Charles Schwab 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE CHARLES SCHWAB CORPORATION 2013 ANNUAL REPORT

MKT10448-26 (3/14)

00105085

THE CHARLES SCHWAB

CORPORATION

211 Main Street

San Francisco, CA 94105

(415) 667-7000

Schwab.com

AboutSchwab.com

twitter.com/CharlesSchwab

linkedin.com/company/CharlesSchwab

facebook.com/CharlesSchwab

youtube.com/user/CharlesSchwab

2013

Annual

Report

Table of contents

-

Page 1

2013 Annual Report THE CHARLES SCHWAB CORPORATION 2013 ANNUAL REPORT THE CHARLES SCHWAB CORPORATION 211 Main Street San Francisco, CA 94105 (415) 667-7000 Schwab.com AboutSchwab.com twitter.com/CharlesSchwab linkedin.com/company/CharlesSchwab facebook.com/CharlesSchwab youtube.com/user/... -

Page 2

At Schwab, we believe in the power of investing to transform people's lives. We see investing as an act of optimism and commitment to the future. We share this belief with our clients - those individual investors and the people and institutions who serve them - who also believe that personal ... -

Page 3

... Human Rights Campaign's Corporate Equality Index for the ninth consecutive year WALT BETTINGER PRESIDENT AND CHIEF EXECUTIVE OFFICER » 2013 CareerBuilder Best Companies to Work for in Arizona A Special Year Some time ago, a close friend and I discussed the nature of the annual letters that CEOs... -

Page 4

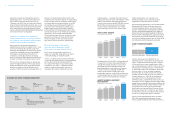

... investment advisors, or companies that sponsor retirement and other 2009 2010 2011 2012 2013 CLIENT PROMOTER SCORES 2013 47 INVESTOR SERVICES 58 ADVISOR SERVICES A DECADE OF CLIENT-FOCUSED INNOVATION Another proof point from 2013 is the rapid growth in assets that our clients have asked Schwab... -

Page 5

...of its capabilities; » Growth of our groundbreaking Schwab Index Advantage ® 401(k) plan and preparation for the launch of our full-service 401(k) program that offers ETFs with real-time pricing and investing, the first major firm to do so; MONEY MARKET FUND FEE WAIVERS (IN MILLIONS) $ 56 8 $433... -

Page 6

... JOE MARTINETTO EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER EXPENSES AS A PERCENTAGE OF AVERAGE CLIENT ASSETS 2013 0.6 4% 0.58% 0.55% 0.3 3% 0.18% Warmly, Morgan Stanley1 Bank of America2 E-Trade Ameritrade Schwab Financial Simply, Growth Finally, in 2013, our financial story began... -

Page 7

... MARGIN 30.4% 29.7% 18.3% 29.7% 31.4% 2009 2010 2011 2012 2013 significantly beyond the average mid-single-digit type returns we assumed. All told, net interest revenue and asset management fees were well above expectations even as trading revenue and money market fund fees were well below... -

Page 8

...% Assets in client accounts Schwab One® , other cash equivalents and deposits from banking clients Proprietary funds (Schwab Funds® and Laudus Funds®): Money market funds Equity and bond funds Total proprietary funds Mutual Fund Marketplace® (1): Mutual Fund OneSource® (2) Mutual fund clearing... -

Page 9

... Officer, Charles Schwab Investment Management, Inc. JAMES D. McCOOL Executive Vice President, Client Solutions JIM McGUIRE Executive Vice President and Chief Information Officer BERNARD J. CLARK Executive Vice President, Advisor Services NIGEL J. MURTAGH Executive Vice President, Corporate Risk... -

Page 10

... Identification No.) 211 Main Street, San Francisco, CA 94105 (Address of principal executive offices and zip code) Registrant's telephone number, including area code: (415) 667-7000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock - $.01 par value... -

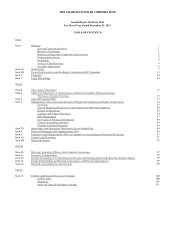

Page 11

...CORPORATION Annual Report On Form 10-K For Fiscal Year Ended December 31, 2013 TABLE OF CONTENTS Part I Item 1. Business General Corporate Overview Business Acquisitions Business Strategy and Competitive Environment Products and Services Regulation Sources of Net Revenues Available Information Risk... -

