Chesapeake Energy 1996 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1996 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHESAPEAKE ENERGY CORPORATION

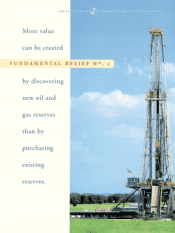

Growth through the drilibit

COMPETITIVE ADVANTAGE N°. i

Therewards for Chesapeake and

its shareholders are generated

by the company's expertise in

producing large amounts of oil and

gas from unconventional reservoirs.

These reservoirs have traditionally

been uneconomic to develop because

of their geological complexity. Using

new technologies, however, we can

now profitably exploit these reservoirs

and generate a rapid return on our

investments.

We have elected to btiild our com-

pany through our expertise with the

drillbit rather than by acquiring other

companies producing properties.

This strategy makes Chesapeake fun-

damentally different and more prof-

itable than most independent energy

companies for three reasons.

First, this strategy enables our

company to capture more upside by

drilling new wells that have much

higher prodtictive capabilities than

older wells. In Chesapeake's project

areas, new wells can develop reserves

with a valtie of up to five times the

cost of drilling such wells. They pro-

vide a much higher return on invest-

ment than can be generated by pur-

chasing partially depleted wells from

other companies and then attempt-

ing to stimulate marginal production

increases.

Secondly, there is less competition

for good exploration ideas in

Chesapeake's areas of operation be-

cause most major oil and natural gas

companies have significantly reduced

domestic onshore exploration efforts,

and many independent producers

have focused on producing property

acqtlisitions. With less competition,

our company has a greater opportu-

nity to leverage its exploration exper-

tise into new areas that could signifi-

cantly increase shareholder

value.

The third reason for

Chesapeake's growth

through the drilibit strat-

egy is the efficiency created

from owning new wells.

J ust as in operating any

new equipment, operating

a newly drilled well is less expensive

than operating an older well which

requires ongoing maintenance.

Consequently, the company's ad-

ministrative and production costs per

unit of oil and natural gas prodticed

have been the lowest in the industry.

This cost structure provides Chesa-

peake with more cash flow to rein-

vest in its drilling program, thereby

providing a key component of the

funding required to continue the

company's growth.

LETTER TO SHAREHOLDERS

The success of this growth

through the drillbit strategy is most

evident in Chesapeake's oil and natu-

ral gas production growth. In the

fourth quarter of fiscal 1993, our first

full quarter as a public company,

Chesapeake produced 1 .1 Bcfe. By

the fourth quarter of fiscal 1996, just

three years later, Chesapeake's pro-

duction had increased sixteenfold to

17.6 Bcfe.

Dtiring fiscal 1 996, Chesapeake

Chesapeake's growth through the drilibit

strategy has resulted in high returns on

investment, greater reserve recovery,

and increased efficiency and cash flow.

continued its high level ofdrilling ac-

tivity, finishing as the fourth most ac-

tive driller of new wells and ranking

first in average depth drilled per well

(more than 16,000 feet).

By drilling deeper and utilizing

today's most sophisticated technolo-

gies in developing well-known, hut

underexploited reservoirs, our com-

pany can reduce exploration risk and

increase the potential for discovering

large amounts of new oil and natural

gas reserves.