Computer Associates 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Computer Associates annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Driving Customer

Success in the

Application Economy

Annual Report 2015

Table of contents

-

Page 1

Driving Customer Success in the Application Economy Annual Report 2015 -

Page 2

... award-winning advanced authentication technologies. We have extended key offerings this year in Application Program Interface (API) management and mobile app analytics that have made us an industry leader. And we are helping some of the world's largest companies process hundreds of millions of... -

Page 3

... some of the world's largest companies process hundreds of millions of API transactions a day." We are also thinking about tomorrow's challenges. In our labs, we are building software to help customers master the unwired enterprise, ambient data and API-assembled applications of the future - while... -

Page 4

... file number 1-9247 CA, Inc. (Exact name of registrant as specified in its charter) Delaware (State or Other Jurisdiction of Incorporation or Organization) 13-2857434 (I.R.S. Employer Identification Number) 520 Madison Avenue, New York, New York (Address of Principal Executive Offices) 1-800... -

Page 5

... Item 9A. Controls and Procedures Item 9B. Other Information 23 24 24 52 52 52 52 53 Part III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item... -

Page 6

This Annual Report on Form 10-K (Form 10-K) contains certain forward-looking information relating to CA, Inc. (which we refer to as the ''Company,'' ''Registrant,'' ''CA Technologies,'' ''CA,'' ''we,'' ''our,'' or ''us'') that is based on the beliefs of, and assumptions made by, our management as ... -

Page 7

...↩: Application Programing Interface (API) Management Solutions, Q3 2014.*'' The solutions evaluated for the report included CA API Gateway (formerly CA Layer 7 API Gateway), CA Mobile API Gateway (formerly CA Layer 7 Mobile Access Gateway) and CA API Developer Portal (formerly CA Layer 7 Portal... -

Page 8

... through Identity and Access Management, Data-centric Security and Application Programing Interface (API) Management. Throughout each of these areas we are focused on developing solutions that are easy to use, easy to implement, and have favorable total cost of ownership. • Addressing shifts... -

Page 9

... CA Service Management solutions help organizations improve service quality and end-user productivity by automating service requests, improving operational processes and mitigating software compliance risk. • API Management solutions help organizations seamlessly and securely connect valuable data... -

Page 10

... and health care institutions. No single customer accounted for 10% or more of our total revenue for fiscal 2015, 2014 or 2013. Approximately 8% of our total revenue backlog at March 31, 2015, is associated with multi-year contracts signed with the U.S. federal government and other U.S. state and... -

Page 11

...on research conducted across global markets, we believe that CA Technologies' new brand positioning, ''Business, rewritten by software,↩'' is resonating, and that marketing campaigns are positively influencing key reputation metrics and future consideration of CA Technologies in purchase decisions... -

Page 12

... support CA Technologies software. We operate principal research and development centers in Islandia, New York; Framingham, Massachusetts; Santa Clara, California; Prague, Czech Republic; as well as Hyderabad and Bangalore, India. In fiscal 2015, research and development focused on three main areas... -

Page 13

... of our products and technology, we are not aware of any single patent that is essential to us or to any of our reportable segments. The source code for our products is protected both as trade secrets and as copyrighted works. Our customers do not generally have access to the source code for our... -

Page 14

...traded on The NASDAQ Global Select Market tier of The NASDAQ Stock Market LLC under the symbol ''CA.'' Our corporate website address is www.ca.com. All filings we make with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our... -

Page 15

... Accounting Officer, and our directors are expected to act on behalf of CA Technologies consistently with the underlying ethical principles of the Code). These documents can also be obtained in print by writing to our Corporate Secretary, CA, Inc., 520 Madison Avenue, New York, New York 10022... -

Page 16

... products and our business to changes introduced by hardware manufacturers and system software developers, there can be no assurance that we will be able to do so in the future. Failure to deliver distinctive management functionality, beyond the basic functionality now being bundled by many hardware... -

