Cracker Barrel 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

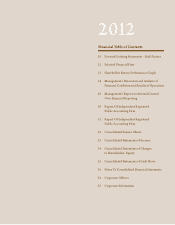

Selected Financial Data

CRACKER BARREL OLD COUNTRY STORE, INC.

(Dollars in thousands except percentages and share data)

For each of the scal years ended

August 3, 2012(a) July 29, 2011(b) July 30, 2010(c) July 31, 2009(d)(e) August 1, 2008(e)

SELECTED INCOME STATEMENT DATA:

Total revenue $ 2,580,195 $ 2,434,435 $ 2,404,515 $ 2,367,285 $ 2,384,521

Income from continuing operations 103,081 85,208 85,258 65,957 65,303

Net income 103,081 85,208 85,258 65,926 65,553

Basic net income per share:

Income from continuing operations 4.47 3.70 3.71 2.94 2.87

Net income per share 4.47 3.70 3.71 2.94 2.88

Diluted net income per share:

Income from continuing operations 4.40 3.61 3.62 2.89 2.79

Net income per share 4.40 3.61 3.62 2.89 2.80

Dividends declared per share (f) $ 1.15 $ 0.88 $ 0.80 $ 0.80 $ 0.72

Dividends paid per share $ 0.97 $ 0.86 $ 0.80 $ 0.78 $ 0.68

AS PERCENT OF TOTAL REVENUE:

Cost of goods sold 32.1% 31.7% 31.0% 32.3% 32.4%

Labor and related expenses 36.8 37.1 37.8 38.7 38.2

Other store operating expenses 18.0 18.6 18.2 17.8 17.7

Store operating income 13.1 12.6 13.0 11.2 11.7

General and administrative expenses 5.7 5.7 6.1 5.1 5.4

Impairment and store dispositions, net — — 0.1 0.1 —

Operating income 7.4 6.9 6.8 6.0 6.3

Income before income taxes 5.7 4.8 4.8 3.8 3.9

SELECTED BALANCE SHEET DATA:

Working capital (decit) $ 18,249 $ (21,188) $ (73,289) $ (66,637) $ (44,080)

Total assets 1,418,992 1,310,884 1,292,067 1,245,181 1,313,703

Current interest rate swap liability 20,215 — — — —

Long-term debt 525,036 550,143 573,744 638,040 779,061

Long-term interest rate swap liability 14,166 51,604 66,281 61,232 39,618

Other long-term obligations 114,897 105,661 93,822 89,670 83,224

Shareholders’ equity 382,675 268,034 191,617 135,622 92,751

SELECTED CASH FLOW DATA:

Purchase of property and equipment, net $ 80,170 $ 77,686 $ 69,891 $ 67,842 $ 87,849

Share repurchases 14,923 33,563 62,487 — 52,380

SELECTED OTHER DATA:

Common shares outstanding at end of year 23,473,024 22,840,974 22,732,781 22,722,685 22,325,341

Stores open at end of year 616 603 593 588 577

AVEGE UNIT VOLUMES (g):

Restaurant $ 3,369 $ 3,234 $ 3,226 $ 3,209 $ 3,282

Retail 863 837 832 841 898

COMPABLE STORE SALES (h):

Period to period increase (decrease)

in comparable store sales:

Restaurant 2.2% 0.2% 0.8% (1.7)% 0.5%

Retail 1.6 0.7 (0.9) (5.9) (0.3)

Memo: Number of stores in comparable base 591 583 569 550 531

12