Circuit City 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROSS PROFIT

Gross profit, which consists of net sales less product cost, shipping, assembly and certain distribution center

costs, was $286.5 million, or 14.9% of net sales, for the year ended December 31, 2004, compared to $264.9 million or

16.0% of net sales in 2003. Our gross profit ratio declined in 2004 as a result of increased pricing pressures on our

computer business both in North America and Europe. The decline was partially offset by improved margins on

industrial products.

Gross profit was $264.9 million for the year ended December 31, 2003, or 16.0% of net sales, compared to

$266.3 million, or 17.2% of net sales, in 2002. As a result of adopting Emerging Issues Task Force ("EITF") Issue No.

02-16, "Accounting by a Customer (including a Reseller) for Certain Consideration Received from a Vendor", $14.5

million of vendor consideration was recorded as a reduction of cost of sales in 2003. Excluding the impact of EITF 02-

16, and therefore on a non-GAAP basis, the gross profit margin would have been 15.1% in 2003 compared to 17.2% in

2002. (The non-GAAP gross profit margin has been included here to provide comparability to the prior year.) The

decline in the gross profit margin was due to continued pricing pressure resulting from weak market demand and

response to competition and changes in the mix of products sold, as customers continue to shift to lower-priced

solutions.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses totaled $260.1 million, or 13.5% of net sales, in 2004, an increase

of $8.7 million, or 3.4%, compared to $251.5 million, or 15.2% of net sales, in 2003. This increase resulted from

approximately $10 million of increased costs in Europe resulting from the effects of changes in foreign exchange rates

and $4 million of higher credit card processing fees from the higher sales volume in 2004. The increase was partially

offset through restructuring actions taken, reducing our employee count in the United States and lowering salary

expense and related benefit costs by $6 million in 2004.

17

Selling, general and administrative expenses for 2003 were $251.5 million compared to $256.1 million in 2002,

a net decrease of $4.6 million or 1.8%. The decrease was realized in our North American operations and included

decreased television advertising spending related to sales of the Company's PCs. In addition, as a result of increased

internet sales, we were able to leverage our total advertising spending and reduce our other advertising expenses by

reducing the number of catalogs we mailed. These decreases were partially offset by approximately $13 million of

increased costs in Europe resulting from the effects of changes in foreign exchange rates and the effects of the adoption

of EITF 02-16. The adoption of EITF 02-16 resulted in the reclassification of $14.5 million of vendor consideration as

a reduction of cost of sales, which would previously have been recorded as a reduction of advertising expense. As a

percentage of sales, selling, general and administrative expenses were 15.2% (14.3% on a non-GAAP basis before the

adoption of EITF 02-16) compared to 16.5% in the year-ago period.

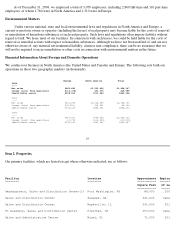

RESTRUCTURING AND OTHER CHARGES

We incurred $7.4 million of restructuring and other charges in 2004. In the first quarter of 2004 we implemented

a plan to streamline the activities of our United States computer businesses' back office and warehouse operations,

resulting in the elimination of approximately 200 jobs. We incurred $3.7 million of restructuring costs associated with

this plan, including $3.2 million for staff severance and benefits for terminated employees and $0.5 million of non-

cash

costs for impairment of the carrying value of fixed assets. We recorded $0.6 million of additional costs in 2004 related

to facility exit costs for our 2003 plan to consolidate United States warehouse locations. We also implemented several

cost reduction plans in Europe during 2004, including a consolidation of United Kingdom sales offices which resulted

in the elimination of 50 jobs. We incurred $2.5 million of restructuring charges for facility exit costs and workforce

reductions in connection with these actions and $0.5 million of additional costs resulting from adjustments to our

estimates of lease and contract termination costs for our 2002 plan to consolidate our United Kingdom operations.

In 2003, we had $1.7 million of restructuring and other charges. In the fourth quarter of 2003 we implemented a