Chesapeake Energy 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT 1

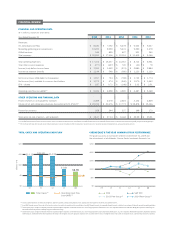

GENERATING VALUE

We grew our total oil and natural gas equivalent production

by 9% in 2014, adjusting for divestitures, while reducing our

total capital expenditures by approximately 14% compared

to 2013. We also reached a production record of 770,000

barrels of oil equivalent (boe) per day in mid-December.

More importantly, we drove billions of dollars in value into

our company through numerous efciencies, continuous im-

provement and cost leadership.

In 2014 we reduced drilling and completions capital ex-

penditures by 18% to $4.5 billion, saving $1 billion compared

to 2013. Our 2014 operating cash ow was approximately

$5 billion, reecting the lowest funding gap in 10 years. In

addition, combined production and general and administrative

costs per boe dropped 10% to a nine-year low.

GAINING FINANCIAL FLEXIBILITY

Chesapeake became dramatically stronger, less complex and

much more exible in 2014 as three major accomplishments

set us apart from our peers. We completed one of the largest

and most signicant transactions in company history with the

divestiture of certain assets in the southern Marcellus and

eastern Utica shales. Receiving approximately $5 billion for

the assets during a depressed commodity price environment

— assets which represented only 8% of proved reserves —

gives us tremendous nancial exibility. We also completed

a $450 million acquisition and exchange that doubled our

working interest in the oil-rich Powder River Basin. Finally, we

successfully spun off our oileld services division into the

public company Seventy Seven Energy Inc.

We reached another rst in company history with a new

unsecured $4 billion credit facility with investment grade-like

terms. Moody’s and S&P each upgraded Chesapeake by two

notches, placing us one level below investment grade at both

rating agencies. Since 2012 we have reduced total leverage

by $5.5 billion.

OPERATING RESPONSIBLY

The safety of our employees, contractors, the environment and

the public is our number one priority, and our 2014 performance

in those areas was outstand-

ing. We ended the year with the

lowest total recordable incident

rate in company history and

reduced our cumulative report-

able spill volume by 42%.

We remain focused on our

responsibility to stakeholders,

and in 2014 that included a

renewed commitment to our landowners. We initiated face-

to-face meetings in our two largest producing regions, Penn-

sylvania and Texas, and continue to initiate communications

with many of our landowners. In 2014 we also invested in our

employees through career development programs, introduced

a competitively based companywide employee compensation

program that aligned with our corporate performance goals

and fostered a culture of continuous learning and elevating

innovative solutions.

DEMONSTRATING E&P LEADERSHIP

Our record accomplishments have positioned us to remain

strong and exible in 2015. We continue to respond decisively

to the lower commodity price environment, including a reduced

capital budget and activity level. However, we will not shift our

focus from driving differential performance, ensuring every

dollar we invest creates value, increases our nancial and

operational exibility and lowers our business costs. These

strategies will allow us to continue the historic transformation

of our company into a leader in the E&P industry. We have

made impressive progress, yet there is so much more we will

accomplish. Thank you for investing in Chesapeake Energy.

DEAR FELLOW SHAREHOLDERS

In 2014 we transformed every aspect of our business to build a new foundation — one based on financial

discipline and profitable and efficient growth from our resources. During this critical year, our employees

delivered exceptional results while significantly improving our financial position. We achieved the best safety

performance in company history and further improved capital efficiencies in our major operating areas. From

a financial perspective, we became significantly stronger, less complex and much more flexible. These along

with many other achievements drove Chesapeake to greater stability and strength.

Robert D. Lawler

President, Chief Executive Ofcer and Director

April 10, 2015