Chesapeake Energy 1996 Annual Report Download

Download and view the complete annual report

Please find the complete 1996 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHESAPEAKE ENERGY CORPORATION

CHESAPEAKE Annual Report

Table of contents

-

Page 1

CHESAPEAKE ENERGY CORPORATION CHESAPEAKE Annual Report -

Page 2

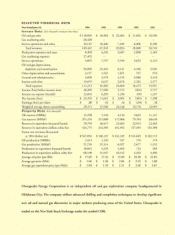

...496 21.85 1.88 $ $ 2.21 $ 3.01 Chesapeake Energy Corporation is an independent oii and gas exploration company headquartered in Oklahoma City. The company utilizes advanced drilling and completion techniques to develop significant new oil and natural gas discoveries in major onshore producing... -

Page 3

CHESAPEAKE ENERGY CORPORATION CHESAPEAKE Annual Report TABLE OF CONTENTS 4 LETTER TO SHAREHOLDERS AREAS OF OPERATION DIRECTORS AND EMPLOYEES 14 24 29 FINANCIALS -

Page 4

CHESA More value can be created FUNDAMENTAL BELIEF N°. by discovering new oil and gas reserves than by purchasing existing reserves. -

Page 5

Chesapeake's drilling in the downdip Giddings Field ofTexas has proven the effectiveness of utilizing horizontal drilling technology in developing larger per-well reserves. -

Page 6

... the drillbir business strategy; Five-year inventory of future drilling opportunities created by establishing dominant leasehold positions; Technological leadership resulting in new oil and gas discoveries and a lower cost structure; Superior profit margins that generate high levels of cash flow per... -

Page 7

CHESAPEAKE ENERGY CORPORATION 450,000 1996'S ACHIEVEMENTS 70,000 600,000 1992 1993 994 995 Proved Reserves Growth 56000 400,000 42,000 360,000 28,000 240,000 4,000 20,000 ,92 'r3 '!' I [ !' ll 2,250 'r3 l4 Oil and Gas Production Growth Asset Growth These graphs illustrate ... -

Page 8

... ENERGY CORPORATION TO BECOME A LEADER in any industry, and more importantly, CHESAPEAKE'S COMPETITIVE ADVANTAGES to remain a leader, a company must develop distinctive core R1u,k TO P OPERATORS ONSHORE USA Operator narre Rig Covrt Avg. Depth c o rn p e t e n c i e s t h a t L 2. 3. Union... -

Page 9

... properties. This strategy makes Chesapeake fundamentally different and more profitable than most independent energy companies for three reasons. from owning new wells. J ust as in operating any First, this strategy enables our company to capture more upside by drilling new wells that have much... -

Page 10

CHESAPEAKE ENERGY CORPORATION COMPETITIVE ADVANTAGE N°. Five-year inventory of drilisites The leading indicator of any oil and natural gas producer's potential for future success is the Through Chesapeake's strategy of building a long-term Inventory of future drillsites, a prospective inves- ... -

Page 11

...sign and manufacture horizontal drilling equipment, and our willingness to experiment with new ideas have allowed Chesapeake to drill increasingly deeper horizontal wells and thereby expand the boundaries of our 3-D seismic projects in the Knox, Lovington, and Williston Basin areas, we have planned... -

Page 12

... number of we! Is; clude lease operating expenses and production taxes), general and administrative expenses, and oil and gas depreciation, depletion, and amorti- Chesapeake's low-cost operating structure and drilling efficiencies generate the highest profit margins in the compans peer group... -

Page 13

CHESAPEAKE ENERGY CORPORATION COMPETITIVE ADVANTAGE N°. Management's large equity stake fifth competitive advantage is management and Chesapeake's Looking Forward Chesapeake's growth strategy has always been based on three fundamental beliefs: directors' ownership of approximately 42% of ... -

Page 14

C H ES A PE\KI IN...1Rd Large amounts of oil and gas can be found in fractured carbonate reservoirs. battery is Iocate. in the heart of the/ company's Masters C(rl. drilling activities. -

