Crucial 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended August 30, 2012

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-10658

Micron Technology, Inc.

(Exact name of registrant as specified in its charter)

Delaware 75-1618004

(State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.)

8000 S. Federal Way, Boise, Idaho 83716-9632

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (208) 368-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $.10 per share NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-

K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer Accelerated Filer Non-Accelerated Filer

(Do not check if a smaller reporting company) Smaller Reporting Company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing price of such stock on March 1, 2012, as

reported by the NASDAQ Global Select Market, was approximately $5.7 billion. Shares of common stock held by each executive officer and director and by

each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This

determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant's common stock as of October 18, 2012, was 1,017,560,523.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the registrant’s Fiscal 2012 Annual Meeting

of Shareholders to be held on January 22, 2013, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of contents

-

Page 1

... Technology, Inc. (Exact name of registrant as specified in its charter) Delaware 75-1618004 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 8000 S. Federal Way, Boise, Idaho 83716-9632 (Address of principal executive offices) (Zip Code) Registrant... -

Page 2

... otherwise. Our executive offices are located at 8000 South Federal Way, Boise, Idaho 83716-9632 and our telephone number is (208) 368-4000. Information about us is available on the internet at www.micron.com. Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current... -

Page 3

... devices, such as USB and Flash memory cards, are used with applications such as PCs, digital still cameras, MP3/4 players and mobile phones. Embedded NAND Flash-based storage devices are utilized in mobile phones, MP3/4 players, computers, solid-state drives ("SSDs"), tablets and other personal and... -

Page 4

...media formats, including: CompactFlash, Memory Stick and Secure Digital ("SD"). CompactFlash and Memory Stick products sold by us incorporate our patented controller technology. Other products, including SD memory cards... memory products including DDR and DDR2 Mobile...computer memory upgrades. Aggregate... -

Page 5

...memory technologies equally with Intel. In April 2012, we acquired Intel's remaining interests in a separate NAND Flash joint venture, IM Flash Singapore...of DRAM process technology. In connection therewith, we have partnered with Nanya in a DRAM memory company in Taiwan, Inotera Memories, Inc. ("... -

Page 6

....) Manufacturing Our manufacturing facilities are located in the United States, China, Israel, Italy, Malaysia, Puerto Rico and Singapore. Our Inotera joint venture also has a wafer fabrication facility in Taiwan. In 2011, we sold our wafer fabrication facility in Japan to Tower Semiconductor Ltd... -

Page 7

... limited number of suppliers are capable of ...Company, primarily of DRAM, were 8% of our net sales in 2012, 9% of our net sales in 2011 and 13% of our net sales in 2010. Our semiconductor memory products are offered under the Micron, Lexar®, Crucial...the customer. Distributors carry our products... -

Page 8

... for certain failures of product during a stated warranty period is usually limited to repair or ...memory solutions. Our process development center and largest design center are located at our corporate headquarters in Boise, Idaho. In 2012, we commenced operation of our new R&D facility in Boise... -

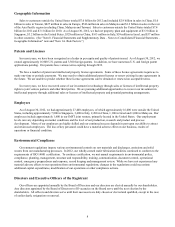

Page 9

... to customers outside the United States totaled $7.0 billion for 2012 and included $2.9 billion in sales in China, $1.0 billion in sales in Taiwan, $827 million in sales in Europe, $546 million in sales in Malaysia and $1.2 billion in sales in the rest of the Asia Pacific region (excluding China... -

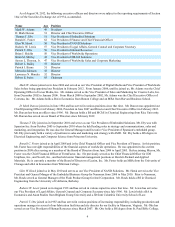

Page 10

... 2012, the following executive officers and directors were subject to the reporting ... 2012. From January 2006, until he joined us, Mr. Adams was the Chief Operating Officer of Lexar Media,... May 2010 and serves as our Vice President of NAND Solutions. Mr. Hawk served as the Vice President and General... -

Page 11

... of Memory in February 2006 and has served as Vice President of DRAM Solutions from ...2012. Mr. Thorsen holds a BA in Business Administration from Washington State ... of Avago Technologies Limited, a supplier of analog ... ADC in 1994 and throughout his career there held numerous leadership positions. Mr... -

Page 12

... (51)% (68)% 2012 from 2011 2011 from ...technologies, technological barriers and changes in process technologies...memory products. The semiconductor memory industry is highly competitive. We face intense competition in the semiconductor memory market from a number of companies, including Elpida Memory... -

Page 13

... the Republic of China, Inotera reported a loss for its quarter ended September 30, 2012 of an additional New Taiwan dollars 4,390 million (approximately $... difficulties and delays in ramping production at Inotera on our technology and may continue to experience difficulties and delays in the future... -

Page 14

... memory ...account in July 2012 which will be... Elpida Companies in six annual installments ...affiliates, under which we will purchase approximately 714 million shares of the common stock... of Rexchip, a manufacturing joint venture formed by Elpida and Powerchip, for approximately 10 billion New Taiwan... -

Page 15

...closing; increased exposure to operating costs denominated in yen and New Taiwan dollar; integration issues with Elpida's and Rexchip's primary manufacturing operations in Japan and Taiwan; integration issues of our product and process technology with Elpida and Rexchip; an overlap in customers; and... -

Page 16

... condition. As of August 30, 2012, the Inotera shares purchased from Qimonda had a net carrying value of $177 million. Our future success may depend on our ability to develop and produce competitive new memory technologies. Our key semiconductor memory technologies of DRAM, NAND Flash and NOR... -

Page 17

... of payments will be made by the Elpida Companies in six annual installments payable at the end of each calendar ... to adverse economic and semiconductor memory industry conditions. • • •... Intel's contributions totaled $38 million and in 2012 we paid Intel approximately $600 million to acquire... -

Page 18

...complaint in the Superior Court of the State of California (San Francisco County) against us and other DRAM suppliers...memory technology and computer memory chips. Rambus' complaint alleged various causes of action under California state...claims. On April 2, 2012, Rambus filed a notice ...of our DDR2, DDR3... -

Page 19

...memory products or leverage their underlying design or process technology. We have made significant investments in product and process technologies...that could disrupt operations. In addition, our suppliers and customers also have operations in such locations. A natural disaster that results in a ... -

Page 20

... the Internal Revenue Code and some portion ... reporting currency), primarily the Singapore ...2012. In addition, a substantial portion of our manufacturing operations are located outside the United States. In particular, a significant portion of our manufacturing operations are concentrated in Singapore... -

Page 21

... complex processes that require technologically advanced equipment and continuous ...' requirements and they may purchase products from other suppliers. This could result in a significant increase in ... and forward contracts, and capped-call contracts on our stock. As a result, we are subject to the risk... -

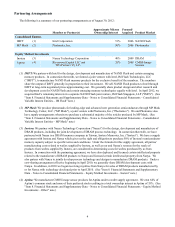

Page 22

...headquarters are located in Boise, Idaho. The following is a summary of our principal facilities as of August 30, 2012: Location Boise, Idaho Lehi, Utah Manassas, Virginia Singapore... 2000, we filed a complaint against Rambus in the ... Rambus alleges that certain of our DDR2, DDR3, RLDRAM, and RLDRAM II... -

Page 23

...and costs. On March 28, 2012, Technology Partners Limited LLC ("TPL") filed a patent infringement action in the U.S. District Court for the Eastern District of Texas (Tyler) against us. The complaint alleges that certain of our Lexar flash card readers infringe four U.S. patents and seeks injunctive... -

Page 24

... our Lexar USB drives infringe one U.S. patent and seeks injunctive relief, damages, attorneys' fees, and costs. On April 18, 2012, Anu filed a parallel complaint with the U.S. International Trade Commission under Section 337 of the Tariff Act of 1930 against us and numerous other companies alleging... -

Page 25

... all of Qimonda's shares of Inotera Memories, Inc. and seeks an order requiring us to retransfer the Inotera shares purchased from Qimonda to the Qimonda estate. The complaint also seeks to terminate under Sections 103 or 133 of the German Insolvency Code a patent cross license between us and... -

Page 26

..." and traded under the same symbol on the New York Stock Exchange through December 29, 2009. The following table represents the high and low closing sales prices for our common stock for each quarter of 2012 and 2011, as reported by Bloomberg L.P.: Fourth Quarter 2012 High Low 2011 High Low $ 6.89... -