Page 17

...our control and other business risks associated with non-U.S. operations can affect our business in unpredictable ways. International revenue has historically represented a significant percentage of our total worldwide revenue. Success in selling and developing our products outside the United States... -

Page 18

... could materially adversely affect our business, financial condition, operating results and cash flow. Our products are designed to improve the productivity and efficiency of our customers' information processing resources. However, a general slowdown in the global economy, or in a particular region... -

Page 19

... and debarment. Approximately 8% of our total revenue backlog at March 31, 2015 is associated with multi-year contracts signed with the U.S. federal government and other U.S. state and local government agencies. These contracts are generally subject to annual fiscal funding approval and may be... -

Page 20

... of electronic data and records, and report financial and management information, including the filing of our quarterly or annual reports with the SEC, on a timely and accurate basis. Failure to properly or adequately address these issues, as well as to manage and protect our infrastructure... -

Page 21

... the failure of another supplier's products. As a result of the foregoing, we could experience: • Loss of or delay in revenue and loss of market share; • Loss of customers, including the inability to obtain repeat business with existing key customers; • Damage to our reputation; • Failure to... -

Page 22

...customers to experience long sales cycles, which for us is driven in part by the varying terms and conditions of our software contracts. These factors can make it difficult for us to predict sales and cash flow on a quarterly basis. Any failure or delay in executing new or renewed license agreements... -

Page 23

... adversely affect our business, financial condition, operating results and cash flow. Failure by us to effectively execute on our announced workforce reductions, workforce rebalancing and facilities consolidations could result in total costs that are greater than expected or revenues that are less... -

Page 24

...Resources Corporation, a software and SaaS technology provider, from June 2006 to August 2010. Adam Elster, 47, has been the Company's Executive Vice President and Group Executive, Worldwide Sales and Services since January 2014. He is responsible for all revenue for the Company and for building and... -

Page 25

... from August 2011 to February 2012, General Manager, CA Services, Support and Education from June 2011 to August 2011, Corporate Senior Vice President and General Manager, CA Services from November 2009 to June 2011, and Senior Vice President, Area Sales Manager for the Eastern United States, from... -

Page 26

...of fiscal 2015: Issuer Purchases of Equity Securities AVERAGE PRICE PAID PER SHARE TOTAL NUMBER OF SHARES PURCHASED AS PART OF PUBLICLY ANNOUNCED PLANS OR PROGRAMS APPROXIMATE DOLLAR VALUE OF SHARES THAT MAY YET BE PURCHASED UNDER THE PLANS OR PROGRAMS PERIOD TOTAL NUMBER OF SHARES PURCHASED (in... -

Page 27

...world's leading providers of information technology (IT) management software and solutions. Our solutions help organizations of all sizes plan, develop, manage, and secure applications and IT infrastructure that increase productivity and enhance competitiveness in their businesses. We do this across... -

Page 28

...buying and deployment process for our customers. This customer focus allows us to better align marketing and sales resources with how customers want to buy. We have also implemented broad-based business initiatives to drive accountability for sales execution. In the past fiscal year, CA Technologies... -

Page 29

... with generally accepted accounting principles in the United States of America (GAAP). Revenue is reported net of applicable sales taxes. Under our business model, we offer customers a wide range of licensing options. For traditional, on-premise licensing, we typically license to customers either... -

Page 30

... commissions and personnel-related expenses. • Services revenue decreased as a result of a decrease in the size and number of services engagements during fiscal 2015, including non-core engagements with government customers that are not directly related to our software product sales. We have also... -

Page 31

... performance indicators with those of our competitors. The following is a summary of the performance indicators that management uses to review performance: YEAR ENDED MARCH 31, 2015(1) 2014(1) (dollars in millions) CHANGE PERCENT CHANGE Total revenue Income from continuing operations Cash provided... -

