Chrysler 2005 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

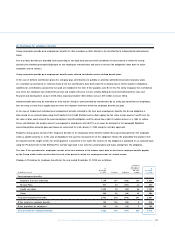

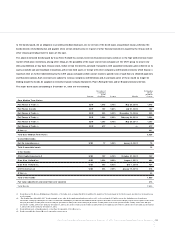

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

Call O ption by Fiat Auto to purchase 51% of Fidis Retail Italia, held by Synesis Finanziaria, exercisable quarterly up to January 31, 2008

(initially up to January 31, 2006, before the extension agreed on February 4, 2005) at a price increased pro rata temporis over the sales

price plus additional payments less any distributions.

Synesis Finanziaria’s right to request Fiat Auto to exercise the above purchase option on 51% of Fidis Retail Italia in the event of which by

January 31, 2008 (January 31, 2006, before the above-mentioned extension) there is a change in control of Fiat or Fiat Auto (also through

the sale of a substantial part of the companies owned by Fiat Auto or one of its brands Fiat,Alfa and Lancia) as set forth in the relative

stockholders’ agreement between Fiat Auto, Synesis Finanziaria and the four money lending banks.

So-called “tag along” option on behalf of Synesis Finanziaria if the same events referred to in the preceding point occur after January 31,

2008 (originally January 31, 2006).

So-called “drag along” option on behalf of Fiat Auto in the event of the sale of the investment after January 31, 2008 (January 31, 2006,

before the above-mentioned extension).

As a result of the transaction, FRI was deconsolidated and has repaid all the loans it previously obtained from the centralised treasury

department of the Group.

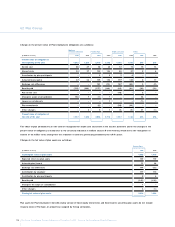

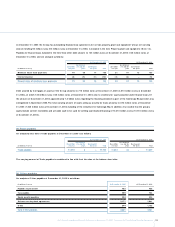

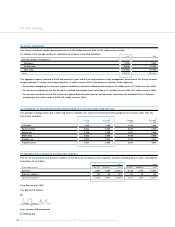

Ferrari

A summary is presented below of the rights arising from the purchase in 2002 of 34% of the capital stock of Ferrari S.p.A. for 775 million

euros by Mediobanca S.p.A., within the framework of a consortium set up for the acquisition and placement of the Ferrari shares.The sale

contract sets out the following principal elements:

Mediobanca assumed the responsibility of sole Global Coordinator in charge of coordinating and leading the consortium, in the event of a

placement by june 30, 2006.

Mediobanca cannot sell its Ferrari shares to another group in the automobile industry as long as the Fiat Group maintains a 51% controlling

interest in Ferrari. Barring certain specific assumptions, the Fiat Group can not reduce its investment in Ferrari below 51% until the end,

depending on the case, of the third or fourth year subsequent to signing the contract.

Fiat holds a call option that allows it to repurchase the Ferrari shares at any time before June 30, 2006, except during the five months

subsequent to the presentation of an IPO application to the competent authorities.The option exercise price is equal to the original price at

which the shares were sold plus interest during the period based on the BOT yield plus 4%.

Mediobanca, moreover, does not hold any put option to resell the purchased Ferrari shares to Fiat, even in the event that the IPO does not

occur or is not completed.

Fiat may share, in declining percentages, in any gain realised by Mediobanca and the other members of the consortium in the event of an IPO.

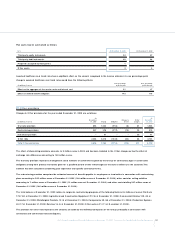

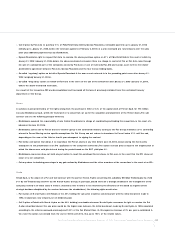

Teksid

Teksid S.p.A. is the object of a Put and Call contract with the partner N orsk Hydro concerning the subsidiary Meridian Technologies Inc. (held

51% by the Teksid Group and 49% by the N orsk Hydro Group). In particular, should there be a strategic deadlock in the management of the

company (namely in all those cases in which a unanimous vote in favour is not reached by the directors on the board as regards certain

strategic decisions disciplined by the contract between the stockholders), the following rights would arise:

Put O ption of N orsk Hydro with Teksid on the 49% holding: the sale price would be commensurate with the initial investment made in

1998, revalued pro rata temporis, net of dividends paid.

Call O ption of Teksid with N orsk Hydro on the 49% holding (exercisable whenever N orsk Hydro renounces its right to exercise the Put

O ption described above):the sale price would be the higher value between the initial investment made by N orsk Hydro in 1998, calculated

according to the criteria expressed previously, and 140% of the Fair Market Value (in this regard, an increase of 2% per year is established in

the event the option is exercised from the start of 2008 until 2013, thus up to 150% of the relative value).