Creative 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

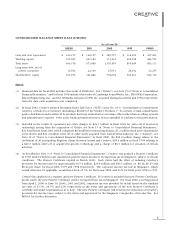

Unaudited data for quarters ended (as a percentage of sales)

Jun 30 Mar 31 Dec 31 Sep 30 Jun 30 Mar 31 Dec 31 Sep 30

2002 2002 2001 2001 2001 2001 2000 2000

Sales, net (1) 100 % 100 % 100 % 100 % 100 % 100 % 100 % 100 %

Cost of goods sold 67 67 67 69 73 76 73 70

Gross profit 33 33 33 31 27 24 27 30

Operating Expenses:

Selling, general and

administrative (1) 24 20 18 24 21 21 16 19

Research and development 6 4 4 5 5 4 4 5

Other charges (2) 14 – – – – 9 – –

Operating (loss) income (11) 9 11 2 1 (10) 7 6

Net (loss) gain from investments (16) – – (9) (32) (29) – 1

Interest income (expense)

and other, net 1 – 1 – – 1 – –

(Loss) income before income

taxes and minority interest (26) 9 12 (7) (31) (38) 7 7

Provision for income taxes (1) (1) (1) – – – (1) (1)

Minority interest in (income) loss – – ––––––

Net (loss) income (27) % 8 % 11 % (7) % (31) % (38) % 6 % 6 %

(1) For the quarter ended March 31, 2002, Creative has adopted EITF Issue No. 01-9, “Accounting for Consideration

Given by a Vendor to a Customer (Including a Reseller of the Vendor’s Products).” As a result, certain consideration

paid to distributors and resellers of its products has been reclassified as a revenue offset rather than as selling, general

and administrative expense. Prior quarters’ financial data have been reclassified to conform to this presentation.

(2) Other charges for the quarter ended June 30, 2002 relates to the write-off of in-process technology arising from the

acquisition of 3Dlabs. For the quarter ended March 31, 2001 includes $8.4 million in restructuring charges, fixed

assets impairment write-downs of $3.2 million and write-off of other assets acquired from Aureal amounting to

$11.2 million. See Notes 12 and 15 of “Notes to Consolidated Financial Statements.”