Page 15

:'y t / ,,*. A4 - r 1 -

Page 16

CHESAPEAKE ENERGY CORPORATION FOCUSING ON fractured carbonate reservoirs where advanced drilling CHESAPEAKE'S AREAS OF OPERATION technologies provide a competitive advantage, Chesapeake's drilling activities are diversified over a number of geographical areas and geological formations. This ... -

Page 17

CHESAPEAKE ENERGY CORPORATION Horizontal drilling technology has evolved With continuing technological improvements, Chesapeake can now rapidly during Chesapeake's three year history as a public company. drill horizontal wells to 16,000', providing increased exploration opportunities. ... -

Page 18

..., PRIMARY OPERATING AREAS Chesapeake's exploration teams continue to search for projects where the company can leverage its proven exploration expertise into new areas. Oklahoroa City Arkom a Basin Chesapeake's three primary operating areas are the Giddings Field in Texas; the Louisiana Austin... -

Page 19

... units and thereby reduce competition for reserves from offsetting wells; Chalk production. After drilling more than 175 wells in the downdip Giddings during the past three years, Chesapeake plans to drill approximately 25 net wells in this area in fiscal 1997. The company will also continue its... -

Page 20

...months later, Chesapeake is the leading lease- hold owner in the Louisiana Trend with over one million acres. The company's early entry and aggressive acquisition program enabled our land cal understanding of the Austin Chalk and our entrepreneurial cul- department to acquire the Louisiana Trend... -

Page 21

... its drilling activity in this area from five wells started in fiscal 1996 to 25-35 wells planned for fiscal 1997. Increasing production from this area should be the driver that provides the opportunity for the company to double its production during the next two years. pating in several gas... -

Page 22

CHESAPEAKE ENERGY CORPORATION PRIMARY OPERATING AREAS Southern Oklahoma During the past three years, Drilled Wells Knox Sholem Alechem Chesapeake has also devel- oped two important new projects in Oklahoma, Knox and Sholem Alechem. In Knox, Chesapeake was the first company to establish ... -

Page 23

... efforts in this area. is using 3-D seismic to target Red River "C" and "D" vertical prospects. The company's first well in this area gressive land acquisition campaign and initial drilling success in fiscal 1996, Chesapeake plans to significantly expand its drilling and seismic activities in the... -

Page 24

CHESA PEAKE EN22 CORPORATION Technology is the key to FUNDAMENTAL BELIEF N° reducing risk 3 and increasing returns. Ch.. a pea fl. - adv d d. activities :111 t Knox, Sholem M.e4 , and Ids of olden Trend ythern Odah a ha vItaIi;ed areas nce sicJ Ia -

Page 25

-

Page 26

... 1993. He founded Heizer Corp. in 1969 and served as Chairman and Chief Executive Officer until 1986, when Heizer Corp. was reorganized into a number of public and private companies. Mr. Heizer was assistant entitles since 1983. Mr. Ward gradu- of the Fuqua School of Business at Duke University... -

Page 27

CHESAPEAKE ENERGY CORPORATION Director Breene M. Kerr has served as a director of the company since February 1993. In 1969, Mr. Kerr founded Kerr Consolidated, Inc.,.of which he is currently Chairman and President, and co-founded the Resource Analysis and Management Group. From 1967 to 1969, he was... -

Page 28

... Dobbs Compliance Manager Richey Albright Foreman Carla Brittain-Reed Geology Technician Mandy Duane Title Assistant Pumper Gary Collings Division Order Analyst Sandra Alvarado Laurie Brown Accounting Gary Dunlap Land Manager Louisiana Tom L. Ward President and Chief Operating Officer Lease... -

Page 29

... Assistant Supervisor Krisri Hirz Receptionist Jennifer Grigsby Accounting Manager Michael Johnson Assistant Controller Mark Lester Senior Vice President- Carrol McCoy Lease Analyst Alan Page Gas Revenue Carol Holden Division Order Supervisor Coordinator Brian Gross Production Engineer... -