Page 12

... the Company, and located in San Francisco except as indicated), in securities brokerage, banking, money management, and financial advisory services. At December 31, 2013, the Company had $2.25 trillion in client assets, 9.1 million active brokerage accounts(a), 1.3 million corporate retirement plan... -

Page 13

... model, the Company can offer personalized service at competitive prices while giving clients the choice of where, when, and how they do business with the Company. Schwab's branches and regional telephone service centers are staffed with trained and experienced financial consultants (FCs) focused... -

Page 14

... specialized planning and full-time portfolio management; Banking - checking accounts linked to brokerage accounts, savings accounts, certificates of deposit, demand deposit accounts, first lien residential real estate mortgage loans (First Mortgages), home equity lines of credit (HELOCs), personal... -

Page 15

... clients through its Corporate Brokerage Retirement Services business and mutual fund clearing services to banks, brokerage firms and trust companies, and also offers proprietary mutual funds, ETFs, collective trust funds, and investment management outside the Company to institutional channels... -

Page 16

... administrator with the Company's investment, technology, trust, and custodial services. Retirement Business Services also offers the Schwab Personal Choice Retirement Account® for retirement plans. Regulation CSC is a savings and loan holding company and Schwab Bank, CSC's depository institution... -

Page 17

... broker-dealers and investment advisors are subject, cover all aspects of the securities business, including, among other things, sales and trading practices, publication of research, margin lending, uses and safekeeping of clients' funds and securities, capital adequacy, recordkeeping and reporting... -

Page 18

... Securities Exchange Act of 1934. All such filings are available free of charge either on the Company's website or by request via email ([email protected]), telephone (415-667-1959), or mail (Charles Schwab Investor Relations at 211 Main Street, San Francisco, CA 94105). Item 1A. Risk... -

Page 19

...privacy and security of client data. In addition, the rules and regulations could result in limitations on the lines of business the Company conducts, modifications to the Company's business practices, increased capital requirements, or additional costs. Financial reforms and related regulations may... -

Page 20

... held in banking or brokerage client accounts, a dramatic increase in the Company's client lending activities (including margin, mortgage-related, and personal lending), unanticipated outflows of company cash, increased capital requirements, other regulatory changes or a loss of market or customer... -

Page 21

...the Company's risk of loss. Examples of the Company's credit concentration risk include: ï,· large positions in financial instruments collateralized by assets with similar economic characteristics or in securities of a single issuer or industry; ï,· mortgage loans and HELOCs to banking clients which... -

Page 22

... condition. The Company is exposed to interest rate risk primarily from changes in the interest rates on its interest-earning assets (such as cash equivalents, short- and long-term investments, and mortgage and margin loans) relative to changes in the costs of its funding sources (including deposits... -

Page 23

.... The Company also faces risk related to external fraud involving the compromise of clients' personal electronic devices that can facilitate the unauthorized access to login and password information for their various online financial accounts, including those at the Company. Such risk has grown... -

Page 24

THE CHARLES SCHWAB CORPORATION Increased price competition from other financial services firms, such as reduced commissions to attract trading volume or higher deposit rates to attract client cash balances, could impact the Company's results of operations and financial condition. The industry in ... -

Page 25

...offices are located in leased premises. The corporate headquarters, data centers, offices, and service centers support both of the Company's segments. Item 3. Legal Proceedings For a discussion of legal proceedings, see "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated... -

Page 26

...Purchases of Equity Securities CSC's common stock is listed on The New York Stock Exchange under the ticker symbol SCHW. The number of common stockholders of record as of January 31, 2014, was 7,191. The closing market price per share on that date was $24.82. The quarterly high and low sales prices... -

Page 27

... release of restricted shares. The Company may receive shares delivered or attested to pay the exercise price and/or to satisfy tax withholding obligations by employees who exercise stock options (granted under employee stock incentive plans), which are commonly referred to as stock swap exercises... -

Page 28

... tax rate Capital expenditures - purchases of equipment, office facilities, and property, net Capital expenditures, net, as a percentage of net revenues Performance Measures Net revenue growth (decline) Pre-tax profit margin Return on average common stockholders' equity (3) Financial Condition (at... -

