Carnival Cruises 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

10 | CARNIVAL CORPORATION & PLC

NOTE 2— SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Basis of Presentation

We consolidate entities over which we have control (see

Notes 3 and 15), as typically evidenced by a direct ownership

interest of greater than 50%. For affiliates where significant

influence over financial and operating policies exists, as typi-

cally evidenced by a direct ownership interest from 20% to

50%, the investment is accounted for using the equity method.

Cash and Cash Equivalents and Short-Term Investments

Cash and cash equivalents include investments with matur-

ities of three months or less at acquisition, which are stated

at cost. At November 30, 2007 and 2006, cash and cash

equivalents are primarily comprised of money market funds,

time deposits and commercial paper.

As of November 30, 2007 and 2006, our short-term invest-

ments were not significant. Purchases and sales of short-term

investments included in our Consolidated Statements of Cash

Flows consisted of investments with original maturities greater

than three months with variable interest rates, which typically

reset every 28 days. Despite the long-term nature of their

stated contractual maturities, we generally had the ability to

quickly liquidate these securities and, accordingly, they are

considered short-term investments. All income generated from

these investments is recorded as interest income.

Inventories

Inventories consist of provisions, gift shop and art merchan-

dise held for resale, fuel and supplies carried at the lower of

cost or market. Cost is determined using the weighted-average

or first-in, first-out methods.

Property and Equipment

Property and equipment are stated at cost. Depreciation

and amortization were computed using the straight-line method

over our estimates of average useful lives and residual values,

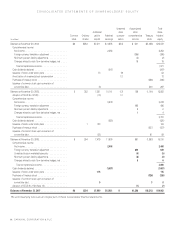

as a percentage of original cost, as follows:

Residual

Values Years

Ships ............................. 15% 30

Ship improvements .................. 0% or 15% 3–28

Buildings and improvements . . . . . . . . . . 0–10% 5–35

Computer hardware and software ...... 0–10% 3–7

Transportation equipment and other . . . . 0–15% 2–20

Leasehold improvements, including

port facilities . . . . . . . . . . . . . . . . . . . . . Shorter of

lease term

or related

asset life

Ship improvement costs that we believe add value to our

ships are capitalized to the ships, and depreciated over the

improvements’ estimated useful lives, while costs of repairs

and maintenance, including minor improvement costs, are

charged to expense as incurred. We capitalize interest as part

of acquiring ships and other capital projects during their con-

struction period. The specifically identified or estimated cost

and accumulated depreciation of previously capitalized ship

components are written off upon replacement or refurbishment.

We review our long-lived assets for impairment whenever

events or changes in circumstances indicate that the carrying

amount of these assets may not be fully recoverable. The

assessment of possible impairment is based on our ability to

recover the carrying value of our asset based on our estimate

of its undiscounted future cash flows. If these estimated

undiscounted future cash flows are less than the carrying

value of the asset, an impairment charge is recognized for the

excess, if any, of the asset’s carrying value over its estimated

fair value.

Dry-dock costs primarily represent planned major mainte-

nance activities that are incurred when a ship is taken out of

service for scheduled maintenance. These costs are expensed

as incurred.

Goodwill

We review our goodwill for impairment annually, or, when

events or circumstances dictate, more frequently. All of our

goodwill has been allocated to our cruise reporting units. The

significant changes to our goodwill carrying amounts since

November 30, 2005 were the changes resulting from using

different foreign currency translation rates at each balance

sheet date, the addition of $161 million of Ibero Cruises good-

will in fiscal 2007 (see Note 15), and the $20 million reduction

to goodwill in fiscal 2006 resulting from the resolution of

certain P&O Princess Cruises plc’s (“P&O Princess”) tax

contingency liabilities that existed at the time of the DLC

transaction.

Our goodwill impairment reviews consist of a two-step

process of first determining the fair value of the reporting unit

and comparing it to the carrying value of the net assets allo-

cated to the reporting unit. Fair values of our reporting units

were determined based on our estimates of market values. If

this fair value exceeds the carrying value, which was the case

for our reporting units, no further analysis or goodwill write-

down is required. If the fair value of the reporting unit is less

than the carrying value of the net assets, the implied fair value

of the reporting unit is allocated to all the underlying assets and

liabilities, including both recognized and unrecognized tangible

and intangible assets, based on their fair value. If necessary,

goodwill is then written down to its implied fair value.