Cogeco 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Cogeco Cable Inc. 2004 7

Competitiveness of the Offering

The distribution market for broadcasting and HSI services remains

competitive. Cogeco Cable’s management regularly evaluates

and adjusts its prices in accordance with market trends. According

to Cogeco Cable’s management, the upward trend towards

standardization of retail prices applied by competitors, who must

eventually strengthen their financial performance, should hold

steady over the long-term, but price reductions for individual

services or bundled services may intervene in the short-term upon

the initiative of one or more competitors. Future adjustments to

Cogeco Cable’s retail and bundled services prices will reflect the

need to maintain the Corporation’s competitive position in its

markets, the need to generate a return on its operations, as well

as the need to maintain the superior quality of services offered

by Cogeco Cable.

Capital Management

A capital committee, comprised of the President and Chief

Executive Officer, the Vice President, Finance and Chief Financial

Officer, the Vice President, Engineering and Development as

well as the Vice President, Marketing and Sales, establishes the

Corporation’s investment strategy and frequently examines the

allocation of capital. Projects aligned with our strategy and pro-

viding acceptable risk-adjusted return on investment are generally

prioritized. Return on investment is assessed giving consideration

to the expected additional Operating Income as well as cost savings.

These analyses are carried out on a case-by-case basis and by

individually affected cable systems, if required.

Expansion Through Acquisitions

To increase the Corporation’s value and returns, Cogeco Cable

strives to acquire, at attractive prices, cable networks that are

adjacent to currently serviced zones, and that serve a significant

number of customers in non-adjacent territories.

Anticipated Results of these Strategies

The above-described strategies should result in increased prof-

itability and reduced indebtedness, as measured according to the

following criteria. These criteria are described in greater detail in

“Fiscal 2005 Financial Guidelines” on page 24:

•

Cogeco Cable expects to increase its Operating Income between

8% and 9%, compared to 16% in 2004 due to lower RGU growth

and price increases compared to fiscal 2004.

•

The Corporation estimates that it will generate Free Cash Flow

between $45 million and $50 million, compared to $43.5 million

in fiscal 2004. The increase will stem primarily from growth in

Operating Income. A significant portion of the Free Cash Flow

will be applied to reduce indebtedness.

•

RGUs should grow by 5% to 6% compared to the 7% increase

experienced in 2004. As penetration of HSI and digital services

increases, the demand for these offerings should diminish

.

Cable Networks

Digital and VOD services are available to 98% and 86% of house-

holds respectively and 87% of households passed are served by

a two-way cable plant. Cogeco Cable’s fiber optic network extends

over 7,500 kilometres and includes 77,500 kilometres of optical

fiber. Cogeco Cable deployed optical fiber to nodes serving clusters

of typically 1,500 households, with many fibers per node in most

cases, which allows the Corporation to further extend the fiber

to smaller clusters of approximately 500 to 1,000 homes rapidly

with relative ease. Node splitting leads to further improvement

in the quality and reliability of services and allows for increasing

traffic of two-way services such as HSI and VOD.

Cogeco Cable has completed the conversion of its IP platform

to the DOCSIS 1.1 standard (Data Over Cable Service Interface

Specifications). DOCSIS 1.1 allows the prioritisation of the signal

packets that must be transmitted in real time, so as to ensure a

continuous transmission flow. Furthermore, DOCSIS 1.1 enables

encryption in the local loop and eases doubling of upstream

throughput. Approximately 50% of all cable modems are currently

operating in a DOCSIS 1.1 mode, and this percentage is growing

as all the new modems are DOCSIS 1.1 and are upgradeable

to DOCSIS 2.0 when deemed necessary. DOCSIS 2.0 will allow for

higher speeds and capacity in the return path, thus providing very

high speed symmetrical services that are particularly well suited

for commercial customer applications; it is also more robust,

allowing for the use of portions of the return path spectrum

that are

normally not useable in a DOCSIS 1.1 mode.

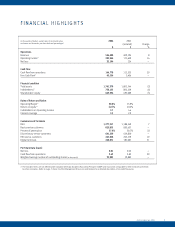

Key Performance Indicators

Cogeco Cable is dedicated to increasing shareholder value and

consequently focuses on optimizing profitability while efficiently

managing its use of capital without jeopardizing future growth.

The following key performance indicators are closely monitored to

ensure that business strategies and objectives are closely aligned

with shareholder value creation. The key performance indicators

are not measurements in accordance with GAAP and should not

be considered an alternative to other measures of performance

in accordance with GAAP.

Income Before Income Taxes Per Home Passed

and Return on Equity

Income before income taxes per home passed provides key

insights on how Cogeco Cable maximizes the value of its fran-

chises. Excluding income taxes from the profitability measure

removes an often volatile and non-controllable factor. The “per

home passed” concept measures Cogeco Cable’s effectiveness

in improving profitability in its franchised areas.