Chrysler 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 173

consolidated financial statements at December 31, 2005). As described in the section Scope of consolidation, on September 29,

2006, Fiat exercised its call option on 28.6% of the shares of Ferrari S.p.A., taking its holding from 56.4% to 85% in this way. The

remaining rights granted by Mediobanca have now ceased. Fiat has a call option exercisable from January 1 to July 31, 2008

on a further 5% of the Ferrari shares held by Mubadala Development Company at a pre-determined price of 303 euros per share

(amounting to a total of 121.2 million euros) less any dividends that may be distributed.

Teksid

Teksid S.p.A. is the object of a put and call agreement with the partner Norsk Hydro concerning the subsidiary Meridian Technologies

Inc. (held 51% by the Teksid group and 49% by the Norsk Hydro group). In particular, should there be a strategic deadlock in the

management of the company (namely in all those cases in which a unanimous vote in favour is not reached by the directors on the

board as regards certain strategic decisions disciplined by the contract between the stockholders), the following rights would arise:

■Put option of Norsk Hydro with Teksid on the 49% holding: the sale price would be commensurate with the initial investment

made in 1998, revalued pro rata temporis, net of dividends paid.

■Call option of Teksid with Norsk Hydro on the 49% holding (exercisable whenever Norsk Hydro renounces its right to exercise

the put option described above): the sale price would be the higher value between the initial investment made by Norsk Hydro

in 1998, calculated according to the criteria expressed previously, and 140% of the fair market value (in this regard, an increase of

two percentage points per year is established in the event the option is exercised from the start of 2008 until 2013, thus up to 150%

of the relative value).

It should be pointed out that at present the conditions that would give rise to a strategic deadlock are considered to be remote.

On December 6, 2006 Teksid and Norsk Hydro reached an agreement for the sale of their interests in Meridian Technologies Inc.

The finalisation of this transaction, subject to the closing of the financing to the purchaser from financial institutions, would lead

to the termination of the above-mentioned agreement.

Fiat S.p.A. is subject to a put contract with Renault (in reference to the original investment of 33.5% in Teksid, now 15.2%).

In particular, Renault would acquire the right to exercise a sale option to Fiat on its interest in Teksid, in the following cases:

■in the event of non-fulfilment in the application of the protocol of the agreement and admission to receivership or any other

redressment procedure;

■in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry

sector;

■should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

■for 6.5% of the capital stock of Teksid, the initial investment price increased by a given interest rate;

■for the remaining amount of capital stock of Teksid, the share of the accounting net equity at the exercise date.

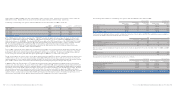

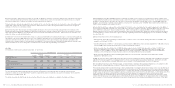

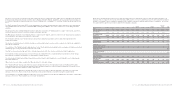

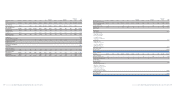

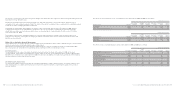

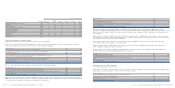

An analysis of Other payables by due date is as follows:

At December 31, 2006 At December 31, 2005

due between due between

due within one and due beyond due within one and due beyond

(in millions of euros) one year five years five years Total one year five years five years Total

Other payables 4,055 903 61 5,019 3,819 879 123 4,821

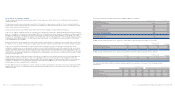

The item Advances on buy-back agreements refers to agreements entered into by the Group during the year or which still remain

effective at the balance sheet date. An amount of 1,316 million euros relate to assets included in Property, plant and equipment,

with the balance of 1,054 million euros relating to inventories.

The item Advances on buy-back agreements represents the following:

■at the date of the sale, the price received for the product is recognised as an advance in liabilities;

■subsequently, since the difference between the original sales price and the repurchase price is recognised in the income

statement as operating lease instalments on a straight line basis over the lease term, the balance represents the remaining lease

instalments yet to be recognised in income plus the repurchase price.

The carrying amount of Other payables is considered in line with their fair value at the balance sheet date.

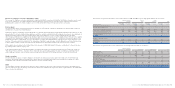

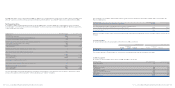

31. Accrued liabilities and deferred income

The item Accrued liabilities and deferred income includes public grants recognised as income over the useful lives of the assets to

which they relate. Furthermore, the item comprises deferred income relating to service contracts, as well as accrued liabilities for

costs that will be settled in the following year.

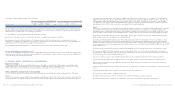

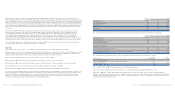

32. Guarantees granted, commitments and contingent liabilities

Guarantees granted

At December 31, 2006, the Group had granted guarantees on the debt or commitments of third parties or associated entities

totalling 726 million euros (1,198 million euros at December 31, 2005). An amount of 364 million euros of the decrease of 472

million euros is due to lower guarantees granted on behalf of Sava S.p.A. for the bonds it has issued.

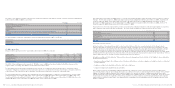

Other commitments and important contractual rights

The Fiat Group has important commitments and rights deriving from outstanding agreements, summarised in the following.

Ferrari

As part of the agreement signed in 2002 for the acquisition by Mediobanca S.p.A. of 34% of the capital stock of Ferrari S.p.A., Fiat

was granted a series of rights by the purchaser which included a call option (further details of this are provided in Note 32 to the

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 172