ComEd 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

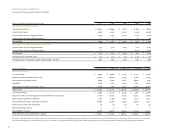

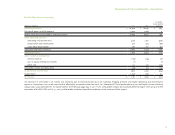

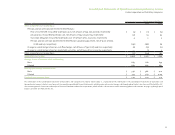

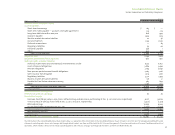

Discussion of Financial Results - Exelon

Operating revenue net of purchased power and fuel expense decreased by $413 million primarily related to a decrease in competitive transition charges (CTC) recoveries

at PECO of $995 million as a result of the end of the transition period on Dec. 31, 2010. This impact on Exelon’s operating income was partially offset by decreased CTC

amortization expense discussed below. Mark-to-market losses of $288 million in 2011 from Generation’s hedging activities compared to $86 million in mark-to-market

gains in 2010 also had an unfavorable impact on Generation’s operating results. In addition, Generation’s operating revenue net of purchased power and fuel expense

decreased by $534 million in the Midwest due to decreased realized margins in 2011 for volumes previously sold under the 2006 ComEd auction contracts and increased

nuclear fuel costs. Partially offsetting these unfavorable impacts were increased operating revenues net of purchased power and fuel expense at Generation of $847

million in the Mid-Atlantic due to increased margins on volumes previously sold under Generation’s power purchase agreement (PPA) with PECO, which expired on

Dec. 31, 2010, and increased operating revenues net of purchased power and fuel expense of $201 million in the South and West primarily driven by the performance

of Exelon’s generating units during extreme weather events that occurred in Texas in February and August of 2011. Operating revenue net of purchased power and

fuel expense in the South and West also was impacted favorably by additional revenues from Exelon Wind, which was acquired in December 2010, and higher realized

margins due to overall favorable market conditions. The decrease in revenue net of purchased power and fuel expense also was partially offset by the 2010 impact of

the impairment charge of certain emission allowances, as well as compensation under the reliability-must-run rate schedule received in 2011. ComEd’s and PECO’s

operating revenues net of purchased power and fuel expense increased by $89 million and $155 million, respectively, as a result of improved pricing primarily due to

the new electric distribution rates effective June 1, 2011, at ComEd and new electric and natural gas distribution rates effective Jan. 1, 2011, at PECO. ComEd’s operating

revenues also increased by $29 million as a result of increased ComEd distribution revenue pursuant to the Illinois Energy Infrastructure Modernization Act (EIMA), which

became effective in the fourth quarter of 2011.

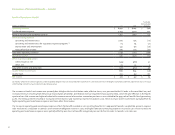

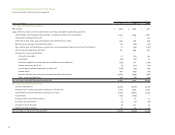

Operating and maintenance expense increased by $596 million in 2011 primarily as a result of increased labor, other benefits, contracting and materials expenses

of $241 million, including Exelon Wind, $88 million of costs related to the acquisitions of Wolf Hollow, Antelope Valley and the proposed merger with Constellation

and a $74 million increase in nuclear refueling outage costs, including the co-owned Salem plant. Exelon’s results also were affected by a $37 million increase in

uncollectible accounts expense at ComEd, principally due to the approval of the recovery rider mechanism by the Illinois Commerce Commission (ICC) in 2010. The

increase in operating and maintenance expense also was attributable to higher storm costs in the ComEd and PECO service territories of $70 million and $13 million,

respectively, which were partially offset at ComEd by a credit of $55 million, net of amortization, for the allowed recovery of certain 2011 storm costs pursuant to EIMA.

These costs were partially offset by one-time net benefits of $32 million to re-establish plant balances and to recover previously incurred costs related to Exelon’s

2009 restructuring plan pursuant to the 2010 ComEd Rate Case order recorded in the second quarter of 2011.

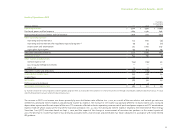

Depreciation and amortization expense decreased by $740 million primarily due to a decrease in CTC amortization expense at PECO of $885 million resulting from

the end of the transition period on Dec. 31, 2010, partially offset by increased depreciation expense primarily due to additional plant placed in service and the

acquisition of Exelon Wind.

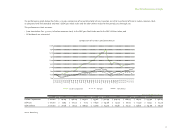

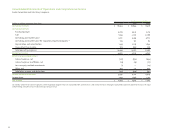

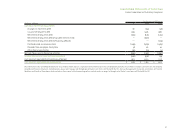

Exelon’s results were favorably impacted by decreased interest expense of $91 million primarily due to the impact of the 2010 remeasurement of uncertain income

tax positions related to the 1999 sale of ComEd’s fossil generating assets and CTCs collected by PECO, which resulted in interest expense of $59 million and $36 million,

respectively, in 2010. In addition, in 2011, Exelon recorded interest income and tax benefits of $46 million, net of tax including the impact on the manufacturer’s

deduction, due to the 2011 nuclear decommissioning trust (NDT) fund special transfer tax deduction. The decrease in interest expense was partially offset by higher

interest expense at Generation and ComEd due to higher outstanding debt balances. Exelon’s results also were significantly affected by unrealized losses on NDT

funds of $4 million in 2011 (compared to unrealized gains of $104 million in 2010) for Non-Regulatory Agreement Units as a result of unfavorable market performance.

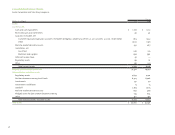

Exelon’s results for the year ended Dec. 31, 2011, were favorably impacted by certain prior year income tax-related matters. In 2010, Exelon recorded a $65 million

(after-tax) charge to income tax expense as a result of health care legislation passed in March 2010 that includes a provision that reduces the deductibility of retiree

prescription drug benefits for Federal income tax purposes. This amount was partially offset by a non-cash charge of $29 million (after-tax) recorded at Exelon in

2011 for the remeasurement of deferred taxes at higher corporate tax rates pursuant to the Illinois tax rate change legislation.