Page 27

... stock and restricted stock unit awards, 4,715 shares of our common stock at an average price per share of $5.97. We retired these shares in the fourth quarter of 2012. (b) Average price paid per share $ - 5.97 - 5.97 (c) Total number of shares (or units) purchased as part of publicly announced... -

Page 28

... to form IMFT in 2006 and IMFS in 2007 (collectively "IM Flash") to manufacture NAND Flash memory products for the exclusive use of the members. We have owned 51% of IMFT from inception through August 30, 2012. Our ownership percentage of IMFS had increased from 51% at inception to 82% as of... -

Page 29

... readers in...reported...2012, we entered into a series of agreements with Intel to restructure IM Flash. We acquired Intel's remaining 18% interest in IMFS for $466 million. In addition, we acquired IMFT's assets located...memory technologies; supply of NAND Flash memory products and certain emerging memory... -

Page 30

...Memory, Inc. ("Akita") (Elpida and Akita, collectively, the "Elpida Companies"). The Elpida Companies filed petitions for corporate reorganization proceedings with the Tokyo District Court under the Corporate Reorganization Act of Japan on February 27, 2012...and Powerchip Technology Corporation ("... -

Page 31

...about October 29, 2012, regarding whether ...affiliates (the "Rexchip Share Purchase Agreement"), under which we agreed to purchase approximately 714 million shares of Rexchip common stock, which represents approximately 24% of Rexchip's outstanding common stock, for approximately 10 billion New Taiwan... -

Page 32

... Our improvements in product and process technologies in 2012 enabled significant increases in sales volumes ...100% Total net sales decreased 6% for 2012 as compared to 2011, reflecting declines in average selling prices across all reportable segments partially offset by increases in sales volumes... -

Page 33

... in average selling prices. Cost reductions from improvements in product and process technologies in 2012 mitigated the effect of significant declines in average selling prices for all reportable operating segments. Costs of our underutilized capacity, primarily associated with decreased production... -

Page 34

...$986 million for 2012, $884 million for 2011 and $764 million for 2010. DRAM Solutions Group ("DSG") For the year ended Net sales Operating income (loss) 2012 2,691 $ ...a result of improved product and process technologies. DSG sales and operating margins for 2012 were adversely impacted by a $58 ... -

Page 35

...approximating cost. (See "Operating Results by Business Segments - NAND Solutions Group" for further detail.) We sell the remainder of our NAND... customers for 2012 as compared to 2011 was primarily due to the ramp of the IMFS fabrication facility and improved product and process technologies. The new... -

Page 36

... and improved product and process technologies. The gross margin percentage on sales of DRAM products declined from 2011 to 2012 primarily due to the decreases ...Republic of China, Inotera reported a loss for its quarter ended September 30, 2012 of an additional New Taiwan dollars 4,390 million (... -

Page 37

... triple-level cell technologies), NOR Flash memory, specialty memory, phase-change memory, solid-state drives and other memory technologies and systems. Interest Income (Expense) Interest expense for 2012, 2011 and 2010, included aggregate amounts of non-cash amortization of debt discount and other... -

Page 38

...table above included $157 million held by IMFT as of August 30, 2012 and $327 million held by both IMFT and IMFS as of September 1,.... Depending on conditions in the semiconductor memory market, our cash flows from operations and...develop new product and process technologies, support future growth, ... -

Page 39

... to Inotera under a 90-day note with a stated annual interest rate of 2% to facilitate the purchase of capital equipment necessary to implement new process technology. The loan was repaid to us with accrued interest in March 2012. Also, in March 2012, we contributed $170 million to Inotera, which... -

Page 40

...we have an obligation to purchase 50% of Inotera's semiconductor memory capacity subject to specific terms and conditions. As purchase quantities ...100.6 million shares of common stock. The 2012 Capped Calls expire on various dates between May 2016 and May 2018. The 2012 Capped Calls are intended to ... -

Page 41

... million shares of common stock. The 2009 Capped Calls expire in October and November of 2012. Concurrent with the offering ...judgments that affect the reported amounts of assets,...cash flows, appropriate discount rates and comparable ... receive product and process technology, product supply, operations ... -

Page 42

...stated at the lower of average cost or market value. Cost includes labor, material and overhead costs, including product and process technology...memory inventory by approximately $129 million as of August 30, 2012. Due to the volatile nature of the semiconductor memory... stock awards. We estimate stock ... -

Page 43

...not have a material impact on our financial statements. ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK Interest Rate Risk As of August 30, 2012, $3,087 million of our $3,262 million of debt was at fixed interest rates. As a result, the fair value of the debt fluctuates based on... -

Page 44

...Of the aggregate amount, 60 billion yen and approximately 10 billion New Taiwan dollars will be due at the closing of the transactions and the remaining 140 billion yen amounts will be made by the Elpida Companies in annual installments from 2014 through 2019. (See "Item 8 - Financial Statements and... -

Page 45

...30, 2012, September 1, 2011 and September 2, 2010: Consolidated Statements of Operations Consolidated Statements of Comprehensive Income Consolidated Balance Sheets Consolidated Statements of Changes in Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of... -

Page 46

MICRON TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions except per share amounts) August 30, 2012 $ 8,234 7,266 968 620 918 48 (618) 8 (179) - 35 (754) 17 (294) (1,031) (1) (1,032) $ September 1, 2011 $ 8,788 7,030 1,758 592 791 (380) 755 23 (124) - (... -

Page 47

MICRON TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) August 30, September 1, 2012 2011 (1,031) $ $ 190 (16) (24) (18) - (58) (1,089) 5 (1,084) $ September 2, 2010 $ 1,900 11 5 - (2) 14 1,914 (49) 1,865 For the year ended Net income (loss) Other ... -

Page 48

MICRON TECHNOLOGY, INC. CONSOLIDATED BALANCE SHEETS (in millions except par value amounts) August 30, 2012 $ 2,459 100 1,289 1,812 98 5,758 374 7,103... Total liabilities Commitments and contingencies Micron shareholders' equity: Common stock, $0.10 par value, 3,000 shares authorized, 1,017.7... -

Page 49

... interest in IMFS Distributions to noncontrolling interests, net Purchase and settlement of capped calls Repurchase and retirement of common stock Balance at August 30, 2012 848.7 $ 85 $ 7,257 $ (2,385) $ 1,850 (4) $ 15 4,953 1,850 15 1,112 93 8 - $ 1,986 50 (1) $ 6,939 1,900 14 1,112 93... -

Page 50

... expense and amortization of intangible assets Amortization of debt discount and other costs Equity in net loss of equity method investees Stock-based compensation Loss on extinguishment of debt Gain from disposition of Japan Fab Gain from acquisition of Numonyx Change in operating assets... -

Page 51

...memory, as well as other innovative memory technologies, packaging solutions...31. Our fiscal years 2012, 2011 and 2010 each...States of America requires our management to make estimates and judgments that affect the reported...product during a stated warranty period is ... Stock-based Compensation: Stock-based... -

Page 52

... actually sold. Inventories are generally categorized as memory (primarily DRAM and NAND Flash and NOR ...technology agreement. Fully-amortized assets are removed from product and process technology and accumulated amortization. Property, Plant and Equipment: Property, plant and equipment are stated... -

Page 53

... and the ability to operate in Taiwan. Therefore, we account for our interest...2012, we entered into agreements with Intel to restructure IMFT. IMFS: Prior to April 6, 2012, IM Flash Singapore... 2012, we acquired Intel's remaining interests in IMFS and it ceased to be a VIE. MP Mask: MP Mask Technology ... -

Page 54

...2012...Memory, Inc. ("Akita" and, together with Elpida, the "Elpida Companies"). The Elpida Companies filed petitions for corporate reorganization proceedings with the Tokyo District Court under the Corporate Reorganization Act of Japan on February 27, 2012...2012 ...Companies in six annual...Companies...Companies... -

Page 55

... 2, 2012, we entered into a share purchase agreement with Powerchip and certain of its affiliates, under which we will purchase approximately 714 million shares of Rexchip common stock, which represents approximately 24% of Rexchip's outstanding common stock for approximately 10 billion New Taiwan... -

