Costco 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM LSTARKE // 9-DEC-98 18:20 DISK004:[98SEA7.98SEA2097]DK2097A.;25

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 754DM/ 0D Foot: 0D/ 0D VJ R Seq: 1 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DK2097A.;25

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

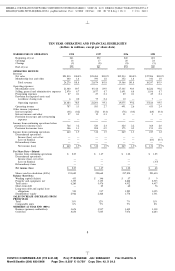

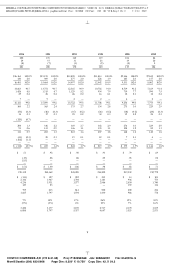

QUARTERLY RESULTS OF OPERATIONS (UNAUDITED)

(dollars in thousands, except per share data)

The following table sets forth the results of operations by quarter for fiscal 1998 and 1997. This information includes all

adjustments which management considers necessary for a fair presentation. Shares used in the earnings per share

calculations fluctuate by quarter depending primarily upon whether convertible subordinated debentures are dilutive during

the respective period.

52 Weeks Ended August 30, 1998 52 Weeks August 31, 1997

First Second Third Fourth First Second Third Fourth

Quarter Quarter Quarter Quarter Total Quarter Quarter Quarter Quarter Total

12 12 12 16 52 12 12 12 16 52

Weeks Weeks Weeks Weeks Weeks Weeks Weeks Weeks Weeks Weeks

REVENUE

Net sales . . . . . . ......... $5,321,256 $5,697,098 $5,241,926 $7,570,100 $23,830,380 $4,785,636 $5,147,425 $4,752,445 $6,798,612 $21,484,118

Membership fees and other . . . 108,507 97,908 96,160 136,922 439,497 97,772 91,468 83,784 117,262 390,286

Total revenue . . . . . . . . . . 5,429,763 5,795,006 5,338,086 7,707,022 24,269,877 4,883,408 5,238,893 4,836,229 6,915,874 21,874,404

OPERATING EXPENSES

Merchandise costs ......... 4,779,296 5,098,992 4,715,755 6,785,648 21,379,691 4,308,369 4,619,208 4,283,157 6,103,751 19,314,485

S,G&A expenses . . . . . . . . . . 470,711 478,732 466,987 653,470 2,069,900 426,104 436,036 426,980 587,639 1,876,759

Preopening expenses . . . . . . . . 7,343 4,071 8,884 6,712 27,010 10,197 6,087 2,458 8,706 27,448

Provision for impaired assets and

warehouse closing costs . . . . 2,000 — 1,500 2,500 6,000 70,000 — 3,500 1,500 75,000

Operating income . . . . . . . . 170,413 213,211 144,960 258,692 787,276 68,738 177,562 120,134 214,278 580,712

OTHER INCOME (EXPENSE)

Interest expense . . . . . . . . . . (10,923) (10,965) (10,477) (15,170) (47,535) (18,933) (17,243) (14,662) (25,443) (76,281)

Interest income and other . . . . 3,720 7,743 7,562 7,637 26,662 3,657 3,461 4,055 4,725 15,898

INCOME BEFORE PROVISION

FOR INCOME TAXES . . . . . . 163,210 209,989 142,045 251,159 766,403 53,462 163,780 109,527 193,560 520,329

Provision for income taxes . . . . 65,284 83,996 56,818 100,463 306,561 21,652 66,331 43,262 76,887 208,132

NET INCOME ............ $ 97,926 $ 125,993 $ 85,227 $ 150,696 $ 459,842 $ 31,810(a) $ 97,449 $ 66,265 $ 116,673 $ 312,197(b)

NET INCOME PER COMMON

AND COMMON

EQUIVALENT SHARE:

Basic . . . . . . . . . . . . . . . . . $ 0.46 $ 0.59 $ 0.39 $ 0.69 $ 2.13 $ 0.16 $ 0.47 $ 0.31 $ 0.55 $ 1.51

Diluted................ $ 0.44 $ 0.56 $ 0.38 $ 0.66 $ 2.03 $ 0.16(a) $ 0.46 $ 0.31 $ 0.54 $ 1.47(b)

Shares used in calculation (000’s)

Basic . . . . . . . . . . . . . . . . . 213,833 214,590 215,913 217,142 215,506 196,548 206,540 211,477 213,052 207,379

Diluted................ 229,413 230,482 232,378 233,501 231,685 199,195 222,894 215,582 225,579 224,668

(a) Net income and net income per common and common equivalent share would have been $70,485 and $.34, respectively,

without the effect of adopting SFAS No. 121, using 226,661 diluted shares.

(b) Net income and net income per common and common equivalent share would have been $350,872 and $1.64, respectively,

without the effect of adopting SFAS No. 121, using 224,668 diluted shares.

7

9 C Cs: 4559