Comfort Inn 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Comfort Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources

Net cash provided by operating activities was $115.5 million for the year ended December 31, 2003,

representing an increase of $16.5 million from $99.0 million for the year ended December 31, 2002. The increase

in cash provided by operating activities was primarily due to improvements in operating income and repayments

related to the marketing and reservation receivable.

During 2002 and 2001, the Company realigned its corporate structure to increase its strategic focus on

delivering value-added services and support to franchisees, including centralizing the Company’s franchise

service and sales operations, consolidating its brand management functions and realigning its call center

operations. The Company recorded a $1.6 million restructuring charge in 2002 of which approximately $0.9

million and $0.4 million was paid in 2003 and 2002, respectively. Approximately $0.3 million of the expense

was related to stock compensation for severed employees and was credited directly to additional paid-in capital.

The restructuring was initiated and completed in 2002. The Company recorded a $5.9 million restructuring

charge in 2001 of which approximately $0.9 million of the expense was related to stock compensation for

severed employees and was credited directly to additional paid-in capital. Through December 31, 2002 the

Company paid $4.4 million and during 2003 the Company paid an additional $0.5 million related to this

restructuring. As a result of these payments, the Company’s obligations related to the 2001 restructuring were

satisfied and approximately $0.1 million was recorded as a reduction of selling, general and administrative

expense in 2003. As of December 31, 2003, the Company’s obligations related to the 2002 and 2001

restructurings were satisfied resulting in no liability remaining at December 31, 2003. The restructuring charges

for 2002 and 2001 are included in selling, general and administrative expenses in the accompanying consolidated

statements of income.

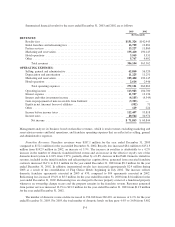

Net cash repayments related to marketing and reservation activities totaled $24.7 million and $17.2 million

during the years ended December 31, 2003 and 2002, respectively. The net repayments are associated with cost

reductions from restructured operations, growth in fees from normal operations and increases in property and

yield management fees. The Company expects marketing and reservation activities to generate positive cash

flows between $18.5 million and $21.0 million in 2004.

Cash (used in) provided by investing activities for the years ended December 31, 2003, 2002 and 2001, was

$27.8 million, ($14.7 million) and $87.7 million, respectively. During the years ended December 31, 2003, 2002

and 2001, capital expenditures totaled $8.5 million, $12.2 million and $13.5 million, respectively. Capital

expenditures include the installation of system-wide property and yield management systems, upgrades to

financial and reservation systems, computer hardware and renovations to the Company’s corporate headquarters

(including a franchisee learning and training center). During 2003, the Company received a cash payment of

$44.7 million from Sunburst related to the prepayment of a note receivable due to the Company. During 2003,

approximately $4.5 million of interest income related to this note was included in net income. As a result of the

prepayment, no interest income related to this note will be realized in future periods.

Financing cash flows relate primarily to the Company’s borrowings under its credit lines and treasury stock

purchases. In June 2001, the Company entered into a five-year $265 million competitive advance and multi-

currency credit facility (“New Credit Facility”). The New Credit Facility provides for a term loan of $115 million

and a revolving credit facility of $150 million. As of December 31, 2003, the Company had $81.5 million of term

loans and $62.0 million of revolving loans outstanding pursuant to this facility. The term loan is payable over the

next four years, $21.1 million of which is due in 2004. The New Credit Facility includes customary financial and

other covenants that require the maintenance of certain ratios including maximum leverage and interest coverage

and restrict the Company’s ability to make certain investments, incur debt and dispose of assets. Borrowings

under the credit facility bear interest at one of several rates, at the option of the Company, including LIBOR plus

.60% to 2.0%, based upon the credit rating of the Company and the loan type. In addition, the Company has the

option to request participating banks to bid on loan participation at lower rates than those contractually provided

by the credit facility. The credit facility requires the Company to pay annual fees ranging, based upon the credit

F-8