Canon 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Canon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

TO OUR SHAREHOLDERS

The global economy was strong in the first half of 2004,

driven by ongoing growth in the United States and China.

While Asian countries generally reported economic expansion,

European nations, for the most part, experienced only

moderate growth. The world economy experienced a

temporary slowdown in the second half, however, indicated

by signs of decelerating growth. The average value of the yen

for the year was ¥108.12 to the U.S. dollar and ¥134.57 to

the euro, representing a year-on-year increase of 7% against

the U.S. dollar, and a decrease of 3% against the euro.

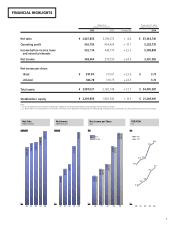

Canon adeptly navigated these conditions to post record

earnings and marked its fifth consecutive year of higher sales

and profits. Net sales grew 8.4% from the previous year, to

¥3,467.9 billion (US$33,345 million), while net income

climbed 24.5%, to ¥343.3 billion (US$3,301 million). We

also met our consolidated financial targets for Phase II of our

Excellent Global Corporation Plan, covering fiscal 2001 through

2005, ahead of schedule, achieving a shareholders’ equity

ratio of 61.6% and an debt to total assets ratio of 1.1%.

In addition, we were recognized by the investment

community for firmly rooting the objective of further

increasing corporate value in all aspects of our business

operations, as called for in Phase II. In fiscal 2005, we will

work to see Phase II to a successful conclusion while laying

a firm foundation for the implementation of Phase III,

Toward Healthy Growth, which will get under way in 2006.

Overview of Fiscal 2004

Revenue growth in fiscal 2004 was underpinned by

continued sharp growth in sales of digital cameras and

color network digital multifunction devices (MFDs) as well as

significantly higher demand for semiconductor production

equipment. By product segment, sales of business machines

advanced 4.1%, to ¥2,388.0 billion (US$22,961 million),

sales of cameras climbed 16.8%, to ¥763.1 billion

(US$7,337 million), and sales of optical and other products

jumped 26.9%, to ¥316.8 billion (US$3,046 million).

During the year, despite ongoing production-reform

efforts and the timely launch of competitive, new products,

the gross profit ratio declined 0.9% from the previous

year, to 49.4%, hurt by the yen’s appreciation against the

U.S. dollar and heightened price competition.