Page 29

... of client assets (e.g., Mutual Fund OneSource funds) directly impact asset management and administration fees. (3) New brokerage accounts include all brokerage accounts opened during the period, as well as any accounts added via acquisition. This metric measures the Company's effectiveness... -

Page 30

...a useful metric when comparing period-to-period client asset flows. The following one-time flows were excluded from core net new assets. ï,· 2013 excludes outflows of $74.5 billion relating to the planned transfer of a mutual fund clearing services client. The Company also reduced its reported total... -

Page 31

... of 315,000 new brokerage accounts from the acquisition of optionsXpress in 2011. Active brokerage accounts reached a record 8.8 million, up 3% from 2011. Net revenues increased by 4% in 2012 from 2011 primarily due to increases in asset management and administration fees, net interest revenue, and... -

Page 32

... in restrictions on capital distributions and discretionary cash bonus payments to executive officers. The Company does not expect the Final Regulatory Capital Rules to have a material impact on the Company's business, financial condition, and results of operations. On October 24, 2013, the Federal... -

Page 33

...revenues $ 100 % $ - - (1)% 100 % Asset Management and Administration Fees Asset management and administration fees include mutual fund service fees and fees for other asset-based financial services provided to individual and institutional clients. The Company earns mutual... -

Page 34

...and administration fees. Mutual fund service fees increased by $84 million, or 8%, in 2013 from 2012, due to market appreciation and growth in client assets invested in the Company's Mutual Fund OneSource funds and equity and bond funds, partially offset by a decrease in net money market mutual fund... -

Page 35

... Cash and investments segregated Broker-related receivables (1) Receivables from brokerage clients Securities available for sale (2) Securities held to maturity Loans to banking clients Loans held for sale Total interest-earning assets Other interest revenue Total interest-earning assets Funding... -

Page 36

... average revenue trades, trades by clients in asset-based pricing relationships, and all commission-free trades, including the Company's Mutual Fund OneSource funds and ETFs, and other proprietary products. Clients' daily average trades is an indicator of client engagement with securities markets... -

Page 37

... intangible assets relating to the optionsXpress acquisition. Growth Rate 2012-2013 12 % 7% (1)% 7% 3% 9% 9% $ Year Ended December 31, Compensation and benefits Professional services Occupancy and equipment Advertising and market development Communications Depreciation and amortization Class action... -

Page 38

... from product sales performance in the Company's branch offices. Employee benefits and other expense increased in 2012 from 2011 primarily due to increases in payroll taxes and the Company's 401(k) plan expense due to increases in average full-time employees and incentive compensation, and an... -

Page 39

...Company provides financial services to individuals and institutional clients through two segments - Investor Services and Advisor Services. The Investor Services segment provides retail brokerage and banking services to individual investors, retirement plan services, and corporate brokerage services... -

Page 40

... short-term interest rates had on the Company's average net interest margin. Asset management and administration fees increased primarily due to increases in advice solutions fees and mutual fund service fees. Advice solutions fees increased due to growth in client assets enrolled in advisory offers... -

Page 41

... solutions fees. Mutual fund service fees increased due to market appreciation and growth in client assets invested in the Company's Mutual Fund OneSource funds, and equity and bond funds. Advice solutions fees increased due to growth in client assets enrolled in advisory offers. Trading revenue... -

Page 42

... Registration Statement) on file with the SEC which enables CSC to issue debt, equity, and other securities. CSC maintains excess liquidity in the form of overnight cash deposits and short-term investments to cover daily funding needs and to support growth in the Company's business. Generally, CSC... -

Page 43

... and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) Schwab Schwab's liquidity needs relating to client trading and margin borrowing activities are met primarily through cash balances in brokerage client accounts, which were $33... -

Page 44

...are intended to ensure the general financial soundness and liquidity of broker-dealers. These regulations prohibit optionsXpress, Inc. from paying cash dividends or making unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount of less than... -

Page 45

... Company's cash position and cash flows include investment activity in security portfolios, levels of capital expenditures, acquisition and divestiture activity, banking client deposit activity, brokerage and banking client loan activity, financing activity in long-term debt, payments of dividends... -

Page 46

...Business Acquisitions On December 14, 2012, the Company acquired ThomasPartners, Inc., a growth and dividend income-focused asset management firm, for $85 million in cash. On September 1, 2011, the Company acquired optionsXpress, an online brokerage firm primarily focused on equity option securities... -

