Carnival Cruises 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.such vouchers are utilized or upon issuance to certain ship charterers. Guest cancellation fees are recognized in

cruise passenger ticket revenues at the time of the cancellation.

Our sale to guests of air and other transportation to and from airports near the home ports of our ships are

included in cruise passenger ticket revenues, and the related cost of purchasing these services are included in

cruise transportation costs. The proceeds that we collect from the sales of third-party shore excursions and on

behalf of our onboard concessionaires, net of the amounts remitted to them, are included in onboard and other

cruise revenues as concession revenues. All of these amounts are recognized on a completed voyage or pro rata

basis as discussed above.

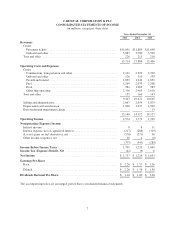

Cruise passenger ticket revenues include fees, taxes and charges collected by us from our guests. A portion of

these fees, taxes and charges vary with guest head counts and are directly imposed on a revenue-producing

arrangement. This portion of the fees, taxes and charges is expensed in commissions, transportation and other

costs when the corresponding revenues are recognized. These fees, taxes and charges included in passenger ticket

revenues and commissions, transportation and other costs were $524 million in 2015, $532 million in 2014 and

$517 million in 2013. The remaining portion of fees, taxes and charges are also included in cruise passenger

ticket revenues but are expensed in other ship operating expenses when the corresponding revenues are

recognized.

Revenues and expenses from our hotel and transportation operations, which are included in our Tour and Other

segment, are recognized at the time the services are performed or expenses are incurred. Revenues from the long-

term leasing of ships, which are also included in our Tour and Other segment, are recognized ratably over the

term of the charter agreement using the straight-line method (see Note 12).

Insurance

We maintain insurance to cover a number of risks including illness and injury to crew, guest injuries, pollution,

other third-party claims in connection with our cruise activities, damages to hull and machinery for each of our

ships, war risks, workers compensation, employee health, directors and officers liability, property damages and

general liabilities for third-party claims. We recognize insurance recoverables from third-party insurers for

incurred expenses at the time the recovery is probable and upon realization for amounts in excess of incurred

expenses. All of our insurance policies are subject to coverage limits, exclusions and deductible levels. The

liabilities associated with crew illnesses and crew and guest injury claims, including all legal costs, are estimated

based on the specific merits of the individual claims or actuarially estimated based on historical claims

experience, loss development factors and other assumptions.

Selling and Administrative Expenses

Selling expenses include a broad range of advertising, such as marketing and promotional expenses. Advertising

is charged to expense as incurred, except for media production costs, which are expensed upon the first airing of

the advertisement. Advertising expenses totaled $627 million in 2015, $623 million in 2014 and $588 million in

2013. Administrative expenses represent the costs of our shoreside ship support, reservations and other

administrative functions, and includes salaries and related benefits, professional fees and building occupancy

costs, which are typically expensed as incurred.

Foreign Currency Translations and Transactions

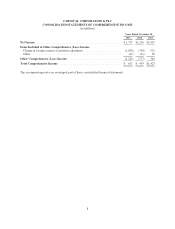

Each business determines its functional currency by reference to its primary economic environment. We translate

the assets and liabilities of our foreign operations that have functional currencies other than the U.S. dollar at

exchange rates in effect at the balance sheet date. Revenues and expenses of these foreign operations are

translated at weighted-average exchange rates for the period. Their equity is translated at historical rates and the

resulting foreign currency translation adjustments are included as a component of accumulated other

16