Chrysler 2005 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

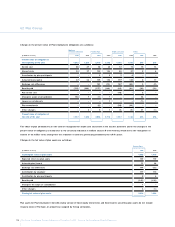

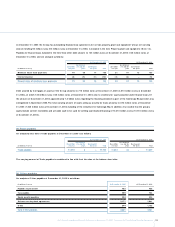

28. D ebt

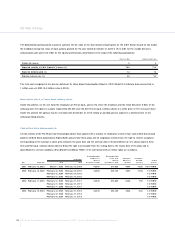

A breakdown of debt and an analysis by due date are as follows:

At December 31, 2005 At December 31, 2004

due between due between

due within one and five due beyond due within one and five due beyond

(in millions of euros) one year years five years Total one year years five years Total

Asset-backed financing 6,907 3,254 49 10,210 6,902 3,223 49 10,174

O ther debt:

Bonds 2,766 2,307 2,561 7,634 2,369 3,029 3,928 9,326

Borrowings from banks 2,877 2,557 128 5,562 8,110 2,266 74 10,450

Loans for banking activities 1,255 – – 1,255 1,322 4 – 1,326

O ther 956 92 52 1,100 751 129 35 915

Total O ther debt 7,854 4,956 2,741 15,551 12,552 5,428 4,037 22,017

Total Debt 14,761 8,210 2,790 25,761 19,454 8,651 4,086 32,191

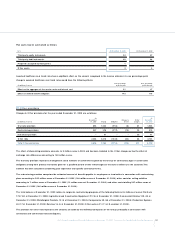

The item Asset-backed financing represents the amount of financing received through both securitisation and factoring transactions which do

not meet IAS 39 derecognition requirements and is recognised as an asset in the balance sheet under the item Current receivables (N ote 19).

The bonds issued by the Fiat Group are governed by different terms and conditions according to their type as follows:

Euro M edium Term N ote (EM TN Program): notes of approximately 5.5 billion euros guaranteed by Fiat S.p.A. have been issued to date under

this program. Issuers taking part in the program are Fiat Finance & Trade Ltd. S.A. (for an amount outstanding of 5,426 million euros), and

Fiat Finance Canada Ltd. (for an amount outstanding of 100 million euros).

Convertible bonds:these represent the residual debt, 15 million euros remaining after the partial repayment in July 2004, of the 5-year bond

originally convertible into General Motors Corporation common stock (the “Exchangeable bond”) at a conversion price of 69.54 U.S. dollars

per share, bearing interest at 3.25% and repayable on January 9, 2007. In order to hedge the risk, implicit in the bond, of an increase in the

General Motors share price above 69.54 U.S. dollars, the Group purchased call options in 2004 on General Motors common stock.These

options, although originally purchased for hedging purposes, are classified as trading (see also N ote 22).

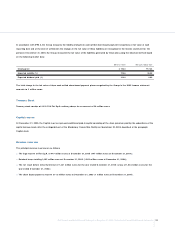

Other bonds:these refer to the following issues:

- Bonds issued by Case N ew Holland Inc. (“CN H Inc.”) in 2004 (bearing coupon interest at 9.25% and repayable on August 1, 2011 for an

amount of 1,050 million U.S. dollars, equivalent to 890 million euros) and in 2005 (bearing coupon interest at 6.00% and repayable on June

1, 2009 for an amount of 500 million U.S. dollars, equivalent to 424 million euros);the bond indenture contains a series of financial

covenants that are common to the high yield American bond market;

- Bonds issued by CN H America LLC and CN H Capital America for a total amount outstanding of 381 million U.S. dollars, equivalent to

323 million euros;

- O ther minor issues for a total of 43 million euros.

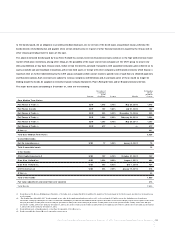

The prospectuses and offering circulars, or their abstracts, relating to these principal bond issues are available on the Group’s website at

www.fiatgroup.com under “Shareholders and Investors - Financial Publications”.

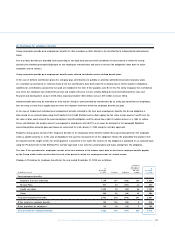

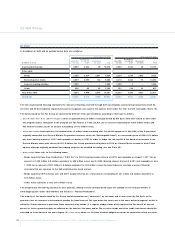

The majority of the bonds issued by the Group contain commitments (“covenants”) by the issuer and in some cases by Fiat S.p.A. as the

guarantor, that are common in international practice for bond issues of this type, when the issuers are in the same industrial segment as that in

which the Group operates. In particular, these covenants may include (i) a negative pledge clause which requires that the benefit of any real

present or future guarantees given as collateral on the assets of the issuer and/or Fiat, on other bonds and other credit instruments should be

extended to these bonds to the same degree, (ii) a pari passu clause, on the basis of which obligations cannot be undertaken which are senior