Page 47

... sheet that are generally short-term in nature (e.g., payables to brokers, dealers, and clearing organizations) or without contractual payment terms (e.g., deposits from banking clients, payables to brokerage clients, and deferred compensation). Less than 1 Year Credit-related financial instruments... -

Page 48

... and Analysis of Financial Condition and Results of Operations (Tabular Amounts in Millions, Except Ratios, or as Noted) RISK MANAGEMENT The Company's business activities expose it to a variety of risks, including operational, credit, market, liquidity, compliance and legal risk. The Company has... -

Page 49

... ongoing process of upgrading, enhancing, and testing its technology systems. This effort is focused on meeting client needs, meeting market and regulatory changes, and deploying standardized technology platforms. Operational risk also includes the risk of human error, employee misconduct, external... -

Page 50

..., for margin loan and securities lending agreements, collateral arrangements require that the fair value of such collateral exceeds the amounts loaned. The Company's credit risk exposure related to loans to banking clients is actively managed through individual and portfolio reviews performed by... -

Page 51

... not purchase subprime loans (generally defined as extensions of credit to borrowers with a FICO score of less than 620 at origination), unless the borrower has compensating credit factors. At December 31, 2013, approximately 1% of both the First Mortgage and HELOC portfolios consisted of loans to... -

Page 52

... cost of all non-agency residential mortgage-backed securities represented less than 1% of the securities available for sale and securities held to maturity portfolios. Schwab performs clearing services for all securities transactions in its client accounts. Schwab has exposure to credit risk... -

Page 53

...its investments in Schwab sponsored money market funds (collectively, the Funds) resulting from clearing activities. At December 31, 2013, the Company had $261 million in investments in these Funds. Certain of the Funds' positions include certificates of deposits, time deposits, commercial paper and... -

Page 54

... compliance with applicable legal and regulatory requirements. These procedures address issues such as business conduct and ethics, sales and trading practices, marketing and communications, extension of credit, client funds and securities, books and records, anti-money laundering, client privacy... -

Page 55

...and may obtain up to five prices on assets with higher risk of limited observable information, such as non-agency residential mortgage-backed securities. The Company's primary independent pricing service provides prices based on observable trades and discounted cash flows that incorporate observable... -

Page 56

... Company's annual goodwill impairment testing date is April 1st. In testing for a potential impairment of goodwill on April 1, 2013, management performed a qualitative assessment of each of the Company's reporting units (generally defined as the Company's businesses for which financial information... -

Page 57

... specified levels, the Company may reduce a borrower's committed line or may liquidate collateral. At December 31, 2013 and 2012, the allowance for loan losses related to personal loans secured by securities was immaterial. Legal and Regulatory Reserves Reserves for legal and regulatory claims and... -

Page 58

...changes in equity valuations; ï,· the Company's ability to monetize client assets; ï,· the performance or valuation of securities available for sale and securities held to maturity; ï,· trading activity; ï,· the level of interest rates, including yields available on money market mutual fund eligible... -

Page 59

... customer securities loaned out as part of the Company's securities lending activities. Equity market valuations may also affect the level of brokerage client trading activity, margin borrowing, and overall client engagement with the Company. Additionally, the Company earns mutual fund service fees... -

Page 60

... must report the breach to the Company's Corporate Asset-Liability Management and Pricing Committee (Corporate ALCO) and establish a plan to address the interest rate risk. This plan could include, but is not limited to, rebalancing certain investment portfolios or using derivative instruments... -

Page 61

...Securities Held to Maturity Note 6. Loans to Banking Clients and Related Allowance for Loan Losses Note 7. Equipment, Office Facilities, and Property Note 8. Intangible Assets and Goodwill Note 9. Other Assets Note 10. Deposits from Banking Clients Note 11. Payables to Brokers, Dealers, and Clearing... -

Page 62

... revenue Other - net Provision for loan losses Net impairment losses on securities (1) Total net revenues Expenses Excluding Interest Compensation and benefits Professional services Occupancy and equipment Advertising and market development Communications Depreciation and amortization Class action... -

