Cisco 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

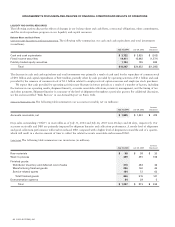

Advanced Technologies The increase in net product sales related to Advanced Technologies was primarily due to sales of products in all

six of our Advanced Technology markets. Sales of our home networking products, which increased $605 million, were related to our

acquisition of the Linksys business in the fourth quarter of fiscal 2003. An increase of $252 million in sales of security products was

primarily due to module and line card sales related to our routers and switches as customers continued to emphasize network security

in light of continuing, well-publicized worms, viruses, and other attacks. Sales of IP telephony products increased $219 million primarily

due to sales of IP phones and associated software related to the transition from analog to IP-based infrastructure. Our wireless technology

product sales increased $157 million due to sales of our access points as we gained new customers and continued deployments with

existing customers. Sales of storage area networking products, which increased $113 million, were related to our acquisition of Andiamo

Systems, Inc. (“Andiamo”) in the third quarter of fiscal 2004. See Note 3 to the Consolidated Financial Statements. The increase of

$85 million in sales of optical products was due to an increase in the sales of the Cisco ONS 15454 platform.

Factors That May Impact Net Product Sales Net product sales may be adversely affected in the future by changes in the geopolitical environment

and global economic conditions; sales cycles and implementation cycles of our products; changes in the mix of our customers between

service provider and enterprise markets; changes in the mix of direct sales and indirect sales; variations in sales channels; and final

acceptance criteria of the product, system, or solution as specified by the customer. Service provider customers typically have longer

implementation cycles, require a broader range of services, including design services, and often have acceptance provisions, which

can lead to a delay in revenue recognition. To improve customer satisfaction, we continue to focus on managing our manufacturing

lead time performance, which may result in corresponding reductions in order backlog. A decline in backlog levels could result in

more variability and less predictability in our quarter-to-quarter net sales and operating results. Net product sales may also be adversely

affected by fluctuations in demand for our products, especially with respect to Internet businesses and telecommunications service

providers, price and product competition in the communications and networking industries, introduction and market acceptance of

new technologies and products, adoption of new networking standards, and financial difficulties experienced by our customers. We

may, from time to time, experience manufacturing issues that create a delay in our suppliers’ ability to provide specific components,

resulting in delayed shipments. To the extent that manufacturing issues and any related component shortages result in delayed shipments

in the future, and particularly in periods when we and our suppliers are operating at higher levels of capacity, it is possible that revenue

for a quarter could be adversely affected if such matters are not remediated within the same quarter.

Our distributors and retail partners participate in various cooperative marketing and other programs. In addition, increasing sales

to our distributors and retail partners generally results in greater difficulty in forecasting the mix of our products and, to a certain

degree, the timing of orders from our customers. We recognize revenue to our distributors and retail partners based on a sell-through

method using information provided by them, and we maintain estimated accruals and allowances for all cooperative marketing and

other programs.

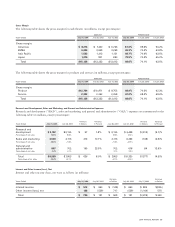

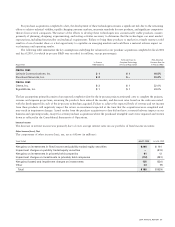

Net Service Revenue

The increase in net service revenue was primarily due to increased technical support service contract initiations and renewals associated

with higher product sales that have resulted in a larger installed base of equipment being serviced and revenue from advanced services,

which relates to consulting support services of our technologies for specific networking needs. Net service revenue is generally

deferred and, in most cases, recognized ratably over the service period, which is typically one to three years.

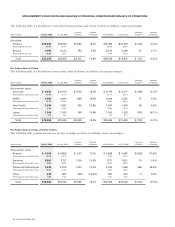

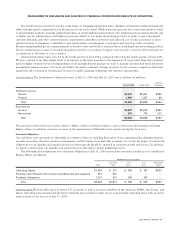

Product Gross Margin

Product gross margin decreased by 1.6% due to the following factors. Changes in the mix of products sold decreased product gross

margin by approximately 3% due to increased sales of home networking products related to our acquisition of the Linksys business and

new product introductions within our switching business. Product pricing reductions and sales discounts decreased product gross margin

by approximately 1%, and higher provision for inventory decreased product gross margin by 0.6%. However, lower manufacturing

costs related to lower component costs and value engineering and other manufacturing related costs increased product gross margin

by approximately 1.5%. Value engineering is the process by which the production costs are reduced through component redesign,

board configuration, test processes, and transformation processes. Higher shipment volume also increased product gross margin by

approximately 1.5%.

Product gross margin may be adversely affected in the future by changes in the mix of products sold, including further periods

of increased growth of some of our lower-margin products, changes in distribution channels, price competition, sales discounts,

increases in material or labor costs, excess inventory and obsolescence charges, changes in shipment volume, loss of cost savings due to

changes in component pricing, impact of value engineering, inventory holding charges, introduction of new products or entering new

markets, and different pricing and cost structures of new markets. If warranty costs associated with our products are greater than we

have experienced, product gross margin may also be adversely affected. Product gross margin may also be affected by geographic mix,

as well as the mix of configurations within each product group.

2004 ANNUAL REPORT 25