Chesapeake Energy 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$5

$10

$15

$20

billions of $

$0

10 11 12 13 14

$14.2B

$7.8B

$6.7B

Total Capex(1) Operating Cash Flow

(non-GAAP) (2)

$5.0B

$14.1B $14.6B

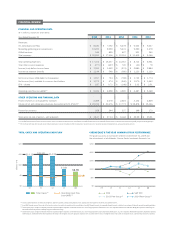

FINANCIAL REVIEW

TOTAL CAPEX AND OPERATING CASH FLOW

FINANCIAL AND OPERATING DATA

($ in millions, except per share data)

(a) A non-GAAP nancial measure. Please refer to the Investors section of our website at www.chk.com for reconciliations of non-GAAP nancial measures to comparable nancial measures calculated in accordance with generally accepted accounting principles.

(b) PV-10 is the present value (10% discount rate) of estimated future gross revenues to be generated from the production of proved reserves, net of production and future development costs, using assumed prices and costs.

Years Ended December 31 2014 2013 2012 2011 2010

Revenues:

Oil, natural gas and NGL $ 8,180 $ 7,052 $ 6,278 $ 6,024 $ 5,647

Marketing, gathering and compression 12,225 9,559 5,431 5,090 3,479

Oileld services 546 895 607 521 240

Total revenues $ 20,951 $ 17,506 $ 12,316 $ 11,635 $ 9,366

Total operating expenses $ 17,474 $ 15,437 $ 14,010 $ 8,714 $ 6,561

Total other income (expense) $ (277 ) $ (627 ) $ 720 $ (41 ) $ 79

Income (loss) before income taxes $ 3,200 $ 1,442 $ (974 ) $ 2,880 $ 2,884

Income tax expense (benet) $ 1,144 $ 548 $ (380 ) $ 1,123 $ 1,110

Net income (loss) attributable to Chesapeake $ 1,917 $ 724 $ (769 ) $ 1,742 $ 1,774

Net income (loss) available to common stockholders $ 1,273 $ 474 $ (940 ) $ 1,570 $ 1,663

EPS – diluted $ 1.87 $ 0.73 $ (1.46 ) $ 2.32 $ 2.51

Operating cash ow (non-GAAP)(a) $ 5,026 $ 4,958 $ 3,920 $ 4,487 $ 5,169

OTHER OPERATING AND FINANCIAL DATA

Proved reserves in oil equivalents (mmboe) 2,469 2,678 2,615 3,132 2,849

Future net oil and natural gas revenues discounted at 10% (PV-10)(b) $ 22,012 $ 21,676 $ 17,773 $ 19,878 $ 15,146

Production (mmboe) 258 244 237 199 173

Stock price (at end of period – split adjusted) $ 19.47 $ 27.14 $ 16.62 $ 22.29 $ 25.91

(1) Includes capital expenditures for drilling and completions, property acquisitions, geological and geophysical costs, property, plant and equipment, investments and capitalized interest.

(2) A non-GAAP nancial measure. Please refer to the Investors section of our website at www.chk.com for reconciliations of non-GAAP nancial measures to comparable nancial measures calculated in accordance with generally accepted accounting principles.

(3) The 2013 peer group is comprised of Anadarko Petroleum Corporation, Apache Corporation,Continental Resources, Inc., Devon Energy Corporation, EOG Resources, Inc., Hess Corporation, Marathon Oil Corporation, Murphy Oil Corporation, Noble Energy, Inc.,

Occidental Petroleum Corporation, SandRidge Energy and Southwestern Energy.

(4) The 2014 peer group is comprised of Anadarko Petroleum Corporation, Apache Corporation,Continental Resources, Inc., Devon Energy Corporation, Encana Corporation, EOG Resources, Inc., Hess Corporation, Marathon Oil Corporation, Murphy Oil Corporation,

Noble Energy, Inc. and Occidental Petroleum Corporation. The change in the companies in our peer group was designed to more accurately show the returns of companies that are more similar to Chesapeake in size, scope and nature of business operations.

CHESAPEAKE’S FIVE-YEAR COMMON STOCK PERFORMANCE

The graph assumes an investment of $100 on December 31, 2009 and

the reinvestment of all dividends. Source: Zacks Investment Research, Inc.

$50

$100

$150

$200

$250

$0

CHK S&P 500

2013 Peer Group(3) 2014 Peer Group(4)

09 11 12 13 1410