Cisco 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Borrowings

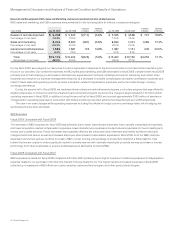

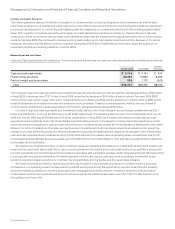

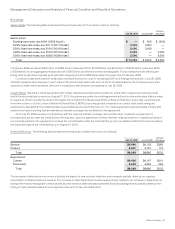

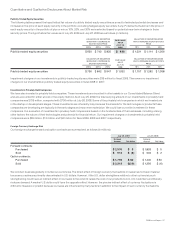

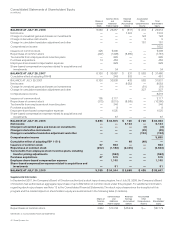

Senior Notes The following table summarizes the principal amount of our senior notes (in millions):

July 25, 2009 July 26, 2008

Increase

(Decrease)

Senior notes :

Floating-rate notes, due 2009 (“2009 Notes”) $—$ 500 $ (500)

5.25% fixed-rate notes, due 2011 (“2011 Notes”) 3,000 3,000 —

5.50% fixed-rate notes, due 2016 (“2016 Notes”) 3,000 3,000 —

4.95% fixed-rate notes, due 2019 (“2019 Notes”) 2,000 — 2,000

5.90% fixed-rate notes, due 2039 (“2039 Notes”) 2,000 — 2,000

Total $ 10,000 $ 6,500 $ 3,500

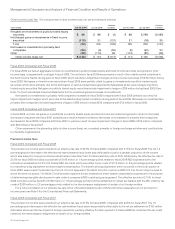

In February 2009, we issued $2.0 billion of 4.95% senior notes due 2019 (“2019 Notes”), and $2.0 billion of 5.90% senior notes due 2039

(“2039 Notes”), for an aggregate principal amount of $4.0 billion, as reflected in the preceding table. The proceeds from the offering are

being used for general corporate purposes after repaying in full the 2009 Notes when they were due in February 2009.

Our senior notes were rated A1 by Moody’s Investors Service, Inc. and A+ by Standard & Poor’s Ratings Services as of July 25, 2009.

Interest is payable semi-annually on each class of the senior fixed-rate notes, each of which is redeemable by the Company at any time,

subject to a make-whole premium. We were in compliance with all debt covenants as of July 25, 2009.

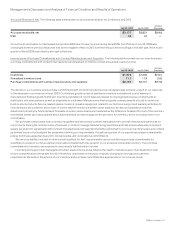

Credit Facility We have a credit agreement with certain institutional lenders that provides for a $2.9 billion unsecured revolving credit

facility that is scheduled to expire on August 17, 2012. Any advances under the credit agreement will accrue interest at rates that are equal

to, based on certain conditions, either (i) the higher of the Federal Funds rate plus 0.50% or Bank of America’s “prime rate” as announced

from time to time, or (ii) the London Interbank Offered Rate (“LIBOR”) plus a margin that is based on our senior debt credit ratings as

published by Standard & Poor’s Ratings Services and Moody’s Investors Service, Inc. The credit agreement requires that we comply with

certain covenants including that we maintain an interest coverage ratio as defined in the agreement.

As of July 25, 2009, we were in compliance with the required interest coverage ratio and the other covenants, and we had not

borrowed any funds under the credit facility. We may also, upon the agreement of either the then-existing lenders or of additional lenders

not currently parties to the agreement, increase the commitments under the credit facility by up to an additional $2.0 billion and/or extend

the expiration date of the credit facility up to August 15, 2014.

