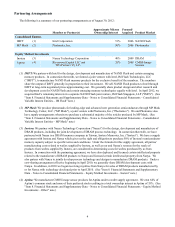

Crucial 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

There can be no assurance that these transactions will close when expected or at all, or that the acquisition of Elpida will

ultimately be consummated on the terms and conditions set forth in the sponsor agreement. The transactions remain subject to

bankruptcy and/or regulatory approval in various jurisdictions including the People's Republic of China. These regulatory

authorities may not approve the transactions or may impose modifications, conditions or restrictions that adversely impact the

value of the transactions to Micron. In addition, the proposed plan of reorganization of the trustees, which contemplates

Micron's acquisition of Elpida pursuant to the sponsor agreement, remains subject to approval of both the court and the

creditors of Elpida, neither of which can be assured. Various creditors are challenging the trustees' proposed plan of

reorganization, and certain creditors have proposed an alternative plan of reorganization that does not contemplate Micron's

acquisition of Elpida. If the requisite court and creditor approvals are not obtained, Micron will not be able to close the

acquisitions.

In addition to the risks described in the immediately preceding risk factor relating to acquisitions generally and to Micron's

ability to consummate the transaction described in the preceding paragraph, these acquisitions are expected to involve the

following significant risks:

• continued deterioration of conditions in the semiconductor memory market threaten Elpida's ability to pay its

obligations;

• we may incur losses in connection with our support, including guarantees, of the Elpida Company's debtor-in-

possession financing and capital expenditures, which losses may arise even if the transactions do not close;

• we are unable to maintain customers, successfully execute our integration strategies, or achieve planned synergies;

• we are unable to accurately forecast the anticipated financial results of the combined business;

• our consolidated financial condition may be adversely impacted by the increased leverage resulting from the

transactions;

• increased exposure to the DRAM market, which experienced significant declines in pricing during 2012 and 2011;

• further deterioration of Elpida's and Rexchip's operations and customer base during the period between signing and

closing;

• increased exposure to operating costs denominated in yen and New Taiwan dollar;

• integration issues with Elpida's and Rexchip's primary manufacturing operations in Japan and Taiwan;

• integration issues of our product and process technology with Elpida and Rexchip;

• an overlap in customers; and

• restrictions on our ability to freely operate Elpida as a result of contractual commitments as well as continued

oversight by the court and trustee during the pendency of the corporate reorganization proceedings of the Elpida

Companies, which could last until all installment payments have been made.

Our pending acquisitions of Elpida and Rexchip are inherently risky, may not be successful and may materially adversely

affect our business, results of operations or financial condition.

Our pending acquisitions of Elpida and Rexchip expose us to significant risks from changes in currency exchange rates.

Under the sponsor agreement, we committed to support plans of reorganization for Elpida that would provide for payments

to the secured and unsecured creditors of Elpida in an aggregate amount of 200 billion yen. Also, under the share purchase

agreement with Powerchip, we agreed to pay approximately 10 billion New Taiwan dollars to purchase approximately 714

million shares of Rexchip common stock. These payments in yen and New Taiwan dollars expose us to significant risks from

changes in currency exchange rates.

On July 2, 2012, we executed a series of separate currency exchange transactions pursuant to which we purchased call

options to buy 200 billion yen with a weighted-average strike price of 79.15 (yen per dollar). In addition, to reduce the cost of

these call options, we sold put options to sell 100 billion yen with a strike price of 83.32 and we sold call options to buy 100

billion yen with a strike price of 75.57. The net cost of these call and put options, which expire on April 3, 2013, of $49 million

is payable upon settlement. These currency options mitigate the risk of a strengthening yen for our yen-denominated payments

under the sponsor agreement while preserving some ability for us to benefit if the value of the yen weakens relative to the U.S.

dollar. On July 25, 2012, we executed a series of separate currency exchange transactions pursuant to which we purchased call

options to buy 10 billion New Taiwan dollars with a weighted-average strike price of 29.21 (New Taiwan dollars per U.S.

dollars). The net cost of these options, which expire on April 2, 2013, of $3 million is payable upon settlement. These currency

options mitigate the risk of a strengthening New Taiwan dollar for our payments under the Rexchip Share Purchase Agreement.

These yen and New Taiwan dollar option contracts were not designated for hedge accounting and are remeasured at fair value

each period with gains and losses reflected in our results of operations. Therefore, changes in the exchange rate between the

U.S. dollar and the yen and the New Taiwan dollar could have a significant impact on our results of operations.