Costco 1998 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM CPICARD // 3-DEC-98 18:50 DISK004:[98SEA7.98SEA2097]DW2097A.;6

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 40D*/ 240D Foot: 0D/ 0D VJ R Seq: 10 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DW2097A.;6

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

COSTCO COMPANIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

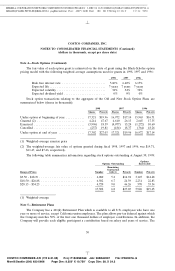

Note 4—Stock Options (Continued)

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option

pricing model with the following weighted average assumptions used for grants in 1998, 1997 and 1996:

1998 1997 1996

Risk free interest rate ......................... 5.60% 6.40% 6.15%

Expected life ................................ 7 years 7 years 7 years

Expected volatility ............................ 34% 34% 32%

Expected dividend yield ........................ 0% 0% 0%

Stock option transactions relating to the aggregate of the Old and New Stock Option Plans are

summarized below (shares in thousands):

1998 1997 1996

Shares Price(1) Shares Price(1) Shares Price(1)

Under option at beginning of year ........... 17,321 $19.96 16,972 $17.14 15,963 $16.71

Granted (2) ........................... 4,214 47.67 4,610 26.13 2,645 17.35

Exercised ............................. (3,996) 18.59 (4,077) 15.24 (1,272) 10.60

Cancelled ............................. (237) 19.81 (184) 18.37 (364) 18.26

Under option at end of year ............... 17,302 $27.03 17,321 $19.96 16,972 $17.14

(1) Weighted-average exercise price

(2) The weighted-average fair value of options granted during fiscal 1998, 1997 and 1996, was $19.71,

$11.47, and $7.46, respectively.

The following table summarizes information regarding stock options outstanding at August 30, 1998:

Options

Options Outstanding Exercisable

Remaining

Contractual

Range of Prices Number Life(1) Price(1) Number Price(1)

$3.50 - $18.19 .............................. 6,080 5.2 $14.94 3,125 $14.48

$18.50 - $26.88 ............................. 6,502 6.7 24.39 2,231 22.83

$28.13 - $54.25 ............................. 4,720 9.0 46.26 570 35.54

17,302 6.8 $27.03 5,926 $19.65

(1) Weighted-average

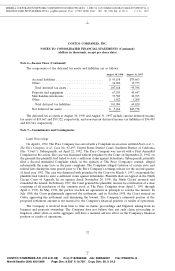

Note 5—Retirement Plans

The Company has a 401(k) Retirement Plan which is available to all U.S. employees who have one

year or more of service, except California union employees. The plan allows pre-tax deferral against which

the Company matches 50% of the first one thousand dollars of employee contributions. In addition, the

Company will provide each eligible participant a contribution based on salary and years of service. The

30

9 C Cs: 5270