Page 30

... Field Supervisor Cheryl Self Land Technician Landman Robert Powell, Jr. Production Facility Operator Thomas Williams Drilling Engineer Lawrence Rogers Production Foreman Stephanie Shedden Lease Records Patsy Warrers Gas Marketing Coordinator Division Order Analyst Brian Winter Geologist... -

Page 31

... ENg'RJ CORPORATION CHESAPEAKE Financial Section 1996 FINANCIALS TABLE OF CONTENTS 30 SELECTED FINANCIAL DATA MANAGEMENT'S DISCUSSION AND ANALYSIS 3' 38 39 REPORT OF INDEPENDENT ACCOUNTANTS CONSOLIDATED BALANCE SHEETS 40 CONSOLIDATED STATEMENTS OF INCOME CONSOLIDATED STATEMENTS OF CASH FLOWS... -

Page 32

CHESAPEAKE EN3(Y CORPORATION SELECTED FINANCIAL DATA Year EndedJune 30, 1996 1995 1994 1993 1992 Revenues: ($ in thousands, except per share data) Oil and gas sales Gas marketing sales $110,849 28,428 6,314 3,831 149,422 8,303 27,452 4,895 50,899 $ 56,983 8,836 1,524 67,343 $ 22,404 ... -

Page 33

... ENW GY CORPORATION MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS ration compared to 60.2 Bcfe of production, resulting in Overview Chesapeake's revenue, net income, operating cash flow, and production reached record levels in 1996. Increased cash flow from... -

Page 34

CHESAPEAKE CORPORATION RESULTS OF OPERATIONS For the fiscal year ended June 30, 1996, the company realized net income of $23.4 million, or $0.80 per comby major field area for fiscal 1996 and fiscal 1995. The company's gas production represented approximately 86% of the company's total production ... -

Page 35

... natural gas marketing services including commodity price structuring, contract administration and Peak. This transaction resulted in recognition of a $1.8 million pre-tax gain during the fourth fiscal quarter of 1996 reported in Interest and Other. A deferred gain from the sale of service company... -

Page 36

... of its future oil and gas production. These strategies include swap arrangements that establish an index-related price above which the company pays the hedging partner and below which the com- Statements), were $4.8 million in fiscal 1996, up 33% from $3.6 million in fiscal 1995, and up from... -

Page 37

... an additional 519,750 shares of Common Stock 12% Senior Notes are redeemable at the option of the company at any time on or after March 1, 1998. All of the company's subsidiaries except Chesapeake Gas Development Corporation ("CGDC") and Chesapeake Energy Marketing, Inc. ("CEMI") have fully and... -

Page 38

... $11 million in fiscal 1996 as compared to $15 million in 1995. In fiscal 1996, other property and equipment additions were $8.8 million, primarily as a result of the purchase of additional office buildings in the company's headquarters complex in Oklahoma City. The company's capital spending... -

Page 39

... internally generated or external capital resources. Forward Looking Statements The information contained in Management's Discussion and Analysis of Financial Condition and Results of Operations in this Annual Report includes certain forward-looking statements. When used in this document, the words... -

Page 40

...have audited the accompanying consolidated bal- To the Board of Directors and Stockholders of Chesapeake Energy Corporation In our opinion, the consolidated balance sheet and the related consolidated statements of income, of cash flows and of stockholders' equity as of and for each of the two years... -

Page 41

CHESAPEAKE ENERGY CORI'ORATION CONSOLIDATED BALANCE SHEETS June 30, 1996 1995 Assets ($ in thousands) Current Assets: Cash and cash equivalents Accounts receivable: Oil and gas sales Gas marketing sales Joint interest and other, net of allowances of $340,000 and $452,000, respectively Related ... -

Page 42

CHESAPEAKE ENERGY CORPORATION CONSOLIDATED STATEMENTS OF INCOME Year Ended June 30, 1996 1995 1994 Revenues: ($ in thousands, extept per share data) Oil and gas sales Gas marketing sales $110,849 28,428 6,314 3,831 149,422 8,303 27,452 4,895 50,899 3,157 4,828 13,679 113,213 36,209 12,854 23,... -