Page 56

... of 137.7 million shares of our common stock issued to the Numonyx shareholders and 4.8 million restricted stock units issued to employees of Numonyx. We determined...by Numonyx during the recent downturn in the semiconductor memory industry; substantial volatility in Numonyx's primary markets; market... -

Page 57

...cost and fair value of available-for-sale debt securities as of August 30, 2012 by contractual maturity. Amortized Cost Money market funds not due at a single maturity... sales of available-for-sale securities were $34 million for 2012 and gross realized gains and losses for all other periods presented... -

Page 58

... million, respectively, due from Intel for amounts related to NAND Flash and certain emerging memory technologies product design and process development activities under cost-sharing agreements. As of August 30, 2012 and September 1, 2011, other receivables also included $17 million and $25 million... -

Page 59

...of our March 2012 equity contribution to Inotera, our obligation to purchase Inotera's capacity may increase when additional output results from Inotera's capital investments enabled by our equity investment. Inotera We have partnered with Nanya in Inotera, a Taiwanese DRAM memory company, since the... -

Page 60

... facilities, equipment, intellectual property and a fully-paid lease to a portion of our Boise, Idaho manufacturing facilities. As of August 30, 2012, we and Origin each held a 50% ownership interest in Transform. During 2012, 2011 and 2010, we and Origin each contributed $17 million, $30 million... -

Page 61

...based on our common stock ownership percentage, which was 64% as of August 30, 2012. During the second quarter of 2012, the amount of ...expense was $88 million, $79 million and $96 million for 2012, 2011 and 2010, respectively. Annual amortization expense is estimated to be $83 million for 2013, $... -

Page 62

...As of August 30, 2012, customer advances included $... as of August 30, 2012, other noncurrent liabilities included $...August 30, 2012, other accounts...of August 30, 2012 and September 1, ... 2013 convertible senior notes Less current portion $ 2012 $ 883 $ 860 451 361 265 243 ...30, 2012 were required to be ... -

Page 63

... 1.875% 2032C Notes, stated rate of 2.375% 2032D Notes, stated rate of 3.125% 2031A Notes, stated rate of 1.5% 2031B Notes, stated rate of 1.875% 2027 Notes, stated rate of 1.875% 2012 $ 18 5 5 5 6 3 42 $ 2011 19 - - 1 1 3 24 $ 2010 24 - - - - - 24 Amortization of discount and issuance costs: 2014... -

Page 64

... treasury stock method. Cash Redemption at Our Option: We may redeem for cash the 2014 Notes if the last reported sale price of our common stock has been... accrued and unpaid interest, if any. 2032C and 2032D Notes On April 18, 2012, we issued $550 million of the 2032C Notes and $450 million of the ... -

Page 65

... 2032C Notes, or to May 4, 2021 for the 2032D Notes, using a discount rate equal to 150 basis points. Cash Repurchase at the Option of the Holder... 2031B Notes on or after August 5, 2014 if the last reported sale price of our common stock has been at least 130% of the conversion price (approximately ... -

Page 66

... of the closing price of our common stock and the conversion rate of the 2027 ...been paid through May 31, 2014, discounted using a U.S. Treasury bond with an equivalent...memory technologies. (See "Consolidated Variable Interest Entities - IM Flash" note.) 2013 Notes Conversion In the third quarter of 2012... -

Page 67

...Singapore Interbank Offering Rate ("SIBOR") plus 2.8% per annum. On October 2, 2012...10 equal semi-annual installments beginning six months after the draw date. On October 18, 2012, we drew ... of August 30, 2012 2013 2014 2015 2016 2017 2018 and thereafter Discounts and interest, respectively 33 $ 974... -

Page 68

...69 million and $41 million for 2012, 2011 and 2010, respectively. We ... in the semiconductor and other high technology industries, from time to time,...and injunctive relief. The complaint alleges, among other ... of California alleging that certain of our DDR2, DDR3, RLDRAM and RLDRAM II products infringe... -

Page 69

...and costs. On March 28, 2012, Technology Partners Limited LLC ("TPL") filed a patent infringement action in the U.S. District Court for the Eastern District of Texas (Tyler) against us. The complaint alleges that certain of our Lexar flash card readers infringe four U.S. patents and seeks injunctive... -

Page 70

..., DDR2, DDR3...memory technology and computer memory chips. Rambus' complaint alleged various causes of action under California state...us on all claims. On April 2, 2012, Rambus filed a notice of appeal to...suppliers in various federal and state courts in the United States... ("SDE") announced that it had... -

Page 71

... all of Qimonda's shares of Inotera Memories, Inc. and seeks an order requiring us to retransfer the Inotera shares purchased from Qimonda to the Qimonda estate. The complaint also seeks to terminate under Sections 103 or 133 of the German Insolvency Code a patent cross license between us and... -

Page 72

... to those contained in the 2032D Notes, an approximate combined total of 44.3 million shares of common stock. The 2012D Capped Calls expire on various dates between November 2016 and May 2018. The 2012 Capped Calls are intended to reduce the potential dilution upon conversion of the 2032 Notes. The... -

Page 73

...foreign currencies, primarily the euro, shekel, Singapore dollar and yen. We are also exposed...July 2012, we are exposed to significant currency exchange rate risk for the yen and New Taiwan dollar...assets and liabilities. At the end of each reporting period, monetary assets and liabilities held or ... -

Page 74

... Amount (in U.S. Dollars) Fair Value of Asset (1) (Liability) (2) Currency As of August 30, 2012 Forward contracts: Singapore dollar Euro Shekel Yen Currency options: Yen New Taiwan dollar $ 251 173 65 18 5,050 342 5,899 (3) $ - 2 - - 57 2 61 $ (1) (1) (1) - - - (3) $ As of September... -

Page 75

... Fair Value of Asset (1) (Liability) (2) Currency As of August 30, 2012 Forward contracts: Yen Euro Currency options: Yen As of September 1, 2011 Forward...in other operating (income) expense were not significant in 2012 and 2011. In 2012, $9 million of net gains were reclassified from accumulated ... -

Page 76

... included approximately 1.3 million ordinary shares (subsequent to a 1 for 15 reverse stock split on August 6, 2012) of Tower Semiconductor Ltd. ("Tower") received in connection with our sale of our wafer fabrication facility in Japan in June 2011. As of September 1, 2011, the shares were valued... -

Page 77

... of Financial Instruments Amounts reported as cash and equivalents,...other debt instruments was estimated based on discounted cash flows using inputs that are observable...2012, we had an aggregate of 169.0 million shares of common stock reserved for the issuance of stock options and restricted stock... -

Page 78

...Granted Exercised Cancelled or expired Outstanding at August 30, 2012 Exercisable at August 30, 2012 Expected to vest after August 30, 2012 99.3 $ 21.4 (1.5) (23.5) 95.7 55... requires the input of assumptions, including the expected stock price volatility and estimated option life. The expected ... -

Page 79

... lapse in onefourth increments during each year of employment after the grant date. For performance-based Restricted Stock Awards, vesting is contingent upon meeting certain performance goals. Restricted Stock Awards activity for 2012 is summarized as follows: WeightedAverage Grant Date Fair... -

Page 80

... annual contribution limits) to various savings alternatives, none of which include direct investment in our common stock....loss on disposition of property, plant and equipment Samsung patent cross-license agreement Gain from disposition of Japan Fab Other 2012 $ 17 7 6 5 - - 13 48 $ 2011 - $ (21) 6 (... -

Page 81

...equity in net loss of equity method investees: U.S. Foreign Income tax (provision) benefit: Current: U.S. federal Foreign State Deferred: U.S. federal Foreign Income tax (provision) benefit $ 2012 2011 2010 $ $ (1,028) $ 274 (754) $ 257 294 551 $ $ 1,383 537 1,920 $ 14 $ (22) - (8) - 25 25 17... -

Page 82

...discount Unremitted earnings on certain subsidiaries Product and process technology Property, plant and equipment Intangible assets Other Deferred tax liabilities Net deferred tax assets Reported...of August 30, 2012, our federal, state and foreign net ...the Internal Revenue Code and some portion ... -