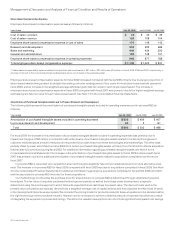

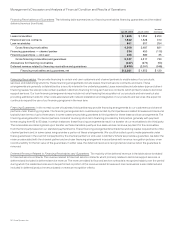

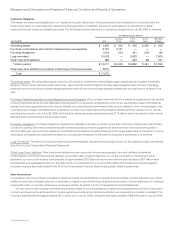

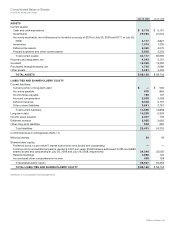

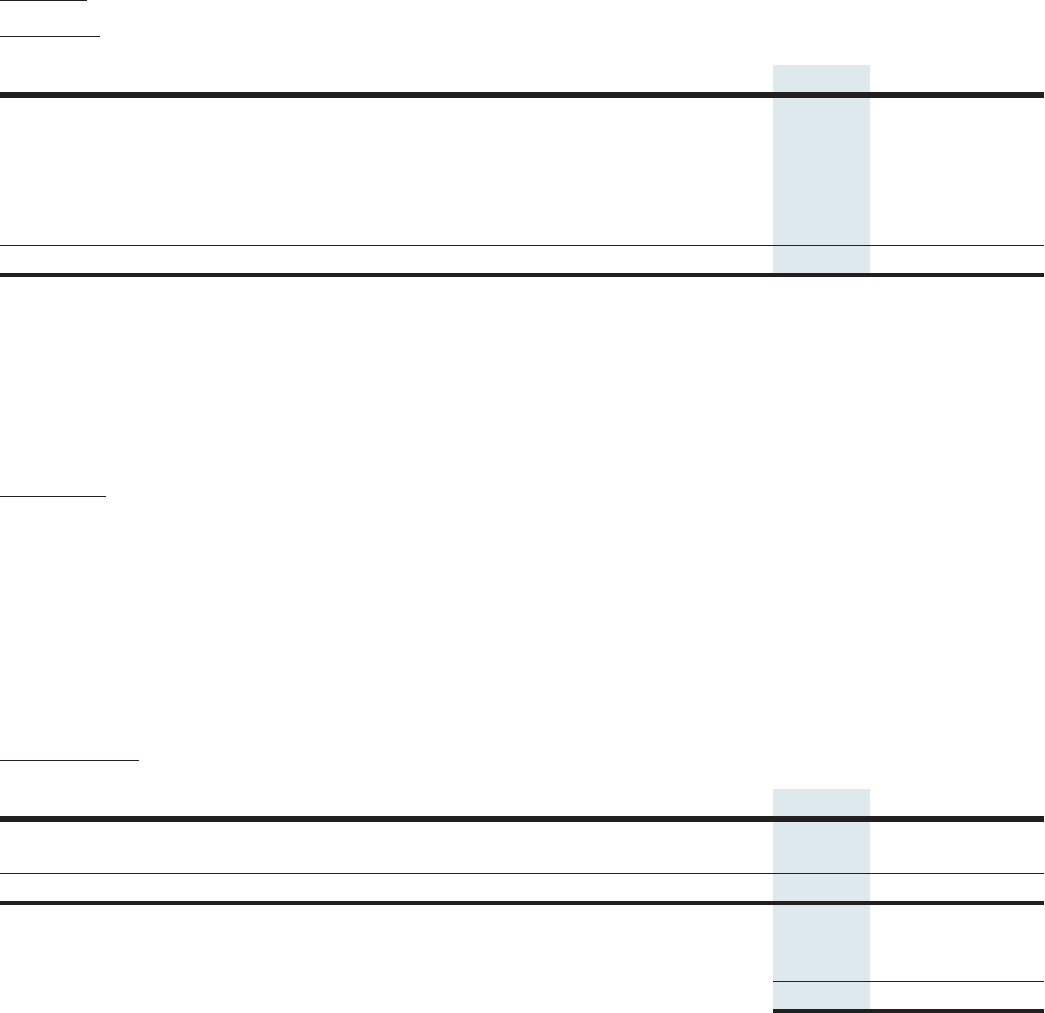

Deferred Revenue The following table presents the breakdown of deferred revenue (in millions):

July 25, 2009 July 26, 2008

Increase

(Decrease)

Service $6,496 $6,133 $363

Product 2,897 2,727 170

Total $9,393 $8,860 $533

Reported as:

Current $6,438 $6,197 $241

Noncurrent 2,955 2,663 292

Total $9,393 $8,860 $533

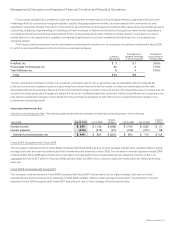

The increase in deferred service revenue reflects the impact of new contract initiations and renewals, partially offset by an ongoing

amortization of deferred service revenue. The increase in deferred product revenue was primarily related to an increase in shipments not

having met revenue recognition criteria as well as other revenue deferrals associated with financing arrangements, partially offset by the

timing of cash receipts related to unrecognized revenue from two-tier distributors.

2009 Annual Report 33