Chrysler 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

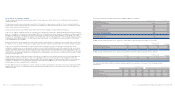

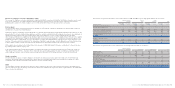

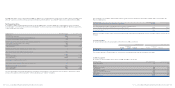

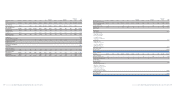

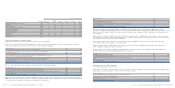

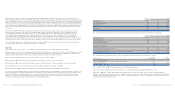

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 177

As the Sector Result includes Interest income and other financial income and Interest expenses and other financial expenses of

financial services companies, the Assets of the Fiat Auto, CNH and Iveco Sectors include financial assets (primarily the investment

portfolio) of financial services companies; similarly Sector Liabilities include the debt of financial services companies. As a result,

the unallocated Group debt represents the debt of the industrial companies.

Other and

Magneti Business elimina- FIAT

(in millions of euros) Fiat Auto Maserati Ferrari CNH Iveco FPT Marelli Teksid Comau Solutions Itedi tions Group

2006

Total net revenues 23,702 519 1,447 10,527 9,136 6,145 4,455 979 1,280 668 401 (7,427) 51,832

Net revenues

intersegment (247) (13) (77) (2) (106) (4,558) (1,678) (225) (332) (453) (9) 7,700 –

Net revenues from

third parties 23,455 506 1,370 10,525 9,030 1,587 2,777 754 948 215 392 273 51,832

Trading profit 291 (33) 183 737 546 168 190 56 (66) 37 11 (169) 1,951

Unusual income

(expenses) 436 – – (145) 19 (66) (15) (30) (206) (9) 1 125 110

Operating result 727 (33) 183 592 565 102 175 26 (272) 28 12 (44) 2,061

Financial income

(expenses) (576)

Unusual financial income –

Result from investments 37 – – 45 32 1 (1) 3 (3) – – 42 156

Result before taxes 1,641

Income taxes 490

Result from continuing

operations 1,151

Other information

Capital expenditure 2,163 82 142 394 865 254 293 32 56 10 45 (24) 4,312

Depreciation and

amortisation (1,538) (30) (145) (293) (421) (402) (201) (38) (23) (13) (7) (10) (3,121)

Impairment (2) – – – (36) (7) (12) (23) (26) – – – (106)

Other non-cash items (1,037) (60) (35) (1,504) (507) (105) (73) (19) (85) (17) (1) (91) (3,534)

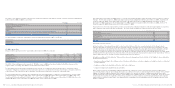

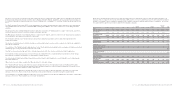

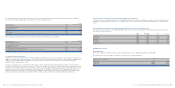

The Iveco Sector produces and sells trucks and commercial vehicles, mainly in Europe, (under the Iveco brand), buses (under the

Irisbus brands) and special vehicles (under the Iveco, Magirus and Astra brands). In addition, Iveco provides financial services to

its customers and dealers mainly through Iveco Finance Holdings Ltd., a company 51% owned by the Barclays group and 49% by

Iveco.

The Fiat Powertrain Technologies (FPT) Sector manufactures car engines and transmissions (these businesses were managed by

the Fiat-GM Powertrain joint venture until April 2005). Starting from 2006 the Sector also includes Iveco and C.R.F. powertrain

activities.

The Components Sector (Magneti Marelli) produces and sells components for lighting systems, engine control units, suspension

and shock absorbers systems, electronic systems and exhaust systems.

The Metallurgical Products Sector (Teksid) produces components for engines, cast-iron components for transmissions gearboxes

and suspensions, and magnesium bodywork components.

The Production System Sector (Comau) designs and produces industrial automation systems and related products for the

automotive industry.

The Services Sector (Business Solutions) provides accounting and human resources services, almost all of which are supplied to

other Group companies.

The activities of the Publishing and Communications Sector (Itedi) mainly include publishing the newspaper La Stampa and selling

advertising space in the print, television and internet media.

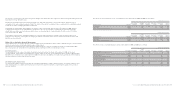

Total Net revenues presented by each Sector includes transactions with other Sectors carried out at arm’s length prices.

Intersegment revenues and expenses are reconciled and are eliminated in the consolidated financial statements of the Group;

intersegment receivables and payables are eliminated in a similar manner.

The item Segment Capital expenditure, Depreciation and amortisation, and Impairment concern intangible assets and property,

plant and equipment.

Other Sector non-cash items comprise the Other provision for risks and charges.

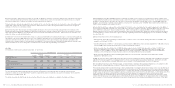

The “Segment Result” arising under IAS 14 is equal to the Operating result. The Operating result and Trading profit include,

respectively, Interest income and other financial income and Interest expenses and other financial expenses of financial services

companies in Net revenues and Cost of Sales of the Sector.

Sector Assets are operating assets used by the Sector in its business and are directly attributed or allocated, in a reasonable

manner,to the Sector.These assets do not include tax assets and investments accounted for using the equity method.

Sector Liabilities are operating liabilities used by the Sector in its business and are directly attributed or allocated, in a reasonable

manner, to the Sector. These liabilities do not include tax liabilities.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 176