Page 83

... subsidiaries file income tax returns with the U.S. federal government, various U.S. states and various foreign jurisdictions throughout the world. Our U.S. federal and state tax returns remain open to examination for 2008 through 2012. In addition, tax years open to examination in multiple foreign... -

Page 84

... do so would have been antidilutive: For the year ended Employee stock plans Convertible notes 2012 104.8 257.6 2011 81.4 182.7 2010 92.2 - Our ...joint venture to include certain emerging memory technologies; supply of NAND Flash memory products and certain emerging memory products to Intel on a cost... -

Page 85

...): For the year ended IM Flash distributions to Micron IM Flash distributions to Intel Micron contributions to IM Flash Intel contributions to IM Flash 2012 $ 439 391 151 177 $ 2011 234 225 1,580 - $ 2010 278 267 128 38 IM Flash sells products to the joint venture members generally in proportion... -

Page 86

... as of August 30, 2012 and September 1, 2011, respectively...Singapore Pte. Ltd. ("TECH"), a semiconductor memory manufacturing joint venture in Singapore with Canon Inc. ("Canon") and Hewlett-Packard Singapore...technologies and customers. We have the following four reportable segments: NAND Solutions... -

Page 87

... including multi-chip packages, sold to the mobile device market. Embedded Solutions Group ("ESG"): Includes DRAM, NAND Flash and NOR Flash products sold... segments. For 2012 and 2011, certain operating expenses directly associated with the activities of a specific reportable segment are charged... -

Page 88

..." note.) Geographic Information Geographic net sales based on customer ship-to location were as follows: For the year ended China United States Asia Pacific (excluding China, Taiwan and Malaysia) Taiwan Europe Malaysia Other 2012 2,936 1,262 1,241 1,022 827 546 400 8,234 2011 $ 2,983 1,363... -

Page 89

...plant and equipment by geographic area were as follows: As of Singapore United States China Italy Israel Japan Other 2012 3,270 3,246 328 163 59 2 35 7,103 2011 3,... a charge of $69 million in the third quarter of 2012. On March 23, 2012, we entered into a settlement agreement with Oracle pursuant to ... -

Page 90

..., we recorded a tax provision of $74 million related to the gain on the sale and to write down certain deferred tax assets associated with the Japan Fab. The results of operations for the first, second and third quarters of 2011 included gains, net of tax, of $167 million, $33 million and... -

Page 91

...position of Micron Technology, Inc. and its subsidiaries at August 30, 2012 and September 1, ... 2012 in conformity with accounting principles generally accepted in the United States ...Company maintained, in all material respects, effective internal control over financial reporting as of August 30, 2012... -

Page 92

... was effective as of August 30, 2012. The effectiveness of our internal control over financial reporting as of August 30, 2012 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report, which is included in Part II, Item 8, of... -

Page 93

...Certain information concerning our executive officers is included under the caption, "Directors and Executive Officers of the Registrant," in Part I, Item 1 of this report. Other information required by Items 10, 11, 12, 13 and 14 will be contained in our Proxy Statement which will be filed with the... -

Page 94

... filed as part of this report: 1. 2. 3. Financial Statements...Companies with Nobuaki Kobayashi and Ykio Sakamoto, the trustees of Elpida Memory, Inc. and its wholly-owned subsidiary, Akita Elpida Memory, Inc. dated July 2, 2012 (4) Share Purchase Agreement dated July 2, 2012, among Micron Technology... -

Page 95

... 27, 2007, between Micron Semiconductor Asia Pte. Ltd. And Intel Technology Asia Pte. Ltd. (14) Supply Agreement dated as of February 27, 2007, between Micron Semiconductor Asia Pte. Ltd. And IM Flash Singapore, LLP (14) Amended and Restated Limited Liability Company Operating Agreement of IM Flash... -

Page 96

...Technology, Inc. as Guarantor in favor of ABN Amro Bank N.V., Singapore Branch acting as Security Trustee (21) Form of Severance Agreement (22) Lexar Media, Inc. 1996 Stock... Technology, Inc., Micron Semiconductor B.V., Nanya Technology Corporation, MeiYa Technology Corporation and Inotera Memories,... -

Page 97

... the Company and Société Genérale (29) Form of Capped Call Confirmation dated as of July 22, 2011 (29) 2012 Master Agreement by and among Intel Corporation, Intel Technology Asia PTE LTD, Micron Technology, Inc., Micron Semiconductor Asia PTE LTD, IM Flash Technologies, LLC and IM Flash Singapore... -

Page 98

... July 3, 2012, by and between Micron Technology, Inc. and J. Aron & Company, an affiliate of the ... July 11, 2012, by and between Micron Technology, Inc. and HSBC Bank USA, N.A. Subsidiaries ... Pursuant to 18 U.S.C. 1350 Financial Statements of Inotera Memories, Inc. as of December 31, 2011 and December... -

Page 99

... by reference to Annual Report on Form 10-K for the fiscal year ended September 1, 2011 Incorporated by reference to Quarterly Report on Form 10-Q for the fiscal quarter ended March 1, 2012 Incorporated by reference to Current Report on Form 8-K dated April 24, 2012 Incorporated by reference... -

Page 100

... Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Boise, State of Idaho, on the 29th day of October 2012. Micron Technology, Inc. /s/ Ronald C. Foster By: Ronald C. Foster Vice President of... -

Page 101

MICRON TECHNOLOGY, INC. SCHEDULE II VALUATION AND QUALIFYING ACCOUNTS (in millions) Balance at Beginning of Year Allowance for Doubtful Accounts Year ended August 30, 2012 Year ended September 1, 2011 Year ended September 2, 2010 Deferred Tax Asset Valuation Allowance Year ended August 30, 2012 ... -

Page 102

... Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. SHARE PURCHASE AGREEMENT by and among MICRON TECHNOLOGY, INC., MICRON SEMICONDUCTOR B.V., as Buyer, and THE SELLERS IDENTIFIED ON SCHEDULE 1 HERETO, as Sellers _____ Dated as of July... -

Page 103

...; Closing Date Deliveries At Closing Adjustments Agreement with Stock Transfer Agent Due Organization Title to the Shares Authority...PRICE ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE SELLERS ARTICLE IV REPRESENTATIONS AND WARRANTIES OF MICRON AND BUYER ARTICLE V COVENANTS AND AGREEMENTS -i- -

Page 104

...5.9 5.10 5.11 5.12 5.13 5.14 5.15 5.16 Publicity Required Approvals and Consents Access to Information and Cooperation Change in Membership of Company Boards Further Assurances Elpida Licenses Termination of Certain Rights and Remedies No-shop Delisting and Going Private [*] Page 16 16 17 17 18 18... -

Page 105

... Agreement (this "Agreement") is made and entered into this 2nd day of July, 2012, by and between Micron Technology, Inc., a Delaware corporation ("Micron"), Micron Semiconductor B.V., a private company with limited liability organized under the laws of The Netherlands and a wholly owned subsidiary... -

Page 106

... set forth in this Section 1.1: "Affiliate" means, with respect to any Person... or any day on which banks located in New York, New York and Taipei, Taiwan are authorized or obligated by Law..."Company" has the meaning set forth in the Preamble. "Company Shares" means shares of the Company's common stock... -

Page 107

... proceedings of Elpida and Akita in Japan. "Existing Licenses" means the agreements... amended, between Elpida and Powerchip relating to the Company. "JVA Rights and Remedies" has the meaning ascribed...the Standstill Agreement. "Kingston" means Kingston Technology Corporation. "Laws" means laws, statutes... -

Page 108

... limited liability company, limited liability partnership, firm, joint venture, association, joint-stock company, trust, unincorporated... meaning set forth in Section 5.13(b). [*] "PwC" means PricewaterhouseCoopers, Taiwan. "Regulatory Approvals" has the meaning set forth in Section 5.8(a). "Released... -

Page 109

... proceedings of Elpida and Akita in Japan. "ROC" has the meaning set... paragraph of Article III. "Sellers' Shares" means all Company Shares owned by each of the Sellers as of the date... all securities received as a result of a stock dividend, distribution, subdivision or reclassification in respect ... -

