Costco 1998 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM CPICARD // 3-DEC-98 18:50 DISK004:[98SEA7.98SEA2097]DW2097A.;6

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 200D*/ 420D Foot: 0D/ 0D VJ R Seq: 4 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DW2097A.;6

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

COSTCO COMPANIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 1—Summary of Significant Accounting Policies (Continued)

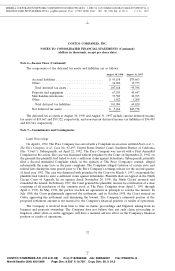

ratable recognition over the one year life of the membership) had been used in fiscal 1998, net income

would have been $444,451, or $1.96 per share (diluted). The Company has decided to make this change in

anticipation of the issuance of a new Securities and Exchange Commission (SEC) Staff Accounting

Bulletin regarding the recognition of membership fee income. However, the SEC has not yet taken a

position as to whether ratable recognition over the one year life of the membership is the appropriate

method for the Company.

The change to the deferred method of accounting for membership fees will result in a one-time, non-

cash, pre-tax charge of approximately $197,000 ($118,000 after-tax, or $.50 per share) to reflect the

cumulative effect of the accounting change as of the beginning of fiscal 1999 and assuming that member-

ship fee income is recognized ratably over the one year life of the membership. This charge is not expected

to have a material effect on the Company’s financial condition, cash flows or ongoing operating results.

Foreign Currency Translation

The accumulated foreign currency translation relates to the Company’s consolidated foreign opera-

tions as well as its investment in the Price Club Mexico joint venture (prior to the 1998 calendar year).

Foreign currency translation is determined by application of the current rate method and included in the

determination of consolidated stockholders’ equity at the respective balance sheet dates.

Because cumulative inflation in Mexico exceeded 100% in the three-year calendar period 1994-1996, a

highly inflationary accounting treatment has been required for Mexico since the beginning of calendar year

1997. Foreign currency translation gains or losses are reflected in the Statement of Income rather than as

an adjustment to stockholders’ equity for fiscal 1998.

Income Taxes

The Company accounts for income taxes under the provisions of Statement of Financial Accounting

Standards (SFAS) No. 109, ‘‘Accounting for Income Taxes.’’ That standard requires companies to account

for deferred income taxes using the asset and liability method.

Supplemental Disclosure of Non-Cash Activities

Fiscal 1998 Non-Cash Activities

• None.

Fiscal 1997 Non-Cash Activities

• In December 1996, approximately $159,400 principal amount of the $285,100, 63⁄4% Convertible

Subordinated Debentures were converted into approximately 7.1 million shares of Costco Common

Stock as a result of a call for redemption of the Convertible Subordinated Debentures.

• In January 1997, approximately $142,700 principal amount of the $179,300, 51⁄2% Convertible

Subordinated Debentures were converted into approximately 6.0 million shares of Costco Common

Stock as a result of the call for redemption of the Convertible Subordinated Debentures.

24

9 C Cs: 52289