Page 43

...726) 10,077 2,622 19,423 Cash flows from investing activities: Exploration, development and acquisition of oil and gas properties Proceeds from sale of oil and gas equipment, leasehold and other Other proceeds from sales Investment in gas marketing company, net of cash acquired (347,294) 11,416 698... -

Page 44

... No cash consideration is exchanged for inventory under this financing arrangement until actual draws on the inventory are made. In fiscal 1996 and 1995, the company recognized income tax benefits of $7,950,000 and $1,229,000, respec- tively, related to the disposition of stock options by directors... -

Page 45

...of period Paid-in Capital: Balance, beginning of period Exchange of Preferred Stock Issuance of Common Stock Warrants Exercise of stock options and warrants Issuance of Common Stock Offering expenses and other Tax benefit from exercise of stock options Change in par value from $.0022 to $.10 Balance... -

Page 46

... include the accounts of Chesapeake Operating, Inc. ("COl"), Chesapeake Exploration Limited Partnership ("CEX"), a limited partnership, Chesapeake Gas Development Corporation ("CGDC"), Chesapeake Energy Marketing, Inc. ("CEMI"), Lindsay Oil Field Sup- ply, Inc.("LOF"), Sander Trucking Company, Inc... -

Page 47

...industry. The company sold its service company assets to Peak for $6.4 million, and simultaneously invested $2.5 million in exchange for a 33.3% partnership interest in Peak. This transaction resulted in recognition of a $1.8 million pre-tax gain during the fourth fiscal quarter of 1996 reported in... -

Page 48

CHESAPEAKE ENERGY CORPORATION action. Results for hedging transactions are reflected in oil and gas sales to the extent related to the company's oil and gas production. tical notes in a registered exchange offer (also referred to as the "10.5% Senior Notes"). Debt Issue Costs Other assets relate ... -

Page 49

... sales; restricted payments; the incurrence of additional indebtedness and the issuance of preferred stock; liens; sale and leaseback transactions; lines of busi- and CGDC owns 6% of the company's producing oil and gas properties, based on the present value of future net revenue at June 30, 1996... -

Page 50

CHESAPEAKE ENERGYCORPORATION CONDENSED CONSOLIDATING BALANCE SHEET As of June 30, 1996 ($ in thousands) CEX Subsidiary Guarantors Non-Guarantor Company Others Combined Subsidiaries (Parent) Eliminations Consolidated Assets Current Assets: Cashandcashequivalents Accounts receivable Inventory $... -

Page 51

... (Parent) Eliminations Consolidated As sets Current Assets: Cash and cash equivalents $ $ 53,227 $ 30,693 8,895 633 93,448 (16,723) 53,227 $ 40,560 8,895 633 5$ 777 31 2,303 $ 10 $ Accounts receivable Inventory 9,867 Other Total Current Assets Property and equipment: Oil and gas properties... -

Page 52

CHESAPEAKE EN5O CORPORATION CONDENSED CONSOLIDATING STATEMENTS OF INCOME For theYear Ended June 30, t996 ($ in thousands) CEX Subsidiary Guarantors Non-Guarantor Company Subsidiaries Others Combined (Parent) Eliminations Consolidated Revenues Oilandgassales Gas marketing sales $ 103,712 $ (1,... -

Page 53

... EN CORPORATION CONDENSED CONSOLIDATING STATEMENTS OF INCOME For theYear Ended June 30, 1994 ($ in thnusanth) CEX Subsidiary Guarantors Non-Guarantor Company Others Combined Subsidiaries (Parent) Eliminations Consolidated Revenues Oil and gas sales $ Oil and gas service operations Interest... -

Page 54

CHESAPEAKE EN5R2 CORPORATION CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS For theYear Ended June 30, 1996 ($ in thousands) CEX Subsidiary Guarantors Non-Guarantor Company Others Combined Subsidiaries (Parent) Eliminations Consolidated Cash flows from operating activities Cash flows from $... -

Page 55

CHESAPEAKE EN5Y CORPORATION CONDENSED CONSOLIDATING STATEMENTS OF CASH FLOWS For theYear Ended June 30, 1995 ($ in thousands) CEX Non-Guarantor Company Subsidiary Guarantors Subsidiaries Combined (Parent) Others Eliminations Consolidated Cash flows from operating activities Cash flows from ... -