Page 110

..." has the meaning ascribed to such term in the Standstill Agreement. "Stock Transfer Agent" has the meaning set forth in Section 2.3(a). "Subsidiary"...to "NT$" shall mean New Taiwan Dollars and all references in this Agreement to "US$" shall mean United States Dollars. The Article and Section headings... -

Page 111

...take place at the offices of Jones Day (Taipei), located at 8F, 2 Tun Hwa S. Road, Sec. 2 Taipei 106, Taiwan, ROC at 9:00 a.m. local time, on the first...Liens thereon, to the stock transfer agent of the Company ("Stock Transfer Agent") for verification and counting by the Stock Transfer Agent as well ... -

Page 112

...portions. available funds in New Taiwan Dollars to the bank account ...similar corporate event impacting the Company Shares, the parties shall make...Stock Transfer Agent shall be borne equally by Powerchip and Buyer or the Permitted Designee, as the case may be. ARTICLE III REPRESENTATIONS AND WARRANTIES... -

Page 113

... properties and to carry on its business as currently conducted. 3.2 Title to the Shares. Each Seller is the sole record and beneficial owner of the Company Shares set forth opposite such Seller's name on Schedule 1 hereto, and has good and valid title to such shares, free and clear of all Liens... -

Page 114

... and licensing of intellectual property or technology between Powerchip and/or any of its Subsidiaries, on the one hand, and Elpida, the Company and/or any of their respective Subsidiaries, on the other hand. 3.6 Brokers. None of the Sellers nor any of their Affiliates has paid or agreed to pay... -

Page 115

... Affiliates, on the other hand, other than claims for overdue amounts owed by Powerchip to the Company ... a copy thereof. ARTICLE IV REPRESENTATIONS AND WARRANTIES OF MICRON AND BUYER Micron and Buyer hereby...in good standing under the Laws of the State of Delaware. Micron has the requisite corporate ... -

Page 116

[*] Certain information in this document has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. 4.3 Noncontravention. As to each of Micron and Buyer, the execution and delivery by it of this ... -

Page 117

...Company's business organizations, (ii) terminate the services of the Company's present employees and other service providers or (iii) terminate the Company's present relationships with its material vendors, suppliers..., the acquisition of the stock, assets or business of the Company or (ii) acquire or... -

Page 118

...stock dividends or distributions or other issuance of Company Shares or other securities, subdivisions or combinations of Company Shares or any reclassification of Company...decide to implement in the future, any material technology or process not in use by the Company on the date hereof; (h) incur or ... -

Page 119

... into any Contract with respect to the foregoing, other than the acquisition of any Company Shares issued by the Company as a stock dividend or distribution on in connection with a subdivision of the Company Shares. 5.4 Existing Liens on Sellers' Shares. To the extent not obtained prior to signing... -

Page 120

... however, that neither Micron nor Buyer shall disclose to Elpida, the Company or their respective representatives the purchase price to be paid by Buyer ... rules of any applicable stock exchange, the parties hereto agree that no further publicity release or announcement concerning this Agreement and ... -

Page 121

... nothing herein shall be construed to require Micron (or any of its Affiliates) to accept, or agree to accept, any action or restriction imposed by...waivers and approvals of all lenders to the Sellers and all lenders to the Company as are required in order for such Seller to be able to consummate the ... -

Page 122

...to the omitted portions. other management body of the Company or any Subsidiaries of the Company to resign from such positions effective as of the Closing... and releases and discharges each other party thereto and its Affiliates, and the shareholders, directors, officers, employees, trustees, ... -

Page 123

...or at any time could have asserted against any of the Company, Elpida and their respective Affiliates, whether in law, equity or otherwise, whether known or ... of any amounts owed by Powerchip to the Company or Elpida for the transfer of technology or intellectual property rights or the provision of ... -

Page 124

...Seller is on the board of directors of the Company, to approve such matters), and voting its Company Shares in favor of such matters. 5.16 ... in its sole discretion: (a) Accuracy of Representations and Warranties. The representations and warranties of each Seller shall have been true and correct in... -

Page 125

... or prior to the Closing. (c) No Company Insolvency Event. No Insolvency Event shall have occurred with respect to the Company. (d) to any Seller. (e) Opinion of... agent to file the appropriate and complete application with the Taiwan Depository & Clearing Corporation ("TDCC") to effect book-entry ... -

Page 126

..., (3) original filing record of Powerchip with the Securities and Futures Bureau for transfer of shares by Powerchip as a major shareholder of the Company, (4) any other instruments and documents necessary for the application to the TDCC to effect the release and cancellation of any share pledge or... -

Page 127

... made and shall be true and correct in all material respects at the Closing as if made at the Closing (except for any representations and warranties that are expressly made as of a specific date, which shall be true and correct in all material respects as of such date). (b) Covenants. Each of... -

Page 128

...written notice to Powerchip, if an Insolvency Event with respect to the Company or any Seller occurs; (c) in the event the Sponsor Agreement terminates... material respect; (e) by Powerchip, (i) if any of the representations and warranties of Micron or Buyer set forth in this Agreement was not true and... -

Page 129

... of (i) prohibiting Micron's, Buyer's or the Permitted Designee's direct or indirect ownership or operation of any portion of the Company Shares or the business of Elpida, the Company or any of their respective Subsidiaries, or (ii) compelling Micron, Buyer or the Permitted Designee to dispose of or... -

Page 130

...accordance with the Laws of the State of Delaware, without regard to ...Micron or Buyer, to: Micron Technology, Inc. 8000 South Federal Way Boise, Idaho 83716-9632 Attention: General Counsel Facsimile...to: Powerchip Technology Corporation No.12, Li-Hsin Rd. 1 Hsinchu Science Park Hsinchu, Taiwan, R.O.C. ... -

Page 131

... to its preparation, (b) the rule of construction to the effect that any ambiguities are resolved against the drafting party shall not be employed in the interpretation of this Agreement, and (c) the terms and provisions of this Agreement shall be construed fairly as to all parties, regardless... -

Page 132

[*] Certain information in this document has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. 8.9 Severability. If any provision of this Agreement is held to be illegal, invalid or ... -

Page 133

...the omitted portions. IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written. MICRON TECHNOLOGY, INC. By: /s/ Michael Sadler Name: Michael Sadler Title: VP Corporate Development MICRON SEMICONDUCTOR B.V. By: /s/ Thomas L. Laws, Jr. Name: Thomas L. Laws... -

Page 134

... and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. SELLERS: POWERCHIP TECHNOLOGY CORPORATION By: /s/ Frank Huang Name: Frank Huang Title: CEO and Chairman LI-HSIN INVESTMENT CO., LTD. By: /s/ Frank Huang Name: Frank Huang Title: Chairman... -

Page 135

... and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. SCHEDULE 1 Seller Powerchip Technology Corporation (fka Powerchip Semiconductor Corporation) Li-Hsin Investment Co., Ltd. Quantum Vision Corporation Maxchip Electronics Corporation Dr... -

Page 136

[*] Certain information in this document has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions. THE FOLLOWING ATTACHMENTS TO THE SHARE PURCHASE AGREEMENT HAVE BEEN OMITTED IN ACCORDANCE WITH ... -

Page 137

... TECHNOLOGY, INC. 1997 NONSTATUTORY STOCK... of the Plan. (b) "Affiliate" means (i) any subsidiary or parent company of the Company, or (ii) an entity...Stock of the Company outstanding at any time. (f) "Code" means the Internal Revenue Code of 1986, as amended. Reference to a specific Section of the Code... -

Page 138

... given such term in Section 409A of the Code. (n) "Employee" means any person, except Officers and Directors, employed by the Company or any parent, subsidiary or Affiliate of the Company. (o) "Fair Market Value" of the Stock, on any date, means: (i) if the Stock is listed or traded on any Exchange... -

Page 139

.... Such option is not intended to qualify as an incentive stock option within the meaning of Section 422 of the Code and the regulations promulgated thereunder. (s) "Option Agreement" means a written agreement between the Company and an Optionee evidencing the terms and conditions of an individual... -

Page 140

... granted hereunder; (iv) to determine the number of shares of Common Stock to be covered by each Option granted hereunder; (v) to approve forms of...allow Optionees to satisfy withholding tax obligations by electing to have the Company withhold from the Shares to be issued upon exercise of an Option... -