Page 63

... losses on securities Other reclassifications included in other revenue Other Other comprehensive (loss) income, before tax Income tax effect Other comprehensive (loss) income, net of tax Comprehensive Income See Notes to Consolidated Financial Statements. $ $ 2013 1,071 $ 2012 928 $ 2011 864... -

Page 64

... 31, 2013 and 2012, respectively) Loans to banking clients - net Equipment, office facilities, and property - net Goodwill Intangible assets - net Other assets Total assets Liabilities and Stockholders' Equity Deposits from banking clients Payables to brokers, dealers, and clearing organizations... -

Page 65

...and equity awards assumed for business acquisitions (See note "24 - Business Acquisitions") Securities purchased during the year but settled after year end Non-cash financing activity: Exchange of Senior Notes (See note "13 - Borrowings") See Notes to Consolidated Financial Statements. 2013 $ 1,071... -

Page 66

... Balance at December 31, 2010 Net income Other comprehensive income, net of tax Issuance of common stock for business acquisition Dividends declared on common stock Stock option exercises and other Stock-based compensation and related tax effects Other Balance at December 31, 2011 Net income Other... -

Page 67

... asset based fees, such as third-party mutual fund service fees, trust fees, 401(k) record keeping fees, and mutual fund clearing and other service fees. In 2013, 2012, and 2011, the Company waived a portion of its asset management fees earned from certain Schwab-sponsored money market mutual funds... -

Page 68

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Principal transaction revenue is primarily comprised of revenue from trading activity in client fixed income securities, which is... -

Page 69

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) models to estimate the expected future cash flow from the securities to estimate the credit loss. Expected cash flows are discounted... -

Page 70

... estate mortgage loan (First Mortgage) and home equity line of credit (HELOC) portfolios. Loss severity estimates are based on the Company's historical loss experience and market trends. The estimated loss severity (i.e. loss given default) used in the allowance for loan loss methodology for HELOC... -

Page 71

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Company's annual impairment testing date is April 1st. The Company can elect to qualitatively assess goodwill for impairment if ... -

Page 72

...and may obtain up to five prices on assets with higher risk of limited observable information, such as non-agency residential mortgage-backed securities. The Company's primary independent pricing service provides prices based on observable trades and discounted cash flows that incorporate observable... -

Page 73

...in the consolidated financial statements. The average yield earned on margin loans was 3.68% and 4.08% in 2013 and 2012, respectively. 4. Other Securities Owned A summary of other securities owned is as follows: December 31, Schwab Funds® money market funds Equity and bond mutual funds State and... -

Page 74

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 5. Securities Available for Sale and Securities Held to Maturity The amortized cost, gross unrealized gains and losses, and ... -

Page 75

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) A summary of securities with unrealized losses, aggregated by category and period of continuous unrealized loss, is as follows: ... -

Page 76

... in 2013. The expected credit losses were measured as the difference between the present value of expected cash flows and the amortized cost of the securities. Further deterioration in the performance of the underlying loans in the Company's nonagency residential mortgage-backed securities portfolio... -

Page 77

... for sale in 2013, 2012, or 2011. 6. Loans to Banking Clients and Related Allowance for Loan Losses The composition of loans to banking clients by loan segment is as follows: December 31, Residential real estate mortgages Home equity lines of credit Personal loans secured by securities Other... -

Page 78

... equity lines of credit 3,025 Personal loans secured by securities 1,384 Other 36 Total loans to banking clients $ 12,407 December 31, 2012 Residential real estate mortgages: First mortgages $ 6,291 Purchased first mortgages 154 Home equity lines of credit 3,269 Personal loans secured by securities... -

Page 79

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2013 Year of origination Pre-2009 2009 2010 2011 2012 2013 Total Origination FICO 740 ... -

Page 80

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2012 Year of origination Pre-2009 2009 2010 2011 2012 Total Origination FICO 740 Total ... -

Page 81

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The Company monitors the credit quality of personal loans secured by securities by reviewing the fair value of collateral to ... -

Page 82

... Payables to brokers, dealers, and clearing organizations include securities loaned of $1.2 billion and $882 million at December 31, 2013 and 2012, respectively. The cash collateral received from counterparties under securities lending transactions was equal to or greater than the market value of... -

Page 83

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 12. Payables to Brokerage Clients The principal source of funding for Schwab's margin lending is cash balances in brokerage client... -

