Cisco 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

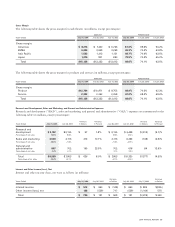

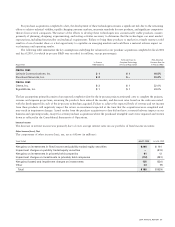

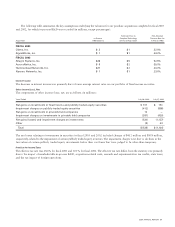

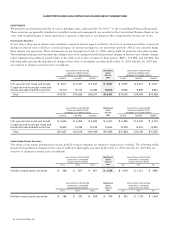

A summary of the accounting of the consolidation under FIN 46(R) and the subsequent purchase of Andiamo, after stock price

related adjustments, is as follows (in millions):

Amount

Cumulative effect of accounting change, net of tax benefit of $5 $567

Variable stock-based compensation 58

Deferred stock-based compensation 90

Net assets 7

Total $722

DISCUSSION OF FISCAL 2003 AND 2002

The following discussion of fiscal 2003 compared with fiscal 2002 should be read in conjunction with the section of this report entitled

“Financial Data for Fiscal 2004, 2003, and 2002.”

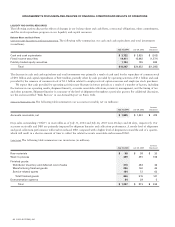

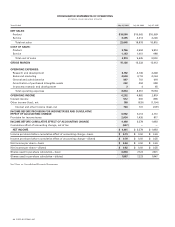

Net Sales

The decrease in net product sales was due to the impact of a combination of a challenging global economic environment, geopolitical

issues, and constraints on information technology-related capital spending, particularly with respect to our service provider customers.

The increase in service revenue was primarily due to increased technical support service contract initiations and renewals associated

with product sales.

Net Product Sales by Theater

Net product sales in the United States were $7.4 billion in fiscal 2003, compared with $7.4 billion in fiscal 2002, a decrease of $69 million

or 0.9%. Net product sales in Americas International in fiscal 2003 were $759 million, compared with $858 million in fiscal 2002,

a decrease of $99 million or 11.5%. The decrease in net product sales reflected the slowdown in the United States and other economies,

overcapacity, and constraints on information technology-related capital spending, which have continued to affect both enterprise and

service provider customers, especially service provider customers. This decrease was partially offset by growth in our net product sales

to the United States federal government, which increased by approximately 20%.

Net product sales in the EMEA theater increased as incumbent service providers began deploying products and some enterprise markets

experienced modest growth. In Asia Pacific, net product sales increased due to infrastructure builds, broadband acceleration, and

investments by Asian telecom carriers. Net product sales in the Japan theater decreased due to ongoing economic challenges in the theater.

Net Product Sales by Groups of Similar Products

Net product sales related to routers decreased due to decreases in sales of midrange and low-end routers. Net product sales related to

switches increased due to increases in sales of fixed LAN and WAN switches partially offset by a decrease in sales of modular LAN switches.

Net product sales related to Advanced Technology products increased primarily due to sales of security products, which increased $160

million; sales of IP telephony products, which increased $148 million; and sales of wireless LAN products, which increased $95 million.

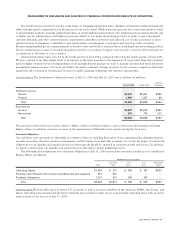

Net Service Revenue

Net service revenue increased due to increased technical support service contract initiations and renewals associated with product

sales that have resulted in a higher installed base of equipment being serviced and revenue from advanced services, which relates to

consulting support services of our technologies for specific networking needs.

Product Gross Margin

The increase in product gross margin of 8.2% was primarily due to lower manufacturing costs related to lower component costs and

value engineering partially offset by the impact of product pricing reductions and changes in the mix of products sold, which increased

product gross margin by 3.5%, and the reduction of production overhead and other manufacturing costs, which increased product

gross margin by 4.7%. The decrease in production overhead related to lower labor costs, depreciation on equipment, and facilities

charges associated with manufacturing activities. The decrease in manufacturing and other related costs was due to lower warranty,

provision for inventory, and other nonstandard costs. The provision for inventory in fiscal 2002 included an excess inventory benefit

of $422 million related to inventory previously written off that was utilized in production and sold.

2004 ANNUAL REPORT 29