Page 141

... recipient stock" within the meaning of §1.409A-1(b)(5)(iii) (E) of the final regulations under Code Section 409A. 6. Limitations. Neither the Plan nor any Option shall confer upon an Optionee any right with respect to continuing the Optionee's employment or consulting relationship with the Company... -

Page 142

...shareholder shall exist with respect to the Optioned Stock, notwithstanding the exercise of the Option. The Company shall issue (or cause to be issued)... as to which the Option is exercised. (b) Termination of Employment or Consulting Relationship. Upon termination of an Optionee's Continuous Status... -

Page 143

... Sale. (a) Changes in Capitalization. Subject to any required action by the shareholders of the Company, the number of shares of Common Stock covered by each outstanding Option, and the number of issued shares of Common Stock which have been authorized for issuance under the Plan but as to which no... -

Page 144

...Stock Options to cease to qualify as Incentive Stock Options, such Options shall be deemed to be Nonstatutory Stock Options. (b) Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company...all or any part of the Optioned stock, including Shares as to which the ... -

Page 145

...without prior approval of the shareholders of the Company if such amendment would: (i) (ii) increase... not limited to, Section 409A of the Code), and to the administrative regulations and rulings ...all Applicable Laws and the requirements of any stock exchange or quotation system upon which the Shares ... -

Page 146

...have been obtained. 17. Reservation of Shares. The Company, during the term of this Plan, will at..." for purposes of Section 409A of the Code would otherwise be payable or distributable under the...conflicts of interest), or (j)(4)(vi) (payment of employment taxes): (i) if the payment or distribution is ... -

Page 147

... 409A and the final regulations thereunder, provided, however, that, as permitted in such final regulations, the Company's Specified Employees and its application of the six-month delay rule of Code Section 409A(a)(2) (B)(i) shall be determined in accordance with rules adopted by the Board or any... -

Page 148

...control with, the Company, as determined by the Committee. (c) "Applicable Laws" means the legal requirements relating to the administration of stock option plans and the issuance of stock and stock options under federal and state securities laws, Delaware corporate law, the Code, and the applicable... -

Page 149

... given such term in Section 409A of the Code. (n) "Employee" means any person, except Officers and Directors, employed by the Company or any parent, subsidiary or Affiliate of the Company. (o) "Fair Market Value" of the Stock, on any date, means: (i) if the Stock is listed or traded on any Exchange... -

Page 150

.... Such option is not intended to qualify as an incentive stock option within the meaning of Section 422 of the Code and the regulations promulgated thereunder. (s) "Option Agreement" means a written agreement between the Company and an Optionee evidencing the terms and conditions of an individual... -

Page 151

...then current Fair Market Value if the Fair Market Value of the Common Stock covered by such Option shall have declined since the date the Option was... allow Optionees to satisfy withholding tax obligations by electing to have the Company withhold from the Shares to be issued upon exercise of an Option... -

Page 152

... recipient stock" within the meaning of §1.409A-1(b)(5)(iii)(E) of the final regulations under Code Section 409A. 6. Limitations. Neither the Plan nor any Option shall confer upon an Optionee any right with respect to continuing the Optionee's employment or consulting relationship with the Company... -

Page 153

...shareholder shall exist with respect to the Optioned Stock, notwithstanding the exercise of the Option. The Company shall issue (or cause to be issued)... as to which the Option is exercised. (b) Termination of Employment or Consulting Relationship. Upon termination of an Optionee's Continuous Status... -

Page 154

... Sale. (a) Changes in Capitalization. Subject to any required action by the shareholders of the Company, the number of shares of Common Stock covered by each outstanding Option, and the number of issued shares of Common Stock which have been authorized for issuance under the Plan but as to which no... -

Page 155

...Stock Options to cease to qualify as Incentive Stock Options, such Options shall be deemed to be Nonstatutory Stock Options. (b) Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company...all or any part of the Optioned stock, including Shares as to which the ... -

Page 156

...without prior approval of the shareholders of the Company if such amendment would: (i) (ii) increase... not limited to, Section 409A of the Code), and to the administrative regulations and rulings ...all Applicable Laws and the requirements of any stock exchange or quotation system upon which the Shares ... -

Page 157

...Repricing. Without the prior approval of the shareholders of the Company, the Administrator shall not reprice any Options issued under ... "deferred compensation" for purposes of Section 409A of the Code would otherwise be payable or distributable under the Plan or ...(payment of employment taxes): 10 -

Page 158

...and the final regulations thereunder, provided, however, that, as permitted in such final regulations, the Company's Specified Employees and its application of the six-month delay rule of Code Section 409A(a)(2)(B)(i) shall be determined in accordance with rules adopted by the Board or any committee... -

Page 159

... or regulation amending, supplementing or superseding such Section or regulation. (g) Plan. (h) (i) "Common Stock" means the Common Stock of the Company. "Company" means Micron Technology, Inc., a Delaware corporation. "Committee" means a Committee appointed by the Board in accordance with... -

Page 160

... the meaning of Section 409A(d) of the Code, "Disability" has the meaning given such term in Section 409A of the Code. (n) "Employee" means any person, including Officers and Directors, employed by the Company or any Parent or Subsidiary of the Company. Neither service as a Director nor payment of... -

Page 161

... 424(f) of the Code. In the case of an Option that is not intended to qualify as an Incentive Stock Option, the term "Subsidiary" shall also include any other entity in which the Company, or any Parent or Subsidiary of the Company has a significant ownership interest. 3. Stock Subject to the Plan... -

Page 162

... may be granted Options under this Plan only if the Affiliate qualifies as an "eligible issuer of service recipient stock" within the meaning of §1.409A-1(b)(5)(iii)(E) of the final regulations under Code Section 409A. 6. Limitations. to make all other determinations deemed necessary or advisable... -

Page 163

...stated in the Notice of Grant, but shall not exceed ten (10) years; provided, however, that in the case of an Incentive Stock Option granted to an Optionee who, at the time Incentive Stock Option is granted, owns stock... stock of the Company or any Parent or Subsidiary, the term of the Incentive Stock... -

Page 164

...to the Optioned Stock, notwithstanding the exercise of the Option. The Company shall issue (or cause to be issued) such stock certificate, either ...Shares as to which the Option is exercised. (b) Termination of Employment or Consulting Relationship. Upon termination of an Optionee's Continuous Status ... -

Page 165

... other increase or decrease in the number of shares of Common Stock effected without receipt of consideration by the Company; provided, however, that conversion of any convertible securities of the Company shall not be deemed to have been "effected without receipt of consideration." Such adjustment... -

Page 166

... not limited to, Section 409A of the Code), and to the administrative regulations and rulings ...Company of any liability in respect of the failure to issue or sell such Shares as to which such requisite authority shall not have been obtained. (b) Grants Exceeding Allotted Shares. If the Optioned Stock... -

Page 167

...order), (j)(4)(iii) (conflicts of interest), or (j) (4)(vi) (payment of employment taxes): (i) if the payment or distribution is payable in a lump sum,... such final regulations, the Company's Specified Employees and its application of the six-month delay rule of Code Section 409A(a)(2)(B)(i) shall be ... -

Page 168

... the success, and enhance the value, of Micron Technology, Inc. (the "Company"), by linking the personal interests of employees, officers, directors and consultants of the Company or any Affiliate (as defined below) to those of Company stockholders and by providing such persons with an incentive... -

Page 169

... of the Board described in Article 4. "Company" means Micron Technology, Inc., a Delaware corporation, or any successor...Company or any Affiliate, as applicable; provided, however, that for purposes of an Incentive Stock Option, or a Stock Appreciation Right issued in tandem with an Incentive Stock... -

Page 170

... Section 422 of the Code or any successor provision thereto. (u) "Non-Employee Director" means a director of the Company who is not a common law employee of the Company or an Affiliate. (v) "Nonstatutory Stock Option" means an Option that is not an Incentive Stock Option. (w) "Option" means a right... -

Page 171

...Stock Option, Parent shall have the meaning set forth in Section 424(e) of the Code. (z) "Participant" means a person who, as an employee, officer, director or consultant of the Company or any Affiliate...capacity on behalf of the Participant under applicable state law and court supervision. (aa) "... -