Page 84

...direct access to $647 million of these credit lines. There were no borrowings outstanding under these lines at December 31, 2013 or 2012. To partially satisfy the margin requirement of client option transactions with the Options Clearing Corporation, Schwab has unsecured standby LOCs with five banks... -

Page 85

... 2011, respectively. Purchase obligations: The Company has purchase obligations for services such as advertising and marketing, telecommunications, professional services, and hardware- and software-related agreements. At December 31, 2013, the Company has purchase obligations as follows: 2014 2015... -

Page 86

... SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Legal contingencies: The Company is subject to claims and lawsuits in the ordinary course of business, including arbitrations, class actions... -

Page 87

... December 31, 2013. 15. Financial Instruments Subject to Off-Balance Sheet Credit Risk or Concentration Risk Off-Balance Sheet Credit Risk Securities lending: The Company loans client securities temporarily to other brokers in connection with its securities lending activities and receives cash as... -

Page 88

... loan. At December 31, 2013 and 2012, the Company had commitments to purchase First Mortgage loans of $208 million and $867 million, respectively. Schwab Bank also has commitments to extend credit related to its clients' unused HELOCs, personal loans secured by securities, and other lines of credit... -

Page 89

...Other securities owned: Schwab Funds® money market funds Equity and bond mutual funds State and municipal debt obligations Equity, U.S. Government and corporate debt, and other securities Total other securities owned Securities available for sale: U.S. agency mortgage-backed securities Asset-backed... -

Page 90

... CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) December 31, 2012 Cash equivalents: Money market funds Commercial paper Total cash equivalents Investments segregated and on deposit... -

Page 91

... Loans to banking clients - net: Residential real estate mortgages Home equity lines of credit Personal loans secured by securities Other Total loans to banking clients - net Other assets Total Liabilities: Deposits from banking clients Payables to brokers, dealers, and clearing organizations... -

Page 92

... Loans to banking clients - net: Residential real estate mortgages Home equity lines of credit Personal loans secured by securities Other Total loans to banking clients - net Other assets Total Liabilities: Deposits from banking clients Payables to brokers, dealers, and clearing organizations... -

Page 93

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) cumulative. Under the terms of the Series A Preferred Stock, the Company's ability to pay dividends on, make distributions with ... -

Page 94

...Restricted stock award expense Employee stock purchase plan expense Total stock-based compensation expense Income tax benefit on stock-based compensation 2013 52 60 $ 2012 57 40 5 3 105 (39) $ 2011 61 23 12 3 99 (37) 4 116 (43) $ $ $ $ The Company issues shares for stock options and... -

Page 95

...$ $ $ 2013 6.33 258 82 $ $ $ $ 2012 4.07 35 1 9 $ $ $ $ 2011 4.16 96 7 38 Management uses a binomial option pricing model to estimate the fair value of options granted. The binomial model takes into account the contractual term of the stock option, expected volatility, dividend yield, and risk-free... -

Page 96

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) The Company's restricted stock units activity is summarized below: WeightedAverage Grant Date Fair Value per Unit $ $ $ $ $ 13.34... -

Page 97

... amortization Capitalized internal-use software development costs Deferred cancellation of debt income Deferred loan costs Deferred Senior Note exchange Net unrealized gain on securities available for sale Other Total deferred tax liabilities Deferred tax asset (liability) - net (1) (1) 2013 $ 190... -

Page 98

... stock options and restricted stock awards excluded from the calculation of diluted EPS totaled 34 million, 74 million, and 63 million shares in 2013, 2012, and 2011, respectively. 22. Regulatory Requirements CSC is a savings and loan holding company and Schwab Bank, CSC's depository institution... -

Page 99

... on the type of business conducted by the broker-dealer. Under the alternative method, a broker-dealer may not repay subordinated borrowings, pay cash dividends, or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount of less... -

Page 100

... income statement line item expenses (e.g., compensation and benefits, depreciation and amortization, and professional services) to the business activities driving segment expenses (e.g., client service, opening new accounts, or business development) and a funds transfer pricing methodology to... -

Page 101

...is an online brokerage firm primarily focused on equity option securities and futures. The optionsXpress® brokerage platform provides active investors and traders trading tools, analytics and education to execute a variety of investment strategies. The combination of optionsXpress and Schwab offers... -

