Chrysler 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

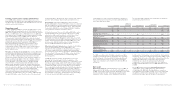

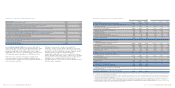

Investment income was 156 million euros in 2006, up from 34

million euros in 2005. The component deriving from valuation

of the companies according to the equity method rose by 10

million euros, while the other components improved from a

negative 81 million euros in 2005, which were impacted by 74

million euros in risks and charges recognised for investments

in China, to a positive balance of 31 million euros in 2006,

also as a result of the higher amount of dividends received.

Result before taxes totalled 1,641 million euros in 2006,

against income of 2,264 million euros in 2005. Net of changes

in unusual items for both years, income before taxes improved

by 1,340 million euros due to the increase in trading profit

(+951 million euros), lower net financial expenses for 267

million euros and higher investment income for 122 million

euros.

Income taxes totalled 490 million euros in 2006 and include

149 million euros for IRAP and 56 million euros in income

taxes for previous years. The tax charge (IRAP excluded) for

2006 was therefore equal to 285 million euros. In 2005 income

taxes totalled 844 million euros and included 277 million euros

for the reversal of deferred tax assets posted at December 31,

Report on Operations Financial Review of the Group 35Report on Operations Financial Review of the Group34

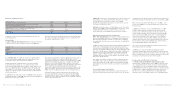

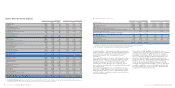

Consolidated Statement of Cash Flows

The consolidated statement of cash flows is presented

as a component of the Consolidated Financial Statements.

2004 by Fiat S.p.A. in connection with the income resulting

from the termination of the Master Agreement with General

Motors, 116 million euros for IRAP, 332 million euros for

current and deferred tax charges primarily attributable to

companies outside of Italy and 119 million euros in income

taxes for previous years.

Excluding IRAP, the Group’s effective tax rate was 32% in 2005

and 21% in 2006. The reduction was caused primarily by

greater use of prior-year tax losses and temporary differences

for which no deferred tax assets had been recognised in prior

years.

Net result for the year was 1,151 million euros in 2006, versus

1,420 million euros in 2005. Excluding the impact of net

unusual items, the Group would have posted a net loss of 376

million euros in 2005 and a net income of 1,041 million euros

in 2006. Therefore, on a comparable basis, net income

improved by 1,417 million euros.

The portion of net result attributable to the equity holders

of the parent was positive by 1,065 million euros in 2006,

against 1,331 million euros in 2005. In 2006 cash flows from operating activities totalled 4,618

million euros.

Income cash flow, that is net income plus amortisation and

depreciation, dividends, changes in provisions and items

relating to sales with buy-back commitments, net of

“Gains/losses and other non-cash items”, amounted to 3,806

million euros, to which must be added the cash generated by

the decrease in working capital which, when calculated on a

comparable consolidation and exchange rate basis, amounted

to 812 million euros.

Cash flows used in investment activities totalled 1,390 million

euros. Net of the reduction in securities held as current assets

(223 million euros), investment activities used a total of 1,613

million euros.

Investments in tangible assets (net of vehicles sold under

buy-back commitments) and intangible assets totalled 3,789

million euros (3,052 million euros in 2005), 926 million euros

of which referred to vehicles for long-term renting operations

(409 million euros in 2005), while 813 million euros referred

to capitalised development costs (656 million euros in 2005).

Investments totalled 1,617 million euros and mainly referred:

■for 893 million euros, to the repurchase of 28.6% of Ferrari and

■for 479 million euros, to the repurchase, upon exercise of

the call option held by Fiat Auto, of 51% of Fidis Retail Italia,

whose corporate name subsequently changed in Fiat Auto

Financial Services (FAFS), within the framework of the creation

of the joint venture with Crédit Agricole. Concurrently, Fidis

Retail Italia was recapitalised by Fiat Auto for an amount

totalling 180 million euros.

In addition to investments during the period, receivables from

financing activities increased, absorbing 876 million euros

in liquidity. This increase is mainly attributable to the growth

in financing extended by the financial services companies of

CNH, net of the collection of financial receivables from others,

associated companies and sold companies.

Reimbursement of the financing disbursed by the centralised

cash management entity to the financial services companies

sold by Fiat Auto upon creation of the joint venture Fiat Auto

A condensed version thereof as well as comments

are provided below.

(in millions of euros) 2006 2005

A) Cash and cash equivalents at beginning of period 6,417 5,767

B) Cash flows from (used in) operating activities during the period (a) 4,618 3,716

C) Cash flows from (used in) investment activities (b) (1,390) (535)

D) Cash flows from (used in) financing activities (c) (1,731) (2,868)

Translation exchange differences (173) 337

E) Total change in cash and cash equivalents 1,324 650

F) Cash and cash equivalents at end of period 7,741 6,417

of which: cash and cash equivalents included as Assets held for sale 5–

G) Cash and cash equivalents at end of period as reported in the consolidated financial statements 7,736 6,417

(a) In 2005 cash flow is shown net of, amongst other things, the unusual financial income of 858 million euros arising from the conversion of the Mandatory Convertible Facility and the gain

of 878 million euros realised on the sale of the investment in Italenergia Bis.

(b) In 2005, cash flows from investment activities benefited, among other things, from the repayment of the loans granted by central treasury to the financial services companies sold by Iveco

as part of the transaction with Barclays (proceeds of approximately 2 billion euros) and from the effects of the unwinding of the joint ventures with General Motors (positive by approximately

500 million euros).

(c) In 2005, cash flows used in financing activities excluded the repayment of the Mandatory Convertible Facility (3 billion euros) and the debt of approximately 1.8 billion euros connected

with the Italenergia Bis transaction, as neither of these gave rise to cash flows.