Page 32

... license agreements that were in effect during the period, generally including maintenance that is bundled with and not separately identifiable from software usage fees or product sales, (ii) maintenance agreements associated with providing customer technical support and access to software... -

Page 33

...license agreements recorded during the same period. Total Revenue Backlog: Total revenue backlog represents the aggregate amount we expect to recognize as revenue in the future as either subscription and maintenance revenue, professional services revenue or software fees and other revenue associated... -

Page 34

... 2014/2013 Revenue: Subscription and maintenance Professional services Software fees and other Total revenue Expenses: Costs of licensing and maintenance Cost of professional services Amortization of capitalized software costs Selling and marketing General and administrative Product development and... -

Page 35

... REVENUE FOR THE YEAR ENDED MARCH 31, 2015 2014 2013 Revenue: Subscription and maintenance Professional services Software fees and other Total revenue Expenses: Costs of licensing and maintenance Cost of professional services Amortization of capitalized software costs Selling and marketing General... -

Page 36

... training. Professional services revenue for fiscal 2015 decreased compared with fiscal 2014 primarily due to a decrease in the size and number of professional services engagements during the first half of fiscal 2015, including non-core engagements with government customers that are not directly... -

Page 37

... of $55 million relating to purchased software. Costs of Licensing and Maintenance Costs of licensing and maintenance include technical support, royalties, and other manufacturing and distribution costs. The costs of licensing and maintenance for fiscal 2015 were generally consistent with fiscal... -

Page 38

... amortization from assets acquired from recent acquisitions. Selling and Marketing Selling and marketing expenses include the costs relating to our sales force, channel partners, corporate and business marketing and customer training programs. For fiscal 2015, the decrease in selling and marketing... -

Page 39

... 2016. The increase in the effective tax rate for fiscal 2015, compared with fiscal 2014, resulted primarily from the favorable resolutions of uncertain tax positions in fiscal 2014 relating to the completion of the examination of our U.S. federal income tax returns for the tax years ended March... -

Page 40

... to the list price of the products); (2) allocations included within internal contract approval documents; or (3) the value for individual software products as stated in the customer contract. The price for the implementation, consulting, education and training services is separately stated in the... -

Page 41

...portion of selling and marketing costs, licensing and maintenance costs, product development costs, general and administrative costs and amortization of the cost of internally developed software. Allocated segment costs primarily include indirect and non-segment-specific direct selling and marketing... -

Page 42

...to a decrease in the size and number of professional services engagements during fiscal 2015 in connection with lower new product sales and a reduction in non-core engagements with government customers that are not directly related to our software product sales. Subscription and Maintenance Bookings... -

Page 43

... the aforementioned contract renewal with a large system integrator in fiscal 2014. New Product Sales by Geography: Total new product sales in fiscal 2015 compared with the year-ago period decreased in the United States and the Latin America region. Total new product sales in the United States were... -

Page 44

... mature product lines, partially offset by an increase in sales of recently acquired products. Total Bookings by Geography: Total bookings in fiscal 2014 compared with the year-ago period increased in all regions, except in the Asia Pacific Japan region. The increase in the Europe, Middle East and... -

Page 45

...our subscription and maintenance agreements, customers generally make installment payments over the term of the agreement, often with at least one payment due at contract execution, for the right to use our software products and receive product support, software fixes and new products when available... -

Page 46

...provide maintenance and unspecified future software products as part of the agreement terms. We can estimate the total amounts to be billed from committed contracts, referred to as our ''billings backlog,'' and the total amount to be recognized as revenue from committed contracts, referred to as our... -

Page 47

...performance due to the high percentage of our revenue that is recognized from license agreements that are already committed and being recognized ratably. We also believe that we would need to demonstrate multiple quarters of total new product sales growth while maintaining a renewal yield in the low... -

Page 48

... for acquisitions and purchased software of $95 million...2015 was $977 million compared with $421 million in fiscal 2014. The increase was primarily due to the $500... in cash dividend payments of ...associated with the Fiscal 2014 Plan of $105 million and an increase in internally developed software... -