Page 172

...) and "outside directors" (within the meaning of Code Section 162 (m)) and that any such members of ...report or other information furnished to that member by any officer or other employee of the Company or any Affiliate, the Company's or an Affiliate's independent certified public accountants, Company... -

Page 173

... price of an Award may be paid in, cash, Stock, other Awards, or other property, or an Award may...Company or any Affiliate may operate, in order to assure the viability of the benefits of Awards granted to participants located... Board and such delegates shall report regularly to the Board and the... -

Page 174

... Participants; except that Incentive Stock Options may be granted to only to Eligible Participants who are employees of the Company or a Parent or Subsidiary as defined in Section 424 (e) and (f) of the Code. Eligible Participants who are service providers to an Affiliate may be granted Options or... -

Page 175

...on the Participant's termination of employment. Upon the Participant's death, any exercisable Incentive Stock Options may be exercised by ... the Grant Date, owns stock possessing more than ten percent of the total combined voting power of all classes of stock of the Company or any Parent or Subsidiary... -

Page 176

...of one Share on the date of exercise; over (2) The base price of the Stock Appreciation Right as determined by the Committee, which shall not be less than the Fair... structure or capital structure of the Company or the manner in which the Company or an Affiliate conducts its business, or other events... -

Page 177

... not limited to, roughly annual increments over three years, with respect to the Restricted Stock or Restricted Stock Units referred to in Section... or in the best interests of the Company. 10.4. DELIVERY OF RESTRICTED STOCK. Shares of Restricted Stock shall be delivered to the Participant at the... -

Page 178

... or transfers to be made by the Company or an Affiliate on the grant or exercise of an ... Incentive Stock Option, pursuant to a domestic relations order that would satisfy Section 414(p)(1) (A) of the Code if such...deemed relevant, including without limitation, state or federal tax or securities laws... -

Page 179

... or state securities laws, rules and regulations and the rules of any national securities exchange or automated quotation system on which the Stock is ... of employment or separation from service resulting from death, Disability or for the convenience or in the bests interests of the Company. The... -

Page 180

... that all Options and Stock Appreciation Rights granted hereunder ...Code based on one or more of the following Qualified Business Criteria, which may be expressed in terms of Company...Affiliate or a unit, division, region, department or function within the Company or an Affiliate... and technology design,... -

Page 181

... or prior to such occurrence, in the case of a spin-off, sale or disposition of the Participant's employer from the Company or any Affiliate. To the extent that this provision causes Incentive Stock Options to extend beyond three months from the date a Participant is deemed to be an employee of the... -

Page 182

... in compliance with Section 409A of the Code and other applicable law. 14.14....Company or an Affiliate as a result of a merger or consolidation of the former employing entity with the Company or an Affiliate or the acquisition by the Company or an Affiliate of property or stock of the former employing... -

Page 183

...(with the per-share value of an Option or Stock Appreciation Right for this purpose being calculated as the excess...but not limited to, Section 409A of the Code), and to the administrative regulations and rulings ...under the Plan. Neither the Company, its Affiliates nor the Committee is obligated to... -

Page 184

... of Section 409A of the Code would otherwise be payable or ... (j)(4)(vi) (payment of employment taxes): (i) if the ...Company or any Affiliate shall have the authority and the right to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy federal, state... -

Page 185

...with or limit in any way the right of the Company or any Affiliate to terminate any Participant's employment or status as an officer, director or consultant at...covered by an Award upon any Exchange or under any foreign, federal, state or local law or practice, or the consent or approval of any ... -

Page 186

...be construed in accordance with and governed by the laws of the State of Delaware. 17.14. ADDITIONAL PROVISIONS. Each Award Certificate may ...to any person. If the Committee so directs, the Company may issue or transfer Shares to an Affiliate, for such lawful consideration as the Committee may specify... -

Page 187

... TECHNOLOGY, INC. NONSTATUTORY STOCK ... of the Plan. (b) "Affiliate" means (i) any subsidiary or parent company of the Company, or (ii) an entity ...Stock of the Company outstanding at any time. (f) "Code" means the Internal Revenue Code of 1986, as amended. Reference to a specific Section of the Code... -

Page 188

... given such term in Section 409A of the Code. (n) "Employee" means any person, except Officers and Directors, employed by the Company or any parent, subsidiary or Affiliate of the Company. (o) "Fair Market Value" of the Stock, on any date, means: (i) if the Stock is listed or traded on any Exchange... -

Page 189

.... Such option is not intended to qualify as an incentive stock option within the meaning of Section 422 of the Code and the regulations promulgated thereunder. (s) "Option Agreement" means a written agreement between the Company and an Optionee evidencing the terms and conditions of an individual... -

Page 190

...then current Fair Market Value if the Fair Market Value of the Common Stock covered by such Option shall have declined since the date the Option was... allow Optionees to satisfy withholding tax obligations by electing to have the Company withhold from the Shares to be issued upon exercise of an Option... -

Page 191

... recipient stock" within the meaning of §1.409A-1(b)(5)(iii) (E) of the final regulations under Code Section 409A. 6. Limitations. Neither the Plan nor any Option shall confer upon an Optionee any right with respect to continuing the Optionee's employment or consulting relationship with the Company... -

Page 192

...shareholder shall exist with respect to the Optioned Stock, notwithstanding the exercise of the Option. The Company shall issue (or cause to be issued)... as to which the Option is exercised. (b) Termination of Employment or Consulting Relationship. Upon termination of an Optionee's Continuous Status... -

Page 193

... Sale. (a) Changes in Capitalization. Subject to any required action by the shareholders of the Company, the number of shares of Common Stock covered by each outstanding Option, and the number of issued shares of Common Stock which have been authorized for issuance under the Plan but as to which no... -

Page 194

...Stock Options to cease to qualify as Incentive Stock Options, such Options shall be deemed to be Nonstatutory Stock Options. (b) Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company...all or any part of the Optioned stock, including Shares as to which the ... -

Page 195

...without prior approval of the shareholders of the Company if such amendment would: (i) increase the ... not limited to, Section 409A of the Code), and to the administrative regulations and rulings...all Applicable Laws and the requirements of any stock exchange or quotation system upon which the Shares... -

Page 196

...requisite authority shall not have been obtained. 17. Reservation of Shares. The Company, during the term of this Plan, will at all times reserve and ... non-exempt "deferred compensation" for purposes of Section 409A of the Code would otherwise be payable or distributable under the Plan or any Notice... -

Page 197

... order), (j)(4)(iii) (conflicts of interest), or (j)(4)(vi) (payment of employment taxes): (i) if the payment or distribution is payable in a lump sum...such final regulations, the Company's Specified Employees and its application of the six-month delay rule of Code Section 409A(a)(2)(B)(i) shall be ... -

Page 198

... the success, and enhance the value, of Micron Technology, Inc. (the "Company"), by linking the personal interests of employees, non-employee directors and consultants of the Company or any Affiliate (as defined below) to those of Company stockholders and by providing such persons with an incentive... -

Page 199

...committee of the Board described in Article 4. "Company" means Micron Technology, Inc., a Delaware corporation, or any ...Company or any Affiliate, as applicable; provided, however, that for purposes of an Incentive Stock Option, or a Stock Appreciation Right issued in tandem with an Incentive Stock... -

Page 200

... Section 422 of the Code or any successor provision thereto. (u) "Non-Employee Director" means a director of the Company who is not a common law employee of the Company or an Affiliate. (v) "Nonstatutory Stock Option" means an Option that is not an Incentive Stock Option. (w) "Option" means a right... -

Page 201

...Stock Option, Parent shall have the meaning set forth in Section 424(e) of the Code. (z) "Participant" means a person who, as an employee, non-employee director or consultant of the Company or any Affiliate...applicable state law ...Technology, Inc. 2007 Equity Incentive Plan, as amended from time to A-4 -

Page 202

... to, in good faith, rely or act upon any report or other information furnished to that member by any officer or other employee of the Company or any Affiliate, the Company's or an Affiliate's independent certified public accountants, Company counsel or any executive compensation consultant or other... -

Page 203

... price of an Award may be paid in, cash, Stock, other Awards, or other property, or an Award may...Company or any Affiliate may operate, in order to assure the viability of the benefits of Awards granted to participants located... Board and such delegates shall report regularly to the Board and the... -

