Chesapeake Energy 1996 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1996 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Qutcompany has led the sec-

tor in totil shareholder return

for the past two years 544%

n fiscal 995 and 431% in fiscal

1996. We believe this success is at-

tributable to our focused and clearly

articulated strategy and to our expe-

rienced and highly motivated iiian-

agement team, supported by techni-

cal teams second to none.

Since Chesapeake's inception in

1989, our business strategy has been

"growth through the drill hit." Using

this strategy, the company has rap-

idly expanded its reserves and produc-

tion through the acquisition and de-

velopment of large blocks of unde-

veloped acreage overlying deep, tin-

derdeveloped geological reservoirs

such as fractured carbonates. We are

attracted to these reservoirs because

they offer low geological risk, large

reserve potential, and the opportu-

nity to earn attractive economic re-

CHESAPEAKE ENERGY CORPORATION

CHESAPEAKE CONTINUES to

lead the independent oil and

CHESAPEAKE'S CONTINUED PROGRESS

natural gas industry in creating

shareholder value.

turns through the application ofad-

vanced drilling and completion tech-

niques.

Our successful implementation of

this strategy has enabled Chesapeake

to become one of the premier inde-

pendent energy producers. As the

corn panv has matured, we have de-

veloped the following five competi-

tive advantages that we believe are the

keys to continued growth:

Growth through the drillbir

business strategy;

Five-year inventory offuture

drilling opportunities created

by establishing dominant

leasehold positions;

Technological leadership result-

ing in new oil and gas discover-

ies and a lower cost structure;

Superior profit margins that

generate high levels of cash

flow per unit of production to

reinvest in growing our

LETTER TO SHAREHOLDERS

company; and

Close alignment of shareholder

and management interests

resulting from management's

40% ownership stake.

Before explaining why we believe

these competitive advantages can

continue to generate attractive re-

turns to our shareholders, we will

highlight our results for fiscal 1996.

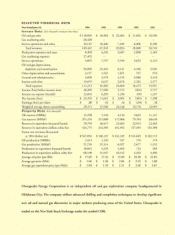

During the year, Chesapeake:

Increased oil and natural gas

production 88% to 60 Bcfe;

Increased total revenues 122%

to $149.4 million;

Increased earnings 100% to

$23.4 million and earnings per

share 91% to $0.80;

Increased operating cash flow

100% to $90.3 million;

Increased proved reserves 76%

to 425 Bcfe and increased

SEC-PV1O value 193% to

$547 million.