Canon 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Canon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

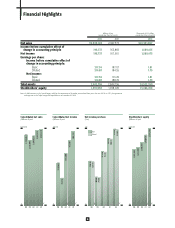

Strong Financial Foundations Sustain Growth

The origins of Canon´s robust performance during the past three years can be found in a wide range

of programs and activities combining our traditional strengths with the commitment to maintaining

profitable operations throughout the Canon Group. For example, production reformation has allowed

us to significantly reduce costs, which is why we will continue these activities into the future.

In addition, the Canon Group is developing new products more efficiently and

rapidly than ever before. Nearly 60% of the Canon brand products now on the

market were launched within the past two years, which means that we are selling

a large number of products with high profitability. While shortening product

development lead times, we have also dramatically reduced production defects.

These efforts made possible the excellent performance of the Canon Group

in 2002 and sustained an increase in consolidated net income well in advance of

our rise in net sales. Comprehensive cash flow management also made it possible

to bring our ratio of cost of sales to net sales down more than three percentage

points from the 2001 result, raise our stockholders´ equity ratio to 54.1%, from

the previous year´s 51.3%, and improve our debt ratio from 10.4% to 5.0%.

Management Reformation Continues to Deliver Results

The management reformation strategies we introduced in 1996 under Phase I

of the Excellent Global Corporation Plan placed Canon firmly on the path to

profitability. Our Groupwide shift to cell production, which was completed in

2002, eliminated more than 20 kilometers of conveyor belt and dozens of automated storage systems,

freeing large volumes of internal and external floor space. Now that we are well into Phase II of the

Excellent Global Corporation Plan, the spirit of reform is becoming firmly established in the corporate

character of the Canon Group. This is why I am confident that our people will continue to seek

innovative ways to improve our operations and performance to ensure even more favorable results

in 2003 and beyond.

4

How was the Canon Group able to complete its third consecutive year of record-breaking

results for consolidated net income? And what does the future hold? In this interview,

Fujio Mitarai, president and CEO of Canon Inc., discusses the momentum of management

reformation and the Group´s prospects for future growth.

50

40

30

20

10

(%)

0

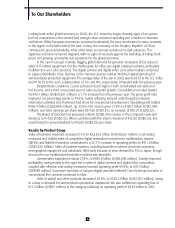

Stockholders´ Equity Ratio

96 97 98 99 00 01 02

54.1

38.1 38.6 42.4 46.5 45.9

51. 3 50

40

30

20

10

(%)

0

Debt Ratio

96 97 98 99 00 01 02

5.0

28.8 26.5

21.4 17.9 13.8 10.4

Interview with the President

Nurturing the Seeds of Success to

Maintain Momentum