Page 49

..., our Board of Directors approved a stock repurchase program that authorized us to acquire up to $1 billion of our common stock. We expect to complete the program by the end of fiscal 2017. We expect to fund the program with available cash on hand and repurchase shares on the open market, through... -

Page 50

...125 million was reclassified to treasury stock. The final number of shares delivered upon settlement of the agreement was determined based on the average price of our common stock over the term of the ASR agreement. Dividends We have paid cash dividends each year since July 1990. For each of fiscal... -

Page 51

... products, including SaaS license agreements; (2) providing customer technical support (referred to as maintenance); and (3) providing professional services, such as product implementation, consulting, customer education and customer training. Software license agreements under our subscription model... -

Page 52

... Historical information, such as general collection history of multi-year software agreements; • Current customer information and events, such as extended delinquency, requests for restructuring and filings for bankruptcy; • Results of analyzing historical and current data; and • The overall... -

Page 53

... greater of the amount computed using the ratio that current gross revenues for a product bear to the total of current and anticipated future gross revenues for that product or the straight-line method over the remaining estimated economic life of the software product, generally estimated to be five... -

Page 54

...in the Notes to the Consolidated Financial Statements for a description of our material legal proceedings. New Accounting Pronouncements In May 2014, the FASB issued Accounting Standards Update No. 2014-09 (ASU 2014-09), Revenue from Contracts with Customers (Topic 606), which requires an entity to... -

Page 55

... in ''Other current assets'' in our Consolidated Balance Sheet. Foreign Exchange Risk We conduct business on a worldwide basis through subsidiaries in 45 foreign countries and, as such, a portion of our revenues, earnings and net investments in foreign affiliates is exposed to changes in foreign... -

Page 56

... the Company or any director or officer or other employee of the Company governed by the internal affairs doctrine shall be a state court located within the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction, the federal district court for the District... -

Page 57

... writing to our Corporate Secretary, at CA, Inc., 520 Madison Avenue, New York, New York 10022. Item 11. Executive Compensation. Information required by this Item that will appear under the headings ''Compensation and Other Information Concerning Executive Officers,'' ''Compensation Discussion and... -

Page 58

...27, 2007). CA, Inc. 2002 Compensation Plan for Non-Employee Directors. Deferred Prosecution Agreement, including the related Information and Stipulation of Facts. Final Consent Judgment of Permanent Injunction and Other Relief, including SEC complaint. Form of Restricted Stock Unit Certificate under... -

Page 59

... (Employment Agreement) under the CA, Inc. 2002 Incentive Plan. Program whereby certain designated employees, including the Company's Named Executive Officers, are provided with certain covered medical services, effective August 1, 2005. Amended and Restated CA, Inc. Executive Deferred Compensation... -

Page 60

... Options (Canadian employees). CA, Inc. 2012 Compensation Plan for Non-Employee Directors. Summary description of amended financial planning benefit. Employment Agreement dated December 10, 2012 between the Company and Michael P. Gregoire. CA, Inc. Change in Control Severance Policy (amended and... -

Page 61

... NUMBER FILING DATE EXHIBIT DESCRIPTION FORM EXHIBIT FILED OR FURNISHED HEREWITH 10.50* Separation Agreement and General Claims Release dated February 14, 2014 between the Company and George J. Fischer. CA, Inc. Executive Severance Policy effective May 13, 2014. Summary description of Director... -

Page 62

...BY REFERENCE EXHIBIT NUMBER FILING DATE EXHIBIT DESCRIPTION FORM EXHIBIT FILED OR FURNISHED HEREWITH 101 The following financial statements from CA, Inc.'s Annual Report on Form 10-K for the year ended March 31, 2015, formatted in XBRL (eXtensible Business Reporting Language): (i) Consolidated... -

