Circuit City 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net cash of $6.8 million was used in financing activities in 2004, primarily for the repayment of short and long-

term borrowings. Net cash of $3.8 million was used in financing activities in 2003. Cash of $4.3 million was used to

repay short and long-term obligations, which was partially offset by $419,000 provided by the exercise of stock

options. Cash of $33.8 million was provided by financing activities in 2002 from bank borrowings and the mortgaging

of our Georgia distribution facility and new United Kingdom facility.

21

Under our $70 million secured revolving credit agreement in the United States, which expires on September 30,

2006, availability as of December 31, 2004 was $54.6 million. The revolving credit agreement contains certain

financial and other covenants, including restrictions on capital expenditures and payments of dividends. We were in

compliance with all of the covenants as of December 31, 2004. There were outstanding letters of credit of $9.1 million

and there were no outstanding advances as of December 31, 2004.

We also maintain a £15 million ($28.5 million at the December 31, 2004 exchange rate, which exchange rate

applies to all the other Sterling denominated amounts below) multi-currency credit facility with a financial institution

in the United Kingdom, which is available to our United Kingdom subsidiaries. The facility does not have a

termination date, but may be canceled by either party on six months notice. Borrowings under the facility are secured

by certain assets of our United Kingdom subsidiaries. At December 31, 2004 there were £

5.3 million ($10.0 million) of

borrowings outstanding under this line with interest payable at a rate of 5.87%.

Our Netherlands subsidiary has a €5 million ($6.7 million at the December 31, 2004 exchange rate, which

exchange rate applies to all the other Euro denominated amounts below) credit facility. Borrowings under the facility

are secured by the subsidiary's accounts receivable and are subject to a borrowing base limitation of 85% of the eligible

accounts. At December 31, 2004 there were €3.5 million ($4.8 million) of borrowings outstanding under this line with

interest payable at a rate of 5.0%. The facility expires in November 2005.

In 2002 we entered into a £6.6 million ($12.5 million), 11½ year term loan agreement with a United Kingdom

bank, to finance the construction of a new United Kingdom facility. The borrowings are secured by the land and

building and are repayable in 40 quarterly installments of £165,000 ($313,000) through August 2012. The outstanding

borrowings bear interest at the 12 month LIBOR plus 160 basis points (5.25% at December 31, 2004). In connection

with this term loan, we also entered into an interest rate collar agreement to reduce our exposure to market rate

fluctuations. At December 31, 2004, the notional amount of the interest rate collar was £5,115,000 ($9,713,000) with

an interest rate cap of 6.0% and a floor of 4.5%. The interest rate collar expires on April 30, 2005. As of December 31,

2004, the collar was in a neutral position. The change in the fair value of this derivative for the year ended December

31, 2004 has been recognized in the Consolidated Statement of Operations as this hedge was determined to be

ineffective. The term loan agreement contains certain financial and other covenants related to our United Kingdom

subsidiaries. As of December 31, 2004, the Company was not in compliance with the financial covenants and has

classified the entire obligation as current.

In April 2002 we entered into a ten year, $8.4 million mortgage loan on our Suwanee, Georgia distribution

facility. The mortgage has monthly principal and interest payments of $62,000 through May 2012, with a final

additional principal payment of $6.4 million at maturity in May 2012. The mortgage loan bears interest at 7.04% and is

collateralized by the underlying land and building.

We are obligated under non-cancelable operating leases for the rental of most of our facilities and certain of our

equipment which expire at various dates through 2014. We currently lease our New York facility from an entity owned

by Richard Leeds, Robert Leeds and Bruce Leeds, the Company's three principal shareholders and senior executive

officers. The annual rental totals $612,000 and the lease expires in 2007. We have sublease agreements for leased space

in Compton, California and Markham, Ontario. In the event the sublessees are unable to fulfill their obligations, we

would be responsible for rent due under the leases. However, we expect the sublessees will fulfill their obligations

under these leases.

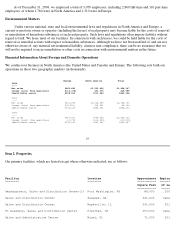

Following is a summary of our contractual obligations for future principal payments on our debt, minimum