Cash America 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

From smoke signals to rotary phones

to PDA phones, man continues to

seek instantaneous communication.

We’ve advanced from waiting months

to receive information to accessing

it within seconds. Similarly, Cash

America’s products and services

allow customers quick solutions to

unexpected financial challenges.

Advances in perception and service

Long past are the days when a cigar-smoking pawnbroker

arbitrarily assigned collateral value. From its inception in

1984, Cash America has boldly pioneered a new image

of the pawn industry. As the first publicly owned national

pawn chain, we have developed a high-

end, customer-focused pawn business:

bright, well-lit stores staffed with

knowledgeable, friendly associates who

access a comprehensive database to

make equitable, consistent assessments

of collateral to serve our customers.

The pawn loan process is simple.

A customer brings in an item of personal property in

support of a short-term loan to meet an immediate cash

need. Within minutes, he receives a loan based on Cash

America’s expected resale value of that property. At any

time during the loan period, the customer has the choice

of returning and paying the loan balance plus fees and

service charges to redeem the items, or electing to have

Cash America keep the property in complete satisfaction

of the customer’s obligation – all with

no negative effects on the customer’s

credit. The typical pawn loan is small –

usually less than $100.

About 70 percent of customers redeem their property.

But in the cases of those who don’t, retail customers

are offered attractively priced sale items in our stores.

In fact, Cash America pawn stores offer bright, friendly

environments for finding bargains on everything from

musical instruments to jewelry and electronics.

Since customers have come to rely on us as a

neighborhood financial resource, we’ve worked to give

them access to a variety of financial tools. Today we

offer cash advances and check cashing services in many

pawn locations, as well as money

orders, money transfers, stored value

cards, insurance and more. Not all

are available in every location, but we

continue to make advances according

to customer demand.

We’re proud to say that the impetus for

our existence – our traditional pawn

business – has become a viable alternative to traditional

financial institutions for millions of hardworking

Americans. We’ve come a long way in advancing the way

our industry functions, and the way it’s perceived by all of

our audiences – customers, regulators, law enforcement,

co-workers, the media and investors. The pawn industry

isn’t just growing, it’s growing up – by broadening service

lines and meeting the needs of customers.

Cash America International, Inc.

Communication

4

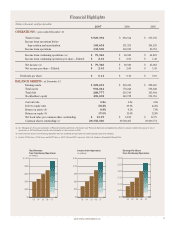

3% Check Cashing/Other

Composition of Net Revenue,

Net of Loan Loss Expense

(12 months ended December 31, 2007)

38% Cash Advance Fees,

Net of Loan Losses

31% Pawn Service

Charges

28% Profit on

Merchandise

Advances