Page 63

... Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. By: /s/ Michael P. Gregoire Michael P. Gregoire Chief Executive Officer (Principal Executive Officer) By: /s/ Richard J. Beckert... -

Page 64

... to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. * Jens Alder * Raymond J. Bromark * Gary J. Fernandes * Michael P. Gregoire * Rohit Kapoor * Jeffrey... -

Page 65

...Inc. and Subsidiaries New York, New York Annual Report on Form 10-K Item 8, Item 9A, Item 15(a)(1) and (2), and Item 15(c) List of Consolidated Financial Statements and Financial Statement Schedule Consolidated Financial Statements and Financial Statement Schedule Year ended March 31, 2015 PAGE The... -

Page 66

... therein. Also, in our opinion, CA, Inc. maintained, in all material respects, effective internal control over financial reporting as of March 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by COSO. /s/ KPMG LLP New York, New York May 8, 2015 63 -

Page 67

... payable Accrued salaries, wages and commissions Accrued expenses and other current liabilities Deferred revenue (billed or collected) Taxes payable, other than income taxes payable Deferred income taxes Total current liabilities Long-term debt, net of current portion Federal, state and foreign... -

Page 68

... amounts) 2015 2014 2013 Revenue: Subscription and maintenance Professional services Software fees and other Total revenue Expenses: Costs of licensing and maintenance Cost of professional services Amortization of capitalized software costs Selling and marketing General and administrative Product... -

Page 69

CA, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income YEAR ENDED MARCH 31, (in millions) 2015 2014 2013 Net income Other comprehensive loss: Foreign currency translation adjustments Total other comprehensive loss Comprehensive income See accompanying Notes to the Consolidated ... -

Page 70

... Net income Other comprehensive loss Comprehensive income Share-based compensation Dividends declared Release of restricted stock, exercise of common stock options, ESPP and other items Treasury stock purchased Balance at March 31, 2015 See accompanying Notes to the Consolidated Financial Statements... -

Page 71

... Investing activities from continuing operations: Acquisitions of businesses, net of cash acquired, and purchased software Purchases of property and equipment Proceeds from sale of assets Capitalized software development costs Purchases of investments Maturities of investments Decrease in restricted... -

Page 72

... fiscal year 2015, the Company sold its CA arcserve data protection solution assets (arcserve). In the fourth quarter of fiscal year 2014, the Company identified its CA ERwin Data Modeling solution assets (ERwin) as available for sale. The results of operations associated with these businesses have... -

Page 73

... agreements and also generally include maintenance; (ii) maintenance agreements associated with providing customer technical support and access to software fixes and upgrades which are separately identifiable from software usage fees or product sales; or (iii) software license agreements bundled... -

Page 74

...to the diverse customer base and geographic areas covered by operations. (k) Cash and Cash Equivalents: All financial instruments purchased with ... were maintained outside the United States at March 31, 2015 and 2014, respectively. Total interest income, which primarily relates to the Company's cash... -

Page 75

... software technology at the acquisition date. Annual amortization of purchased software products is the greater of the amount computed using the ratio that current gross revenues for a product bear to the total of current and anticipated future gross revenues for that product or the straight-line... -

Page 76

... or uncollected) is reported as deferred revenue in the liability section of the Company's Consolidated Balance Sheets. Deferred revenue (billed or collected) excludes unbilled contractual commitments executed under license and maintenance agreements that will be billed in future periods. See... -

Page 77

...of application programming interface (API) management and security software. The acquisition of Layer 7 will enable the Company to provide security and management technology to the API marketplace that complements its current identity and access management software suite. The total purchase price of... -

Page 78

.... The income from discontinued operations relating to both ERwin and the sale of arcserve for fiscal years 2015, 2014 and 2013 consisted of the following: YEAR ENDED MARCH 31, (in millions) 2015 2014 2013 Subscription and maintenance Software fees and other Total revenue Income from operations of... -

