Charles Schwab 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

money market funds’ investments in a single structured

investment vehicle; and we chose to exit the credit card

business at a cost of $30 million. Although as stockholders

we are pained by these charges and are disappointed in

ourselves, we move into 2011 and begin a new year with

a clean slate and condence that we have put the major

issues from the nancial crisis behind us.

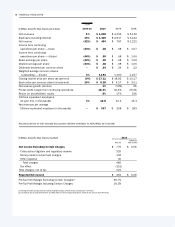

Our net income in 2010 was $775 million before these

charges and $454 million after, with earnings per share

calculated at $0.65 before and $0.38 after these charges.

Our pre-tax prot margin was 29.7 percent before and

18.3 percent after these charges. (See Letter from the

Chief Financial Ofcer, page 6, and reconciliation of these

nancial measures on page 8.)

INVESTING FOR GROWTH

As we saw client momentum build over the past 12

months, we continued to make signicant investments

in enhancing the quality of the client experience. These

investments lay the foundation for long-term growth.

Last year, we nearly doubled our project spending to

$130 million as we invested to achieve two primary goals.

First, we worked to make it easier for clients to access

our solutions and to do business with us. Second, we

broadened the services available through Schwab in

order to stay ahead of the evolving needs of a diverse

client population.

While we are pleased with our ability to generate organic

growth within our existing business lines, occasionally we

look outside to complement our ability to serve our clients’

needs. That was the case last November when we acquired

assets of Windward Investment Management, Inc., for

$150 million in cash and stock. Windward has a track

record of managing client portfolios with above-benchmark

returns and lower relative volatility. With the renamed

Windhaven™ Portfolios, we have strengthened our set

of investing solutions for both individual investors and

independent investment advisors who want to outsource

a portion of their money management.

FOCUSING ON CLIENT NEEDS

Schwab is, rst and foremost, a client-driven company.

And seeing the world through the eyes of our clients

helps ensure we operate the company in a way that

leads to long-term growth. We think this approach

makes us different.

In 2010, our actions demonstrated how we’re different

and how that makes a difference in the nancial lives of

millions of Americans. Let me share a few examples.

1. We believe in nancial opportunity for all.

We began last year with two announcements that

support our corporate purpose of “helping everyone

be nancially t.”

We reduced and simplied online equity trade •

commissions to a at rate of $8.95, regardless

of the number of shares traded or the size of the

client’s account.

We launched Schwab Managed Portfolios-ETFs — a •

relatively sophisticated and diversied set of portfolios

that invest in low-cost Exchange Traded Funds.

By January 2011, we had expanded our ETF offerings to

a total of 13 proprietary equity and xed-income funds,

all of which feature low operating expense ratios and

commission-free online trading in Schwab accounts.

As we continue to expand our reach to more Americans,

we recently announced a relationship with AARP to provide

nancial guidance services to its large and growing

organization dedicated to helping people aged 50 and

up. This program will serve millions of eligible AARP

members with special discounts, complimentary nancial

consultations, and access to our On Investing magazine.

2. We believe people need the right tools to

achieve nancial tness.

During 2010, we introduced new products, entered

new business alliances, and upgraded client tools

and technology.

Through our agreement with J.P. Morgan, a leading U.S.

bond underwriter, we expanded our clients’ access to new

municipal and corporate bond issues. Since announcing

this agreement last April, Schwab clients have had the

opportunity to participate in more than 500 new bond

offerings. Fixed income investors at Schwab now have

access to more than 30,000 individual xed income

securities. Schwab clients also gained access to J.P.

Morgan’s award-winning xed income research. Later in

2 LETTER FROM THE CHIEF EXECUTIVE OFFICER