Page 56

... to a bank, variable interest at a referenced base rate + 1.75% (10% per annum at June 30, 1996), collateralized by office buildings, payments due in monthly installments through May 1998 Notes payable to various entities to acquire oil service equipment, interest varies from 7% to 11% per annum... -

Page 57

... the facility size to $125 million and expanded its bank group with Union Bank remaining as agent. The maturity date of the Revolving Credit Facility is April 30, 2001. The facility provides for interest at the Union Bank reference rate (8.25% at June 30, 1996) or, at the option of the company the... -

Page 58

... $2.3 million at June 30, 1996, which is available to offset future federal income taxes payable and has no expiration date. In accordance with certain provisions of the Tax Reform Act of 1986, a change of greater than 50% of the beneficial ownership of the company within a three-year period... -

Page 59

... GPM Gas Corporation Plains Marketing and Transportation, Inc. Texaco Exploration & Production, Inc. $ 6,190 $ 6,105 $ 2,659 $ 2,249 28% 27% 12% 10% Bonus Plan. The company contributed $187,000, $95,000 and $70,000 to the Savings and Incentive Stock Bonus Plan during the fiscal years ended June... -

Page 60

CHESAPEAKE ENERGY CORPORATION exercisable at dates determined by the Stock Option Committee of the Board of Directors. No options may be granted under the NSO Plan after December 10, 2002. fund a portion of the company's exploration and development capital expenditures and fot general cotporate ... -

Page 61

... operated by the com- Hedging Activities Periodically the company utilizes hedging strategies to hedge the price of a portion of its future oil and gas production. These strategies include swap arrangements that establish an index-related price above which the company pays the hedging partner... -

Page 62

... consolidated net operating results of the company's oil and gas operations. June 30, ($ in thousands) 1996 1995 1994 Oil and gas sales Production costs (a) $110,849 $56,983 $22,404 (8,303) (4,256) (3,647) Depletion and depreciation Imputed income tax provision (b) Results of operations from oil... -

Page 63

... existing equipment and operating methods. Presented below is a summary of changes in estimated reserves of the company based upon the reports prepared by Williamson for 1996, 1995 and 1994, along with those prepared by the company's petroleum engineers for 1996 and 1995: 1995 Gas 1996 Oil (MBbI... -

Page 64

...year-end economic conditions. Estimated future income taxes are computed using current statutory income tax rates including consideration for the current tax basis of the properties and related carryforwards, giving effect to permanent differences and tax credits. The resulting future net cash flows... -

Page 65

CHESAPEAKE ENERGY CORPORATION LJ E The principal sources of change in the standardized measure of discounted future net cash flows are as follows: june 30, ($ in thousands) 1996 1995 1994 Standardized measure, beginning of year Sales of oil and gas produced, net of production costs Net changes in... -

Page 66

CHESAPEAKE ENERGY CORPORATION Annual Report Evaluation and Information Request Card We would appreciate your feedback about our Annual Report. How wouldyou rate our communication on the following: 1) Chesapeake's strategy for continued growth excellent I I satisfactory unsatisfactory 2) ... -

Page 67

NO POSTAGE NECESSARY IF MAILED IN THE UNITED STAT ES BUSINESS REPLY MAIL FIRST-CLASS MAIL PERMIT NO: 1049 OKLAHOMA CITY OK POSTAGE WILL BE PAID BY THE ADDRESSEE CHESAPEAKE ENERGY CORPORATION Post Office Box 18496 Oklahoma City, OK 73 154-9956 I -

Page 68

... Last Common Stock Chesapeake Energy Corporation's common stock is listed on the New York Stock Exchange under the symbol CHK. As of September 30, 1996, there were approximately 7,815 beneficial owners of common stock. Corporate Headquarters 6100 North Western Avenue Oklahoma City, Oklahoma 73118... -

Page 69

CHESAPEAKE ENERGY CORPORATION 6100 North Western Avenue Oklahoma City, Oklahoma 73118