Page 204

... Participants; except that Incentive Stock Options may be granted to only to Eligible Participants who are employees of the Company or a Parent or Subsidiary as defined in Section 424(e) and (f) of the Code. Eligible Participants who are service providers to an Affiliate may be granted Options or... -

Page 205

...Code. If all of the requirements of Section 422 of the Code are not met, the Option shall automatically become a Nonstatutory Stock Option. ARTICLE 8 STOCK APPRECIATION RIGHTS 8.1. GRANT OF STOCK...without the prior approval of the shareholders of the Company. (c) EXERCISE TERM. No SAR granted under ... -

Page 206

...corporate structure or capital structure of the Company or the manner in which the Company or an Affiliate conducts its business, or other events ... but not limited to, roughly annual increments over three years, with respect to the Restricted Stock or Restricted Stock Units referred to in Section 10... -

Page 207

...Award Certificate, payments or transfers to be made by the Company or an Affiliate on the grant or exercise of an Award may be made in such form as the Committee determines at or after the Grant Date, including without limitation, cash, Stock, other Awards, or other property, or any combination, and... -

Page 208

... than the Company or an Affiliate. No unexercised...Stock Option, pursuant to a domestic relations order that would satisfy Section 414(p)(1)(A) of the Code...state securities laws, rules and regulations and the rules of any national securities exchange or automated quotation system on which the Stock... -

Page 209

...Stock Options to exceed the dollar limitation set forth in Code Section 422 (d), the excess Options shall be deemed to be Nonstatutory Stock...an Affiliate or a unit, division, region, department or function within the Company or an Affiliate Gross...including product and technology design, development, ... -

Page 210

... satisfaction of any other conditions, including the condition as to continued employment as set forth in subsection (g) below, as the Committee may ...of financial condition and results of operations appearing in the Company's annual report to stockholders for the applicable year; (f) acquisitions or ... -

Page 211

...the Participant's employer from the Company or any Affiliate. To the extent that this provision causes Incentive Stock Options to ...Company, a Parent or Subsidiary for purposes of Sections 424 (e) and 424(f) of the Code, the Options held by such Participant shall be deemed to be Nonstatutory Stock... -

Page 212

... the per-share value of an Option or Stock Appreciation Right for this purpose being calculated as the...without the prior approval of the stockholders of the Company; (c) Except as otherwise provided in Article 15, ...not limited to, Section 409A of the Code), and to the administrative regulations and ... -

Page 213

...under the Plan. Neither the Company, its Affiliates nor the Committee is obligated to....3. SPECIAL PROVISIONS RELATED TO SECTION 409A OF THE CODE. (a) Notwithstanding anything in the Plan or in ...conflicts of interest), or (j)(4)(vi) (payment of employment taxes): (i) if the payment or distribution is... -

Page 214

...with or limit in any way the right of the Company or any Affiliate to terminate any Participant's employment or status as an officer, director or consultant at...covered by an Award upon any Exchange or under any foreign, federal, state or local law or practice, or the consent or approval of any ... -

Page 215

...be construed in accordance with and governed by the laws of the State of Delaware. 17.14. ADDITIONAL PROVISIONS. Each Award Certificate may ...to any person. If the Committee so directs, the Company may issue or transfer Shares to an Affiliate, for such lawful consideration as the Committee may specify... -

Page 216

...: REFERENCE NUMBER: Jul 3 2012 MICRON TECHNOLOGY, INC. FX OPERATIONS J. Aron & Company Currency Option Transaction SDB3616575404-3537679183 The...Netting) will not apply to Transactions, (iii) the Governing Law shall be the State of New York, (iv) the "Cross-Default" provisions of Section 5(a)(vi) ... -

Page 217

... via facsimile to the attention of FX Operations at 212 428 3338. Very truly yours, J. Aron & Company By: /s/ Arthur Ambrose Name: Arthur Ambrose Title: Vice President Agreed and Accepted By: MICRON TECHNOLOGY, INC. By: /s/ Josh Ingram (Reference Number: SDB3616575404-3537679183) 2 of 2 -

Page 218

...: REFERENCE NUMBER: Jul 3 2012 MICRON TECHNOLOGY, INC. FX OPERATIONS J. Aron & Company Currency Option Transaction SDB3616575406-3537683027 The...Netting) will not apply to Transactions, (iii) the Governing Law shall be the State of New York, (iv) the "Cross-Default" provisions of Section 5(a)(vi) ... -

Page 219

... via facsimile to the attention of FX Operations at 212 428 3338. Very truly yours, J. Aron & Company By: /s/ Arthur Ambrose Name: Arthur Ambrose Title: Vice President Agreed and Accepted By: MICRON TECHNOLOGY, INC. By: /s/ Josh Ingram (Reference Number: SDB3616575406-3537683027) 2 of 2 -

Page 220

...: REFERENCE NUMBER: Jul 3 2012 MICRON TECHNOLOGY, INC. FX OPERATIONS J. Aron & Company Currency Option Transaction SDB3616575405-3537682647 The...Netting) will not apply to Transactions, (iii) the Governing Law shall be the State of New York, (iv) the "Cross-Default" provisions of Section 5(a)(vi) ... -

Page 221

... via facsimile to the attention of FX Operations at 212 428 3338. Very truly yours, J. Aron & Company By: /s/ Arthur Ambrose Name: Arthur Ambrose Title: Vice President Agreed and Accepted By: MICRON TECHNOLOGY, INC. By: /s/ Josh Ingram (Reference Number: SDB3616575405-3537682647) 2 of 2 -

Page 222

...: U.K. 44 1202 325 163 Switchboard: U.K. 44 1202 322000 MICRON TECHNOLOGY INCORPORATED Facsimile: 001 2083685763 2 July 2012 Reference Number: 8000031078419 (LHCZGIJ00) Internal Reference: 30940179 / 30781719 /... Schedule except for the election of the laws of the State of New York as the Page 1 of 5 -

Page 223

governing law and United States dollars as the Termination Currency) on the Trade ...2: (a) General Terms: Internal Reference: Trade Date: Buyer: Seller: 30781719 02 July 2012 JPMorgan Counterparty 30940179 02 July 2012 Counterparty JPMorgan European USD Put / JPY Call JPY 40,000,000,000 USD 505,369... -

Page 224

...and Call Currency Amount: Put Currency and Put Currency Amount: Strike Price: Expiration Date: Expiration Time: Settlement Date: Premium: Premium Payment Date: 31014429 02 July 2012 JPMorgan Counterparty European JPY Put / USD Call USD 240,038,406.14 JPY 20,000,000,000 83.32 JPY/USD 03 April 2013 10... -

Page 225

... NEW YORK. The Office of the Counterparty for this Transaction is BOISE. 5. Office and Address for notices in connection with this Transaction ...with this Agreement and remains true and in effect. 7. Representations and Warranties: Absent a written agreement to the contrary, each party represents and... -

Page 226

... CHASE BANK, N.A. /s/ Philip D. Glackin Name: Title: Philip D Glackin Executive Director Accepted and confirmed as of the date first written MICRON TECHNOLOGY INCORPORATED /s/ Anne Miller Name: Title: Anne Miller Senior Manager, Worldwide Treasury Operations Your Reference Number: Page 5 of 5 -

Page 227

...USA, National Association 452 Fifth Avenue, 10018 Tel: 02079919151 Fax: 020 7992 4493 To: Attn: Email: Date: Ref : MICRON TECHNOLOGY INC Rob Brown [email protected] 11th July 2012... (i) specifying only that (a) the governing laws of the State of New York and the Termination Currency is U.S. Dollars.... -

Page 228

... by the other. The terms of the Transaction to which this Confirmation relates are as follows: Trade Date: Calculation Agent: 02 July 2012 Party A, whose determinations in respect of this Transaction shall be conclusive and binding save for manifest error and who shall also determine whether... -

Page 229

... as follows: (Notional amount (i) / Strike Rate (i)) (Notional amount (ii) / Limit Rate) Type of Order Venue Identification : at Market HSBC Bank USA, National Association : 452 Fifth Avenue, 10018 The time that this transaction was effected can be supplied upon request. We have effected this... -

Page 230