Cobra 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Cobra annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ANNUAL REPORT 11

09 10 11 12 13

Percent

Increase

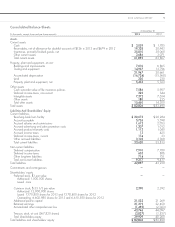

(in thousands, except per share amounts) 2013 2012 (Decrease)

Operating Data

Net sales $ 111,237 $118,906 (6.4 ) %

Gross profit 30,289 34,528 (12.3 ) %

(Loss) earnings from operations (1,699 ) 3,292 (151.6 ) %

Interest expense (778 ) (1,036 ) (24.9 ) %

Other income 1,280 1,022 25.2 %

Net (loss) earnings (1,140 ) 3,170 (136.0 ) %

Net (loss) earnings per common share:

Basic $ (0.17 ) $ 0.48 (135.4 ) %

Diluted (0.17 ) 0.48 (135.4 ) %

EBITDA As Defined* $ 901 $ 7,153 (87.4 ) %

Gross margin 27.2% 29.0% (6.2 ) %

SG&A as a percentage of net sales 28.8% 26.3% 9.5 %

As of December 31:

Total assets $ 82,806 $ 83,490 (0.8 ) %

Bank debt 20,673 20,284 1.9 %

Shareholders’ equity 39,909 40,260 (0.9 ) %

Book value per share $ 6.04 $ 6.09 (0.8 ) %

Shares outstanding 6,603 6,611 (0.1 ) %

* This amount is considered a “non-GAAP” financial measure under Securities and Exchange Commission rules. As required, a reconciliation of this financial

measure to the comparable GAAP measure is provided on page 11 of this Summary Annual Report.

FINANCIAL HIGHLIGHTS

Table of Contents

01 Financial Highlights

02 Shareholders’ Letter

04 The Year in Review

08 Consolidated Statements of Operations

09 Consolidated Balance Sheets

10 Consolidated Statements of Cash Flows

11 Quarterly Financial Data & EBITDA

12 Five–Year Financial Summary

13 Corporate Information

Net Sales

(in thousands)

$105,229

EBITDA as Defined

(in thousands)

09 10 11 12 13

Book Value

Per Share

09 10 11 12 13

$110,520

$123,259 $118,906

$111,237

$857 $901

$6,166

$7,853

$7,153

$4.96 $5.13

$5.58

$6.09 $6.04