Page 102

... Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Other Business Acquisition On December 14, 2012, the Company acquired ThomasPartners, Inc., a growth and dividend income-focused asset management firm, for $85 million in cash... -

Page 103

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) Condensed Balance Sheets December 31, Assets Cash and cash equivalents Receivables from subsidiaries Other securities owned - at ... -

Page 104

... from stock options exercised and other Other financing activities Net cash (used for) provided by financing activities (Decrease) Increase in Cash and Cash Equivalents Cash and Cash Equivalents at Beginning of Year Cash and Cash Equivalents at End of Year $ $ 2013 1,071 $ 2012 928 $ 2011 864... -

Page 105

THE CHARLES SCHWAB CORPORATION Notes to Consolidated Financial Statements (Tabular Amounts in Millions, Except Per Share Data, Option Price Amounts, Ratios, or as Noted) 27. Quarterly Financial Information (Unaudited) Fourth Quarter Third Quarter 1,373 909 290 282 1,296 .22 .22 .06 22.69 20.74 32... -

Page 106

...deteriorate. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of The Charles Schwab Corporation and subsidiaries as of December 31, 2013 and 2012, and the results of their operations and their cash flows for each... -

Page 107

... process designed under the supervision of and effected by the Company's chief executive officer and chief financial officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of published financial statements in accordance with accounting principles... -

Page 108

... Over Financial Reporting and the Report of Independent Registered Public Accounting Firm are included in "Item 8 - Financial Statements and Supplementary Data." Item 9B. None. Other Information PART III Item 10. Directors, Executive Officers, and Corporate Governance The information relating... -

Page 109

.... and Charles Schwab Bank, and a trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust, and Laudus Institutional Trust, all registered investment companies. Mr. Bettinger has been President and Chief Executive Officer of CSC... -

Page 110

...until 2011 and as Senior Vice President - Investor Services of Schwab from 2006 until 2009. Mr. Gill joined Schwab in 2001. Mr. Martinetto has been Executive Vice President and Chief Financial Officer of CSC and Schwab since 2007. He has served as Chief Executive Officer of Charles Schwab Bank since... -

Page 111

... The exhibits listed below are filed as part of this annual report on Form 10-K. Exhibit Number 2.1 Exhibit Agreement and Plan of Merger, dated March 18, 2011, by and among The Charles Schwab Corporation, Neon Acquisition Corp. and optionsXpress Holdings, Inc., filed as Exhibit 2.1 to the Registrant... -

Page 112

... Stock Option Agreement for Joseph R. Martinetto under The Charles Schwab Corporation 2004 Stock Incentive Plan dated May 18, 2007, filed as Exhibit 10.295 to the Registrant's Form 10-Q for the quarter ended June 30, 2012, and incorporated herein by reference. Directed Employee Benefit Trust... -

Page 113

.... Form of Notice and Premium-Priced Stock Option Agreement under The Charles Schwab Corporation 2004 Stock Incentive Plan, filed as Exhibit 10.309 to the Registrant's Form 10-K for the year ended December 31, 2012, and incorporated herein by reference. Employment Agreement dated as of March 13, 2008... -

Page 114

... and Stock Option Agreement for Non-Employee Directors under The Charles Schwab Corporation Directors' Deferred Compensation Plan II and The Charles Schwab Corporation 2004 Stock Incentive Plan and successor plans, filed as Exhibit 10.358 to the Registrant's Form 8-K dated January 24, 2013, and... -

Page 115

...in XBRL (Extensible Business Reporting Language) (i) the Consolidated Statements of Income,(ii) the Consolidated Statements of Comprehensive Income, (iii) the Consolidated Balance Sheets, (iv) the Consolidated Statements of Cash Flows, (v) the Consolidated Statements of Stockholders' Equity, and (vi... -

Page 116

... on February 24, 2014. THE CHARLES SCHWAB CORPORATION (Registrant) BY: /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of... -

Page 117

... Qualifying Accounts Supplemental Financial Data for Charles Schwab Bank (Unaudited) F-2 F-3 - F-9 Schedules not listed are omitted because of the absence of the conditions under which they are required or because the information is included in the Company's consolidated financial statements and... -

Page 118

...$ 2 Includes collections of previously written-off accounts. Excludes banking-related valuation and qualifying accounts. See "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - 6. Loans to Banking Clients and Related Allowance for Loan Losses." F-2 -

