Charles Schwab 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

When I look back on 2010, it reminds me of a typical early

morning in my ofce. On most mornings, the darkness and

fog give way to incredible sunshine and magical views of

the San Francisco Bay. Similarly, the environment in 2010

evolved from a time of bleakness early in the year to a time

of building optimism as the year came to a close.

Yes, our near-term nancial performance continues

to suffer from record low interest rates, but our valued

clients are increasingly engaged, and we are more

focused than ever on clients and their needs. Looking

forward to 2011, I feel a sense of optimism and

excitement. We are aggressively investing in building

our business for the long term ... and our clients are

rewarding us with their business.

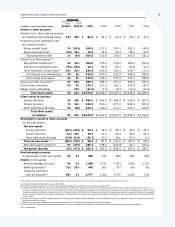

In 2010, our clients brought $78.1 billion in net new

assets* to Schwab — a gure that handily outpaces the

results reported by other brokerage rms. More importantly,

client momentum strengthened as the year went on. During

the fourth quarter of 2010, clients entrusted us with $26.2

billion of net new assets, our best performance since the

rst quarter of 2008. By year-end, clients had entrusted us

with almost $1.6 trillion of their hard-earned money, up 11

percent over 2009.

How do we achieve these results? It all starts with our

unwavering belief that if you do the right thing by your

clients, they will choose to do more business with you. It’s

a simple philosophy, but one that drives every decision we

make. We call it “Through Clients’ Eyes.”

This philosophy works. Clients opened 829,000 new

brokerage accounts last year, with 99,000 of these

in December — our strongest month for new accounts

in more than eight years. We now serve more than

10 million client accounts, including approximately

8 million brokerage, 700,000 bank, and 1.5 million

retirement plan accounts.

These and many other signs indicate that the darkness

of early 2010 is beginning to transition to daylight as we

move into 2011.

IMPROVING FINANCIAL RESULTS

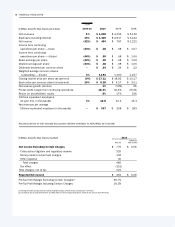

In 2010, our net revenues of $4.2 billion grew 1 percent

over 2009. However, consistent with momentum across

the rm, we achieved revenue growth of 14 percent

when viewing the fourth quarter of 2010 relative to the

fourth quarter of 2009. In addition, we concluded the

year with sequential quarterly improvement across all

three major sources of revenue — asset management

and administration fees, net interest revenue, and

trading revenue.

Our operating nancial performance in 2010 was quite

strong. However, our reported results were masked by

several one-time charges related to the recent nancial

crisis. Specically, we incurred charges of $320 million

for settling litigation and regulatory matters related to

a mutual fund we manage; we incurred charges of

$132 million to cover remaining losses recognized by our

To My Fellow Stockholders:

FROM WALT BETTINGER

President and Chief Executive Ocer

LETTER FROM THE CHIEF EXECUTIVE OFFICER 1

* Excluding $51.5 billion in institutional withdrawals from our low-revenue mutual fund clearing unit