Page 79

...allowances. These balances include revenue recognized in advance of customer billings but do not include unbilled contractual commitments executed under license agreements. The components of ''Trade accounts receivable, net'' were as follows: AT MARCH 31, (in millions) 2015 2014 Accounts receivable... -

Page 80

... and amortization expense was as follows: YEAR ENDED MARCH 31, (in millions) 2015 2014 2013 Depreciation Amortization of purchased software products Amortization of internally developed software products Amortization of other intangible assets Total depreciation and amortization expense $ 71 124... -

Page 81

...recognized at March 31, 2015, the annual amortization expense over the next five fiscal years is expected to be as follows: YEAR ENDED MARCH 31, (in millions) 2016 2017 2018 2019 2020 Purchased software products Internally developed software products Other intangible assets Total $ 110 109 37 256... -

Page 82

...2015, 2014 and 2013 was $77 million, $75 million and $64 million, respectively. The maturities of outstanding debt are as follows: YEAR ENDED MARCH 31, (in millions) 2016...500 million. This option is subject to certain conditions and the agreement of the facility lenders. In April 2015...an applicable ... -

Page 83

... operating outside the United States and uses guarantees and letters of credit issued by financial institutions to guarantee performance on certain contracts. At March 31, 2015 and 2014, approximately $27 million and $49 million, respectively, of this line of credit were pledged in support of bank... -

Page 84

... as ''Other expenses (gains), net'' in the Company's Consolidated Statements of Operations. At March 31, 2015, foreign currency contracts outstanding consisted of purchase and sale contracts with a total gross notional value of approximately $298 million, and durations of less than three months. The... -

Page 85

...ENDED MARCH 31, 2015 2014 2013 Interest expense, net - interest rate swaps designated as fair value hedges Other expenses (gains), net - foreign currency contracts $ $ (8) (31) $ $ (12) (20) $ $ (12) 11 The Company is subject to collateral security...of total debt is based on quoted prices for ... -

Page 86

...On May 29, 2014, the case was unsealed. Both the DOJ and the individual plaintiff have filed amended complaints. The current complaints relate to government sales transactions under the Company's General Services Administration (GSA) schedule contract, entered into in 2002 and extended until present... -

Page 87

..., as permitted under Delaware law. Note 12 - Stockholders' Equity Stock Repurchases: On May 14, 2014, the Company's Board of Directors approved a stock repurchase program that authorized the Company to acquire up to $1 billion of its common stock. During fiscal year 2015, the Company repurchased... -

Page 88

... held by an Acquiring Person, will entitle the holder to receive, for an exercise price of $100, that number of shares of the Company's common stock (or, in certain circumstances, cash, property or other securities) having an aggregate Market Price (as determined under the Rights Agreement) equal to... -

Page 89

... compensation in the following line items in the Consolidated Statements of Operations for the periods indicated: YEAR ENDED MARCH 31, (in millions) 2015 2014 2013 Costs of licensing and maintenance Cost of professional services Selling and marketing General and administrative Product development... -

Page 90

...NUMBER OF SHARES (in millions) WEIGHTED AVERAGE EXERCISE PRICE WEIGHTED AVERAGE REMAINING CONTRACTUAL LIFE (in years) AGGREGATE INTRINSIC VALUE(1) (in millions) Vested Expected to vest(2) Total... of grant using the Black-Scholes option pricing model. The Company believes that the valuation technique... -

Page 91

... YEAR ENDED MARCH 31, 2015 2014 2013 Weighted average fair value Dividend yield Expected volatility factor(1) Risk-free interest rate(2) Expected life (in ...life is the number of years the Company estimates that options will be outstanding prior to exercise. The Company's computation of expected life... -

Page 92

...25.73 24.13 23.41 Employee Stock Purchase Plan: The Company maintains the 2012 Employee Stock Purchase Plan (ESPP) for all eligible employees. The ESPP offer period is semi-annual and allows participants to purchase the Company's common stock at 95% of the closing price of the stock on the last day... -

