Chrysler 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 2015 | ANNUAL REPORT

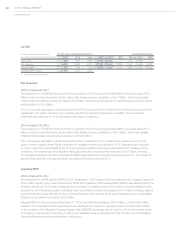

Operating Results

Operating Activities — Year Ended December 31, 2013

For the year ended December31, 2013, our net cash from operating activities of €7,618 million was primarily the

result of:

(i) net profit from continuing operations of €1,708 millionadjusted to add back (a)€4,364 million for depreciation

and amortization expense and (b)other non-cash items of €531 million, which primarily included €336million of

impairment losses and asset write-offs on tangible and intangible assets, €59million loss related to the devaluation

of the official exchange rate of the VEF per U.S.$, €56million write-off of the book value of the equity recapture

rights resulting from the acquisition of the remaining 41.5 interest in FCA US that was previously not owned,

€105million of write-down in financial assets from the lending portfolio of our financial services activities, partially

offset by €74million of the share of profit or loss of equity method investees;

(ii) positive impact of change in working capital of €1,378 million primarily driven by (a)€1,322 million increase in

trade payables, mainly related to increased production in NAFTA as a result of increased consumer demand for

our vehicles, and increased production in Maserati, (b)€746 million in net other current assets and liabilities mainly

related to increases in accrued expenses and deferred income as well as indirect taxes payables, (c)€232 million

decrease in trade receivables principally due to the contraction of sales volumes in EMEA and LATAM which were

partially offset by (d)€922 million increase in inventory (net of vehicles sold under buy-back commitments), mainly

related to increased finished vehicle and work in process levels at December31, 2013 compared to December31,

2012, in part driven by higher production levels in late 2013 to meet anticipated consumer demand in the NAFTA,

APAC and Maserati segments;

(iii) a net increase of €464 million in provisions, mainly related to accrued sales incentives due to increased dealer

stock levels at December31, 2013 compared to December31, 2012 to support increased sales volumes; which

were partially offset by a net reduction in the post-retirement benefit reserve;

(iv) €92 million dividends received from jointly-controlled entities; and

(v) €534 million of cash flows from discontinued operations.

These positive contributions were partially offset by:

(vi) €1,569million non-cash impact of deferred taxes mainly arising from the recognition of previously unrecognized

deferred tax assets relating to FCA US.

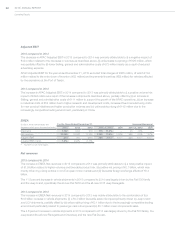

Investing Activities — Year Ended December 31, 2015

For the year ended December31, 2015, net cash used in investing activities of €9,300 million was primarily the result of:

(i) €8,819 million of capital expenditures, including €2,504 million of capitalized development costs that supported

investments in existing and future products. Capital expenditures primarily related to the mass-market vehicle

operations in NAFTA and EMEA, investment in Alfa Romeo and the completion of the Pernambuco plant;

(ii) a total of €266 million for investments in joint ventures, associates and unconsolidated subsidiaries, of which €171

million was for the GAC Fiat Chrysler Automobiles Co. Ltd. joint venture; and

(iii) €426 million of cash flows used by discontinued operations.

These cash outflows were partially offset by:

(iv) €410 million of a net decrease in receivables from financing activities which primarily related to the decreased

lending portfolio of the financial services activities of the Group in Brazil and China.