Page 119

... to maturity Loans to banking clients (3) Loans held for sale Other interest-earning assets Total interest-earning assets Net unrealized gain on securities available for sale Noninterest-earning assets Total Assets Liabilities and Stockholder's Equity: Interest-bearing banking deposits Total sources... -

Page 120

...Interest-earning assets: Cash and cash equivalents (1) Securities available for sale (2) Securities held to maturity Loans to banking clients (3) Loans held for sale Other interest-earning assets Total interest-earning assets Interest-bearing sources of funds: Interest-bearing banking deposits Total... -

Page 121

... CHARLES SCHWAB CORPORATION Supplemental Financial Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) 3. Securities Available for Sale and Securities Held to Maturity The amortized cost, gross unrealized gains and losses, and fair value of securities available for sale and securities... -

Page 122

THE CHARLES SCHWAB CORPORATION Supplemental Financial Data for Charles Schwab Bank (Unaudited) (Dollars in Millions) December 31, 2011 Securities available for sale: U.S. agency mortgage-backed securities Asset-backed securities Corporate debt securities Certificates of deposit U.S. agency notes ... -

Page 123

... institutions of total assets $ 1,450 1,098 712 1,849 5,109 2.2 1.7 1.1 2.8 % % % % $ 5. Loans to Banking Clients and Related Allowance for Loan Losses The composition of the loan portfolio is as follows: December 31, Residential real estate mortgages Home equity lines of credit Personal loans... -

Page 124

...$ $ $ $ $ The maturities of the loan portfolio at December 31, 2013, are as follows: After 1 year through 5 years $ 1,705 1,303 21 3,029 $ Within 1 year Residential real estate mortgages Home equity lines of credit (2) Personal loans secured by securities Other Total (1) (2) (1) After 5 years... -

Page 125

... percent of average total deposits from banking clients: 2013 Amount Rate Analysis of average daily deposits: Money market and other savings deposits Interest-bearing demand deposits Total $ $ 73,167 12,298 85,465 0.03 % 0.10 % $ $ 2012 Amount Rate 54,318 11,227 65,545 0.05 % 0.13 % $ $ 2011 Amount... -

Page 126

...both deposits from banking clients and payables to brokerage clients is completely offset by interest revenue on related investments and loans, the Company considers such interest to be an operating expense. Accordingly, the ratio of earnings to fixed charges, excluding deposits from banking clients... -

Page 127

..., 2013. The following is a listing of the significant subsidiaries of the Registrant: Schwab Holdings, Inc. (holding company for Charles Schwab & Co., Inc.), a Delaware corporation Charles Schwab & Co., Inc., a California corporation Charles Schwab Bank, a Federal Savings Association Charles Schwab... -

Page 128

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM We consent to the incorporation by reference in the following Registration Statements of our report dated February 24, 2014, relating to the consolidated financial statements and financial statement schedule of The Charles Schwab Corporation and the... -

Page 129

...; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2014 /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer -

Page 130

... b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 24, 2014 /s/ Joseph R. Martinetto Joseph R. Martinetto Executive Vice President and Chief Financial Officer -

Page 131

... the Report fairly presents, in all material respects, the financial condition and results of operations of the Company for the periods presented therein. (2) /s/ Walter W. Bettinger II Walter W. Bettinger II President and Chief Executive Officer Date: February 24, 2014 A signed original... -

Page 132

... Executive Vice President and Chief Financial Officer Date: February 24, 2014 A signed original of this written statement required by Section 906 has been provided to The Charles Schwab Corporation and will be retained by The Charles Schwab Corporation and furnished to the Securities and Exchange... -

Page 133

...company Age: 73. Director since 2003. Term expires in 2014. Member of the Compensation Committee; Nominating and Corporate Governance Committee; Risk Committee. STEPHEN A. ELLIS Chief Executive Officer, Asurion, LLC, a provider of consumer technology protection services Age: 51. Director since 2012... -

Page 134

... company's annual report, 10-K, 10-Q, quarterly earnings release, or monthly activity report without charge, contact: Charles Schwab Investor Relations 211 Main Street San Francisco, CA 94105 (415) 667-1959 These documents may also be viewed in the Investor Relations section of the company's website...