the Number of Earned Performance-Based RSU Shares Metric 1: Return on Net Assets ("RONA Definition: Tax-affected operating income, divided by average net working capital plus average net property, plant and equipment expense, measured each calendar year. Final... -

Page 218

...2014 compared to average closing price per share of all available trading days in the 4th quarter of 2011, measured against the market capitalization-weighted Russell 3000 Auto Parts Index; all measures include dividends Weight: 20% of Performance-Based RSU Shares granted Number of Performance-Based... -

Page 219

... to the public or to the Company's competitors. (b) You further acknowledge and agree that: (i) the business in which the Company is engaged is intensely competitive and that your position and employment by Delphi has required, and will continue to require, that you have access to, and knowledge of... -

Page 220

... Information of the Company or its customers or suppliers, without limitation as to when or how you may have acquired such information, other than in the proper performance of your duties to Delphi, unless and until such Confidential Information is or shall become general public knowledge through no... -

Page 221

...become the registered or beneficial owner of up to five percent (5%) of any class of share of any entity in Competition with Delphi that is publicly traded on a recognized domestic or foreign securities exchange, provided that you do not otherwise participate in the business of such corporation. C-3 -

Page 222

... For purposes of this Agreement, "Business" means the creation, development, manufacture, sale, promotion and distribution of vehicle electronics, transportation components, integrated systems and modules, electronic technology and other products and services which Delphi engages in, or is preparing... -

Page 223

... President and General Counsel and the Vice President of Human Resources of Delphi if, at any time during your employment or within twenty-four (24) months following the termination of your employment with Delphi, you accept a position to be employed by, associated with or represent any person, firm... -

Page 224

jurisdiction of the federal and state courts located within the state of Michigan in any matter arising out of or in connection with, this Agreement. I, Date: (Signature) (Type/Print Name) C-6 , have executed this Confidentiality and Noninterference Agreement on the respective date set forth below: -

Page 225

Exhibit 12.1 DELPHI AUTOMOTIVE PLC COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES Successor Year ended December 31, Period from August 19 to December 31, 2009 Period from January 1 to October 6, 2009 Predecessor Year ended December 31, 2011 2010 (dollars in millions) 2008 (dollars in ... -

Page 226

... LLC Delphi International Services Company, LLC Delphi Medical Systems, LLC Delphi Technologies, Inc. Monarch Antenna, Inc. SpaceForm Welding Solutions, Inc. Delphi Properties Management LLC Delphi Global Real Estate Services, LLC HE Microwave LLC* Delphi International Holdings LLP Delphi Automotive... -

Page 227

Delphi Automotive Taiwan Ltd. Delphi China LLC Beijing Delphi Wan Yuan Engine Management Systems Company, Ltd.* Delphi Automotive Systems (China) Holding Company Limited Beijing Delphi Technology Development Company, Ltd. Delphi Electrical Centers (Shanghai) Co., Ltd. Delphi Electronics (Suzhou) Co.... -

Page 228

... mbH Delphi Deutschland Services GmbH Unterstutzungsgesellschaft mbH Delphi Diesel Systems Romania Srl D2 Industrial Development and Production SRL Delphi Financial Services, LLC Delphi France Holding SAS Delphi Automotive Systems Dix SAS Delphi Diesel Systems S.L. Delphi France... -

Page 229

... ve Ticaret Anonim Sirket* Delphi Packard Electric Ceska Republika, S.R.O. Delphi Packard Romania SRL Delphi Slovensko s.r.o. Delphi Technologies Holding S.á r.l. Delphi International Investments, LLC Delphi Korea LLC Delphi Latin America S.á r.l. Delphi Automotive Systems do Brasil Ltda. Noteco... -

Page 230

...AB P.T. Delphi Automotive Systems Indonesia Packard Korea Inc.* Daehan Electronics Yantai Co., Ltd. Specialty Electronics (Singapore) Pte Ltd.• TECCOM GmbH TecDoc Information Systems GmbH *Entity is Joint Venture • Entity in Liquidation Sweden Indonesia Korea Peoples Republic of China Singapore... -

Page 231

... 17, 2012, with respect to the consolidated financial statements and schedule of Delphi Automotive PLC and the effectiveness of internal control over financial reporting of Delphi Automotive PLC included in this Annual Report (Form 10-K) of Delphi Automotive PLC for the year ended December 31, 2011... -

Page 232

... directors (or persons performing the equivalent functions): (a) (b) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and... -

Page 233

..., whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Kevin P. Clark Kevin P. Clark Senior Vice President and Chief Financial Officer (Principal Financial Officer) Date: February 17, 2012 -

Page 234

... the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ Rodney O'Neal Rodney O'Neal Chief Executive Officer & President (Principal Executive Officer) Date: February 17, 2012 A signed original of this written statement required by... -

Page 235

... ACT OF 2002 In connection with the filing of this annual report on Form 10-K of Delphi Automotive PLC (the "Company") for the period ended December 31, 2011, with the Securities and Exchange Commission on the date hereof (the "Report"), I, Kevin Clark, Chief Financial Officer, certify, pursuant to...