Charles Schwab 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER FROM THE CHIEF EXECUTIVE OFFICER 76 LETTER FROM THE CHIEF EXECUTIVE OFFICER

Fred Reichheld and Bain & Company, who together

pioneered the concept of promoter scoring, shows

that high Promoter Scores can be an effective

predictor of future growth for a company. And it

makes sense: If your clients feel so strongly about

the service you provide that they want to refer you

to others, your rm is likely to continue growing.

What are some of the things that

didn’t go so well in 2013?

Just as in the area of things that went well,

there are two categories here: those things that

didn’t go so well that we have no control over,

and those things that didn’t go so well that

we need to look in the mirror and address.

While the increase in long-term interest rates

in 2013 helped us, the Federal Reserve’s overall

policies governing interest rates were the dominant

environmental factor outside of our control that

hurt our nancial results. With the Fed Funds

target interest rate set at near zero, we continued

to waive money market fund fees — $674 million

in 2013. We did so to ensure that our clients

invested in Schwab managed money market

funds would not experience negative returns.

These waived fees come, dollar-for-dollar, off our

top-line revenue and, arguably, our bottom-line

pre-tax prots. And while the Fed started to loosen

up longer-term interest rates by moving toward a

reduction in its program of buying $85 billion of

xed income securities every month, those long-

term rates still remained at historical lows. As a

result, the spread that we could earn between

what we pay clients on their idle cash and what

we can invest it at was constrained. It did improve

but was still quite a bit less than what we expect

to earn in a more historically normal interest rate

environment. In fact, we believe the positive revenue

impact of a more normal interest rate environment

will be measured in billions of dollars per year.

Also outside of our control in 2013, despite the

outstanding year for the U.S. stock markets, was the

unexpectedly low level of our clients’ stock trading.

As a result, our trading revenue did not perform as

well as we had expected. Although we saw some

revenue growth in trading, our expectations were

for higher levels of trading based on historical

averages for years following a presidential election.

Frankly, our projections proved to be too optimistic.

Can you discuss some of the areas

that didn’t go as well in 2013 that were

not a result of the environment?

At Schwab, we put a high value on humility, and

we are much harder on ourselves than others

might be. We set high standards for serving

our clients, rewarding our stockholders with

consistent and strong nancial performance, and

meeting the expectations of our regulators with

our risk management capabilities. And sometimes

we fall short. Two areas where we didn’t meet

our standards in 2013 stand out to me.

First, we fell short of our goals for client access to

our systems last spring. We had instances where

our clients could not access our website or other

electronic systems due to malicious actions by

third parties. Although one could argue that this

issue has affected most major nancial institutions

in the United States and revolves around global

challenges that are beyond our control, we don’t

accept that answer. We have to do better, and we

will strive to be better. Every year we invest hundreds

of millions of dollars in maintaining and upgrading

our technology in an effort to ensure that it is

available whenever and however our clients want

to access Schwab. Subsequent to the downtime

issues we faced in early 2013, we have invested

millions more dollars in an effort to prevent the

same situation from recurring. Can I assure our

clients that it will never happen again? No, I cannot.

Can I assure them that all of us at Schwab, and

the technology rms we work with, are working

hard to avoid the situation happening again? Yes.

The second area I would highlight is related to

the challenges around the overall regulatory

environment. Schwab and our subsidiaries are

regulated by a number of governmental entities

including the Federal Reserve, the Ofce of the

Comptroller of the Currency, and the Securities and

Exchange Commission. Some of our subsidiaries

are also regulated by self-regulatory organizations

like the Financial Industry Regulatory Authority.

Our regulators have important jobs to do, and we

have deep respect for their professionalism and

efforts. We have a strong culture of compliance, and

compliance is inherent in most everything we do.

We spend tens of millions of dollars and thousands

upon thousands of hours of staff time every year

in an effort to comply with the myriad rules and

regulations applicable to our business. Despite

these efforts, we still incur regulatory nes. While

the amount of regulatory nes we incurred in 2013

was not material, and almost all of it was from a

recently acquired subsidiary, I am still disappointed

that we were subject to any nes at all. While I

know that it is unrealistic to ever expect this amount

to be zero, I will always be disappointed if it isn’t.

We take our compliance obligations seriously,

and as the regulatory environment continues to

increase in complexity, our people will continue

to strive to do great work on behalf of our clients

while meeting our regulatory responsibilities.

What stands out to you as particularly

innovative actions you undertook in 2013?

Last year was a huge year for innovation at Schwab.

But at Schwab, we strive to innovate not just for

the sake of it, but for the benet of our clients.

Advancements that come to mind from 2013 are:

»The launch of ETF OneSource™, offering

Schwab clients commission-free, online access

to 119 ETFs from Schwab and ve other providers;

»The introduction of the Schwab Accountability

Guarantee™, which offers a refund of

program fees paid by clients if, for any

reason, they are not happy with one of our

participating investment advisory services;

»Additions to our lineup of low-cost Schwab-

managed ETFs while our clients’ balances in

those ETFs nearly doubled to $16.9 billion;

»The growing reach of our brand through

expansion of our independent branch model,

ending the year with 24 independent branches

with strong momentum in leads and assets;

»The introduction of the Schwab Advisor Center®

app for Android™ devices to better serve our

independent investment advisor clients;

»The launch of the Schwab Retirement

Income Variable Annuity® to help

people at or near retirement;

»The introduction of the ThomasPartners®

dividend equity investment strategy to

our clients;

»Continued integration of optionsXpress into

Schwab and expansion of its capabilities;

»Growth of our groundbreaking Schwab Index

Advantage® 401(k) plan and preparation for

the launch of our full-service 401(k) program

that offers ETFs with real-time pricing and

investing, the rst major rm to do so;

»The introduction of Schwab OpenView

MarketSquare™, a review site that compiles

feedback and ratings from independent

RIAs on some of the leading technology

vendors and products in the industry, and our

online advisor directory to help individuals

nd an advisor who meets their needs;

»The launch of our new brand and advertising

campaign — Own your tomorrow™;

»Delivery of more than 100,000 nancial plans

for our clients, up 84 percent from 2012.

When you look to the future, what do you

see for Schwab and its stockholders?

I see a bright future for all our constituencies: our

clients, our stockholders, and our employees.

The multiyear strategy we began in 2009 to rebuild

investments in our client capabilities is paying

off. We are building trust with our clients and

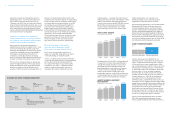

MONEY MARKET FUND

FEE WAIVERS

(IN MILLIONS)

2009

$224

2013

$674

2012

$587

2010

$433

2011

$568