Page 93

...was reconciled to the tax expense computed at the U.S. federal statutory tax rate as follows: YEAR ENDED MARCH 31, (in millions) 2015 2014 2013 Tax expense at U.S. federal statutory tax rate Effect of international operations U.S. federal and state tax contingencies Domestic manufacturing deduction... -

Page 94

... for tax purposes Deductible state tax and interest benefits Other Total deferred tax assets Valuation allowances Total deferred tax assets, net of valuation allowance Deferred tax liabilities: Purchased software Depreciation Other intangible assets Internally developed software Total deferred tax... -

Page 95

... benefit is audited and finally resolved. The number of years with open tax audits varies depending on the tax jurisdiction. The Company is subject to tax audits in the following major taxing jurisdictions: • United States - federal tax years are open for years 2013 and forward; • Brazil - tax... -

Page 96

... to the list price of the products); (2) allocations included within internal contract approval documents; or (3) the value for individual software products as stated in the customer contract. The price for the implementation, consulting, education and training services is separately stated in the... -

Page 97

...operations before income taxes for fiscal year 2015: Segment profit Less: Purchased software amortization Other intangibles amortization Software development costs capitalized Internally developed software products amortization Share-based compensation expense Other expenses (gains), net(1) Interest... -

Page 98

...: (in millions) UNITED STATES EMEA(1) OTHER ELIMINATIONS TOTAL Year Ended March 31, 2015 Revenue: From unaffiliated customers Between geographic areas(2) Total revenue Property and equipment, net Total assets Total liabilities Year Ended March 31, 2014 Revenue: From unaffiliated customers Between... -

Page 99

... is allocated to a geographic area based on the location of the sale, which is generally the customer's country of domicile. No single customer accounted for 10% or more of total revenue for fiscal year 2015, 2014 or 2013. Note 18 - Profit Sharing Plan The Company maintains a defined contribution... -

Page 100

SCHEDULE II CA, Inc. and Subsidiaries Valuation and Qualifying Accounts BALANCE AT BEGINNING OF PERIOD ADDITIONS/ (DEDUCTIONS) CHARGED/ (CREDITED) TO COSTS AND EXPENSES BALANCE AT END OF PERIOD DESCRIPTION DEDUCTIONS(1) Allowance for doubtful accounts (in millions) Year ended March 31, 2015 Year... -

Page 101

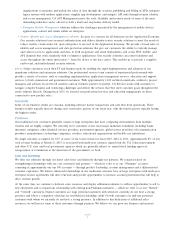

Comparison of 5 Year Cumulative Total Return* Among CA, Inc., the S&P 500 Index, and S&P Software $250 CA, Inc. S&P 500 $200 S&P Software *$100 invested on 3/31/10 in stock or index, including reinvestment of dividends. Fiscal year ending March 31. $150 $100 $50 $0 3/10 3/11 3/12 3/13 ... -

Page 102

... Executive Offices CA, Inc. 520 Madison Avenue New York, NY 10022 1-800-225-5224 Stockholder Information A copy of the Annual Report on Form 10-K, filed with the Securities and Exchange Commission, is available without charge upon written request addressed to: Investor Relations CA, Inc. 520 Madison... -

Page 103

... Michael C. Bisignano Executive Vice President, General Counsel and Corporate Secretary Guy A. Di Lella Chief Human Resources Ofï¬cer Adam Elster Executive Vice President and Group Executive, Worldwide Sales and Services Lauren P. Flaherty Executive Vice President and Chief Marketing Ofï¬cer Jacob... -

Page 104

..., please visit ca.com Copyright © 2015 CA, Inc. All rights reserved. All trademarks, trade names, service marks and logos referenced herein belong to their respective companies. CA Technologies continues to pursue new discoveries that advance sustainability for the company, our customers and the...